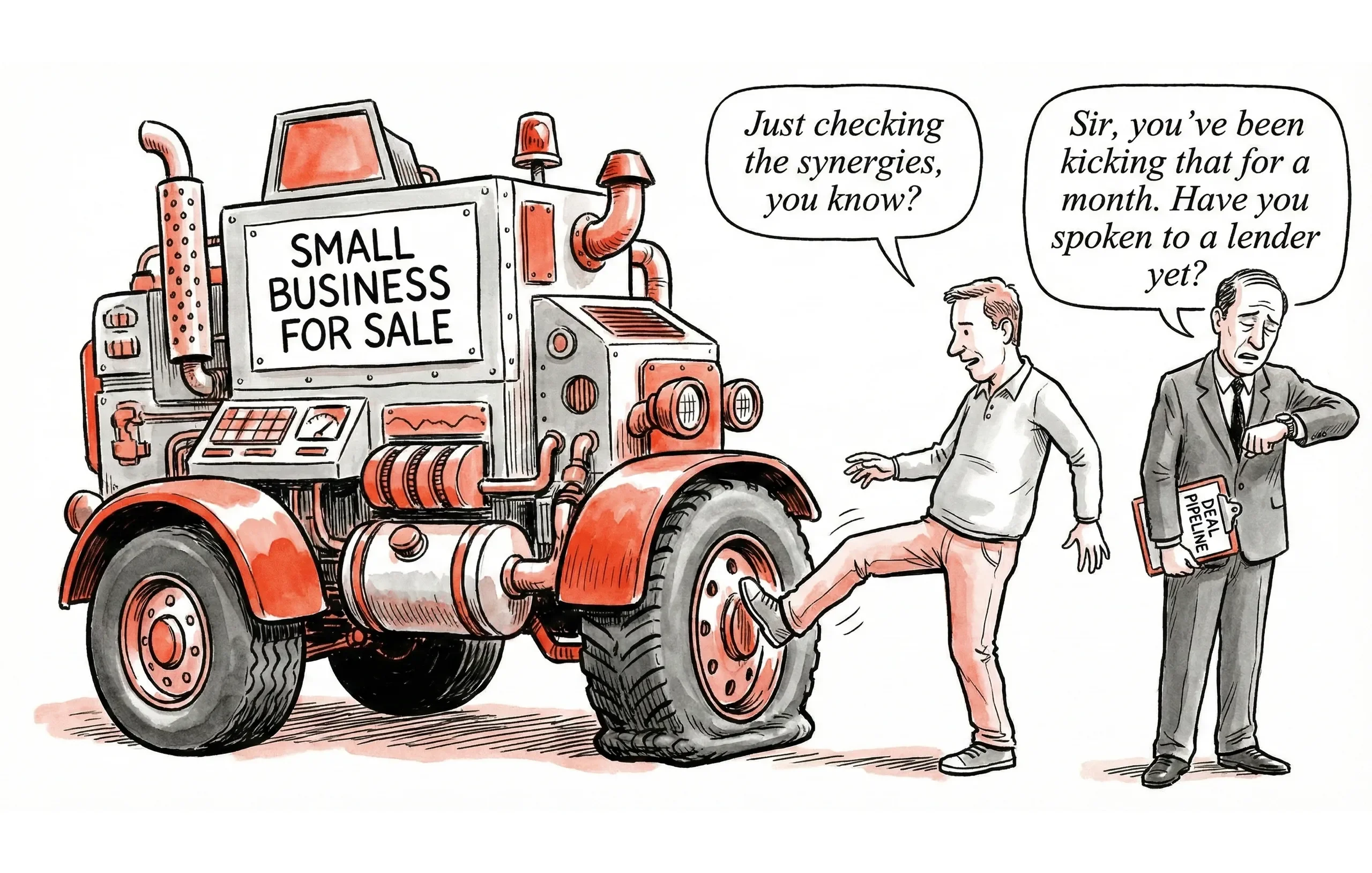

If you’ve been in business brokerage for more than a month, you know the pain. You get an inquiry on a Monday morning. The prospect sounds enthusiastic. They talk a big game about "synergies" and "roll-up strategies." You spend weeks nurturing the relationship, answering emails at 9 PM, and prepping the CIM.

Then comes the silence. Or worse, the confession: "I actually don't have the liquid cash right now," or "My wife isn't on board yet."

You’ve just been tire-kicked.

In an industry where 80% of small businesses listed for sale never actually sell, your ability to ruthlessly filter serious buyers from daydreamers isn't just a skill—it's survival.

We analyzed the latest data from Q3 2025, including reports from BizBuySell, the IBBA, and the SBA, to build a qualification framework that works in today's market. Here is how top-tier brokers protect their time and close more deals.

The Market Has Changed (And You Must Too)

Before we dive into the "how," let's look at the "where." The Q3 2025 market is accelerating.

According to the latest BizBuySell Insight Report, completed transactions are up 8% year-over-year, and the median time on market has dropped to 149 days—the fastest pace since 2017.1 This creates a high-velocity environment. If you are spending 30 days engaging with an unqualified buyer, you aren't just wasting time; you are missing the market window.

However, prices are softening. The median sale price has dipped 2% to $320,044, driven by a slight decline in seller revenue and cash flow[1] Buyers are active, but they are price-sensitive and risk-averse. They aren't overpaying anymore.

This means you need a buyer who isn't just willing to buy, but capable of closing in a tighter credit environment.

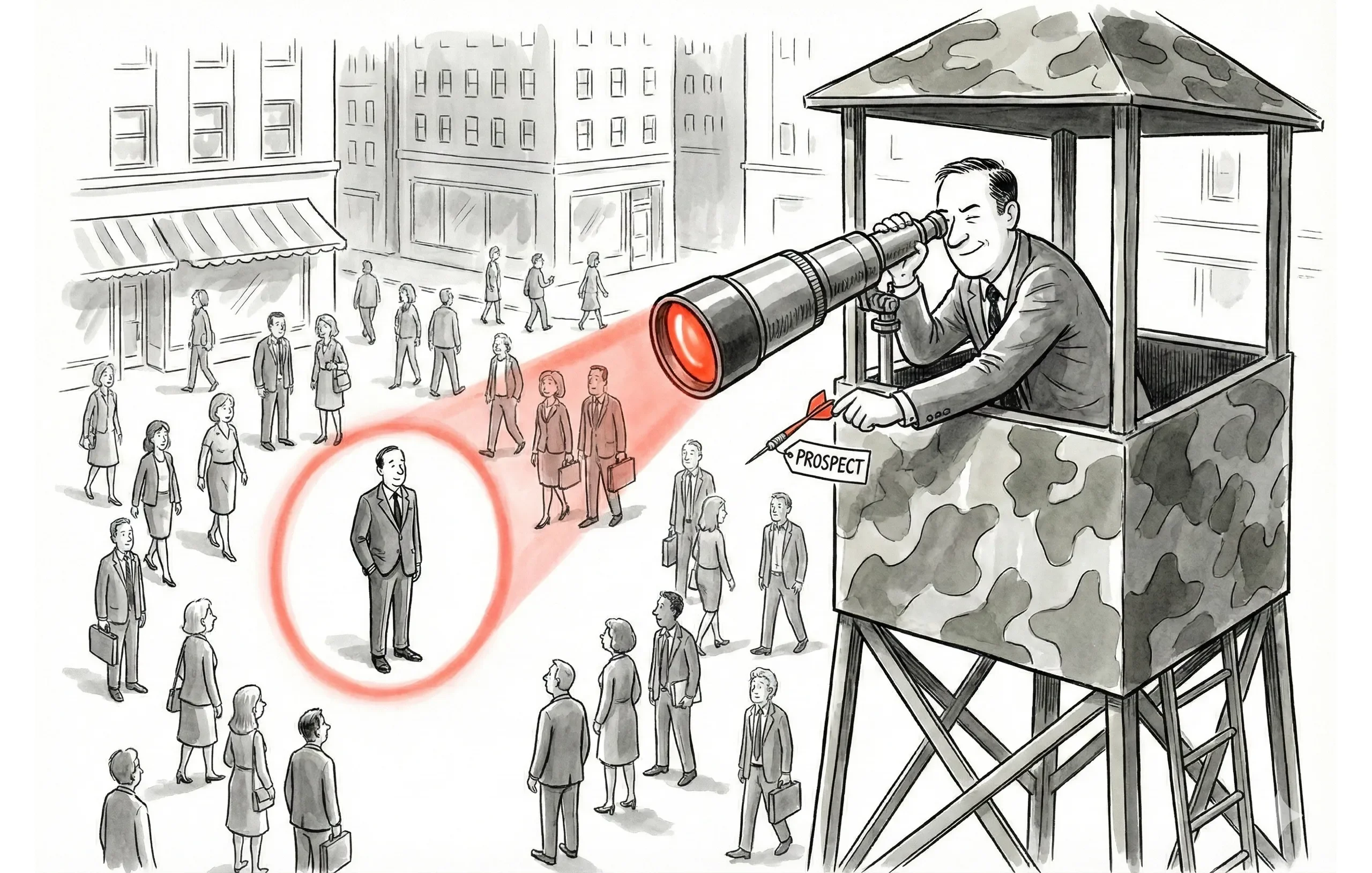

Phase 1: The "Corporate Refugee" Reality Check

Who is buying right now? If your inbox is flooded with mid-career professionals looking to leave their 9-to-5, you aren't alone.

Data shows that roughly 40% of today's buyers are "Corporate Refugees"—professionals aged 40-59 seeking autonomy[1]

The Trap:These buyers often have great resumes but zero deal experience. They are used to corporate budgets and predictable paychecks. They often treat the acquisition process like a job interview, conducting endless "research" without ever pulling the trigger.The Filter:You need to assess their "CEO Mindset" immediately. As Walker Deibel notes in Buy Then Build, successful acquisition requires a drive for results and comfort with ambiguity—traits that middle management often suppresses[2]Ask this early: "Have you assembled your transaction team yet?"A serious buyer has already spoken to a CPA and a transaction attorney. A tire kicker says, "I'll find them once I find a deal."[3]

Phase 2: The Financial Gauntlet (New SBA Rules)

Here is where most deals die in 2025. If you are still qualifying buyers based on rules from two years ago, you are setting yourself up for failure.

The SBA’s Standard Operating Procedures (SOP 50 10 8) introduced critical changes that every broker must memorize.

The "10% Hard Equity" Rule

In the past, creative brokers could structure deals where a seller note on "standby" covered a chunk of the buyer's equity injection. That loophole has tightened significantly.

- The Old Way: Buyer brings 5%, Seller carries 5% on standby.

- The New Reality: The SBA requires a minimum 10% equity injection. While a seller note can still count toward this, it must be on full standby (no principal or interest payments) for the entire life of the SBA loan (typically 10 years).

The Litmus Test:Most sellers will never agree to a 10-year pause on payments. This effectively means your buyer needs to bring the full 10% in cash.When a buyer asks, "Can I buy this with no money down?" or "Can we structure 90% seller financing?", you can now point to federal regulations. If they don't have liquid access to at least 10-20% of the purchase price, they aren't a buyer. They're a spectator[4]

Phase 3: Behavioral Red Flags (Spotting the "Ghost")

Sometimes the financials look fine, but the behavior screams danger. Top brokers track "speed to action" as a primary qualification metric.

The "Time Kills Deals" Metric

Response time is a proxy for interest. Statistics show that responding to an inquiry within 5 minutes increases conversion probability by 900%[5] Conversely, if a buyer takes three weeks to return a simple NDA, they will likely take three months to review due diligence materials.

Watch for these personas:

- The Window Shopper: Asks generic questions ("Why are they selling?") but refuses to share their own "Buy Box" criteria[6]

- The Ghost: Disappears for weeks, then resurfaces expecting you to drop everything.

- The "Expert" Nitpicker: Fixates on the furniture or the logo color rather than the EBITDA margins. They are looking for reasons not to buy[7]

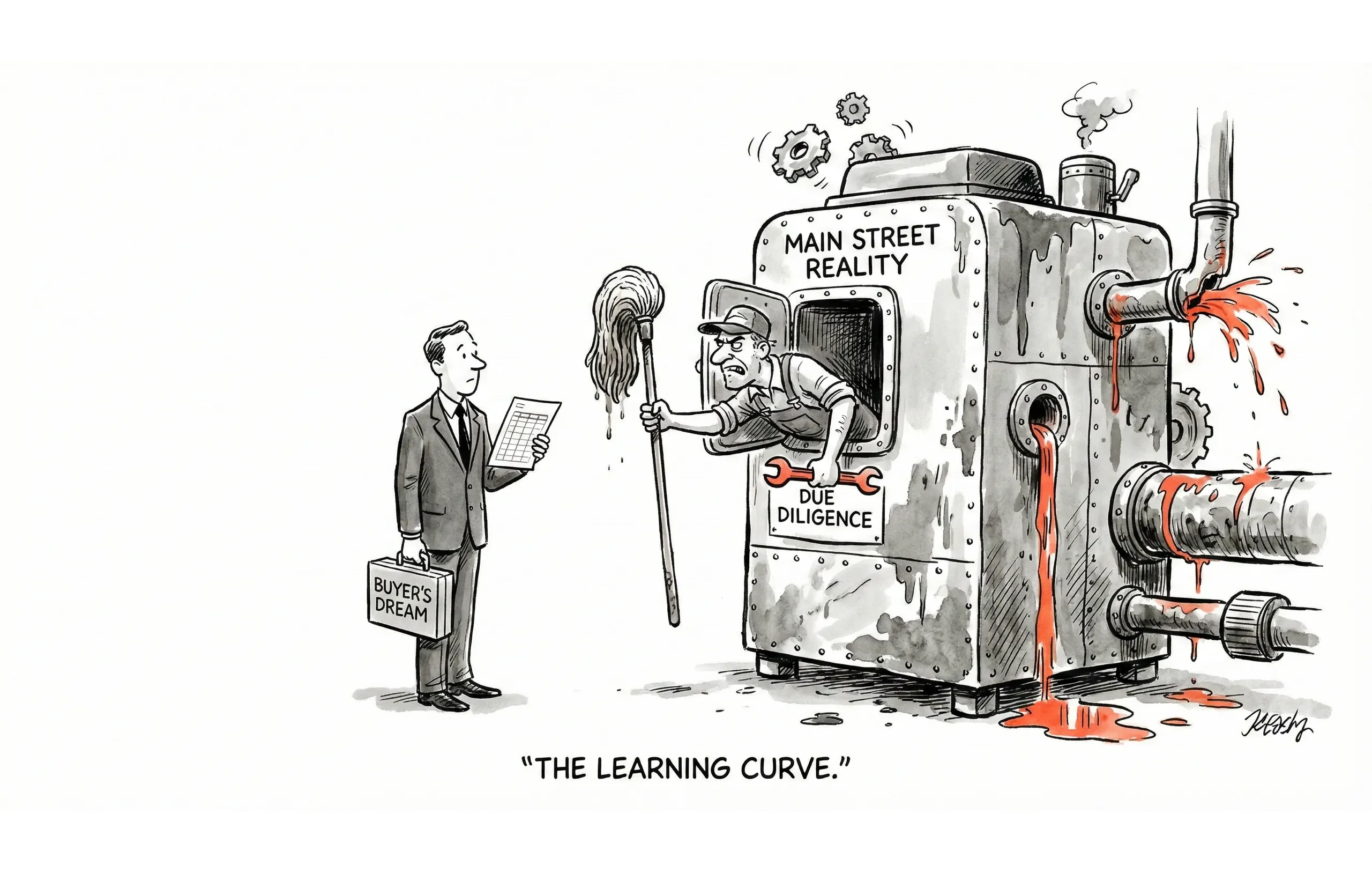

Phase 4: Due Diligence Horror Stories (Don't Let This Be You)

Why does this matter? Because when you let an unqualified buyer through the gate, disaster strikes at the 11th hour.

- The DUI Deal Killer: One broker recounted a deal where a buyer, fully funded and days away from closing on a bar, went out to celebrate, got a DUI, and lost their ability to hold a liquor license. The deal evaporated instantly[8]

- The Hidden Subcontractor: Another buyer, overconfident in their financial analysis skills but lacking operational experience, failed to realize the "30 clients" listed were actually sub-contracts from a single general contractor. The revenue collapsed post-close[9]

The Lesson: Qualification isn't just about money. It's about character, operational competence, and common sense.

The Bottom Line: Professionalize Your Funnel

You cannot afford to be a tour guide for people who can't buy tickets.

To survive the "Silver Tsunami" and the resulting flood of inquiries:

- Automate the NDA/POF step. Don't get on a call until you have paper in hand.

- Verify Liquidity immediately. A screenshot of a crypto wallet doesn't count. Demand a redacted bank statement or a letter from a CPA[10]

- Test for "SBA Reality." Ensure they understand the 10% equity injection rule before showing them a listing.

Your time is the only inventory you can't restock. Protect it.

Works Cited 10 sources cited

- BizBuySell Insight Report - Market Trends, accessed December 11, 2025, https://www.bizbuysell.com/insight-report/

- Quotes by Walker Deibel (Author of Buy Then Build) - Goodreads, accessed December 11, 2025, https://www.goodreads.com/author/quotes/18574135.Walker_Deibel

- Coffee & Tea with Dessert Shop For Sale in Orange, California - BizBen, accessed December 11, 2025, https://www.bizben.com/business-for-sale/coffee-tea-with-dessert-shop-9387758

- Using the SBA 7(a) Loan to Buy a Business - NerdWallet, accessed December 11, 2025, https://www.nerdwallet.com/business/loans/learn/sba-business-acquisition-loan

- 45 Best Sales Statistics 2025: Contact, Follow-Up, Closing - Flowlu, accessed December 11, 2025, https://www.flowlu.com/blog/productivity/sales-statistics/

- HBR Guide to Buying a Small Business - The Key Point, accessed December 11, 2025, https://thekeypoint.org/2023/08/28/hbr-guide-to-buying-a-small-business/

- Managed Service Provider - Long Term Clients for sale in Fairfield, Connecticut - BizBen, accessed December 11, 2025, https://www.bizben.com/business-for-sale/managed-service-provider-for-sale-in-stamford-connecticut-286134

- Business sellers: what killed your deal? : r/smallbusiness - Reddit, accessed December 11, 2025, https://www.reddit.com/r/smallbusiness/comments/1iqdx8v/business_sellers_what_killed_your_deal/

- How to F*ck Up Due Diligence (a true story) - Builders - Beehiiv, accessed December 11, 2025, https://buildersnl.beehiiv.com/p/fck-due-diligence-true-story

- Proof of Funds (POF) | Real Estate Financing Letter + Example - Wall Street Prep, accessed December 11, 2025, https://www.wallstreetprep.com/knowledge/proof-of-funds/