You know the feeling. You’ve got a fantastic listing—clean financials, solid add-backs, a seller who actually listens to reason. You float it on the marketplaces, and the inbox floods. But three months later, you’re staring at a dead deal. The "perfect" buyer who signed the LOI couldn't secure financing, or worse, they got cold feet during due diligence because they didn't really understand the industry.

It’s the classic "Phantom Buyer" scenario, and it’s a deal-killer. According to the IBBA and M&A Source Market Pulse Report, a lack of buyer financing and unrealistic expectations remain top reasons deals fall apart at the closing table.

Top brokers don't leave this to chance. They don't just post and pray; they proactively source buyers. They treat buyer sourcing not as a passive administrative task, but as a hunter-gatherer mission.

Buyer Sourcing Channels

Successful brokerage is about diversification. If you rely solely on inbound traffic, you are at the mercy of the "tire kickers"—the window shoppers who consume your time but never sign a check.

1. Inbound (Listing-Driven)

This is your bread and butter, but it requires a heavy filter.Sources:

- Marketplaces: BizBuySell, BizQuest, etc.

- Proprietary Website: Your own firm’s "Businesses for Sale" page.

- Email Blasts: Notifications to your general list when a new CIM is ready.

The Reality Check:BizBuySell's 2024 Insight Report noted a 5% increase in transactions, but the median time to sell still hovers around 168 days. Inbound buyers are often "corporate refugees" (42% of the buyer pool) looking to buy a job. They need heavy hand-holding and education on SDE vs. EBITDA.

2. Buyer Database (The "Gold Mine")

Most brokers sit on a gold mine they rarely excavate: their CRM.Who is in there?

- The "Almost" Buyer: They lost out on a deal 6 months ago. They are vetted, funded, and hungry.

- The Past Client: They bought a business 3 years ago. Are they ready for a bolt-on acquisition?

- The "Dry Powder" Crowd: PE groups and search funders you met at a conference who are actively looking for platform deals.

Pro Tip: Don't just blast them. Segment them. A blast about a $500k Main Street pizzeria sent to a PE firm looking for $2M EBITDA manufacturing deals is the fastest way to get unsubscribed.

3. Direct Outreach (The "Sniper" Approach)

This is where you earn your commission. Instead of waiting for a buyer, you go find the perfect buyer.Strategies:

- Strategic Competitors: Who would benefit most from this acquisition?

- Private Equity Groups (PEG): Using databases like PitchBook or SourceScrub to find firms with specific mandates.

- LinkedIn Prospecting: Targeting VPs of Operations or Regional Managers who might be looking to own their own show.

4. Referral Network (The "Warm Intro")

Referrals close faster. Why? Because trust is transferred.Your COI (Center of Influence):

- CPAs: They know which clients have cash and are looking for tax-advantaged investments.

- Wealth Managers: Their clients need diversification beyond stocks.

- Lenders: They know who just got pre-approved but hasn't found a deal yet.

5. Industry Networks

Don't just join the IBBA; join the trade associations of the businesses you sell. If you list a heavy civil construction firm, the best buyer might be at the National Utility Contractors Association conference, not browsing a brokerage website.

Building a Buyer Database

A database is only as good as the data you put in it. If your CRM is just a graveyard of names and emails, it’s useless. You need "deal-level" fidelity.

Data to Capture

Field | Why It Matters |

|---|---|

Liquidity / "Dry Powder" | Can they actually close, or are they dreaming? |

SDE/EBITDA Floor & Ceiling | Don't send them deals too small to move the needle or too big to swallow. |

Geographic Mandate | Are they willing to relocate? (Main Street buyers usually aren't). |

Industry Exclusions | "No Restaurants" is a common filter. Respect it. |

Timeline | Are they a 1031 exchange buyer with a deadline? |

Keeping It Alive

A static database is a dead database.

- The "90-Day Bump": Every 90 days, send a personal note (not a blast) to your top 50 buyers. "Still looking for HVAC deals in the Midwest?"

- Deal Teasers: Send "blind" teasers before the listing goes public. Make them feel like insiders.

Direct Outreach Tactics

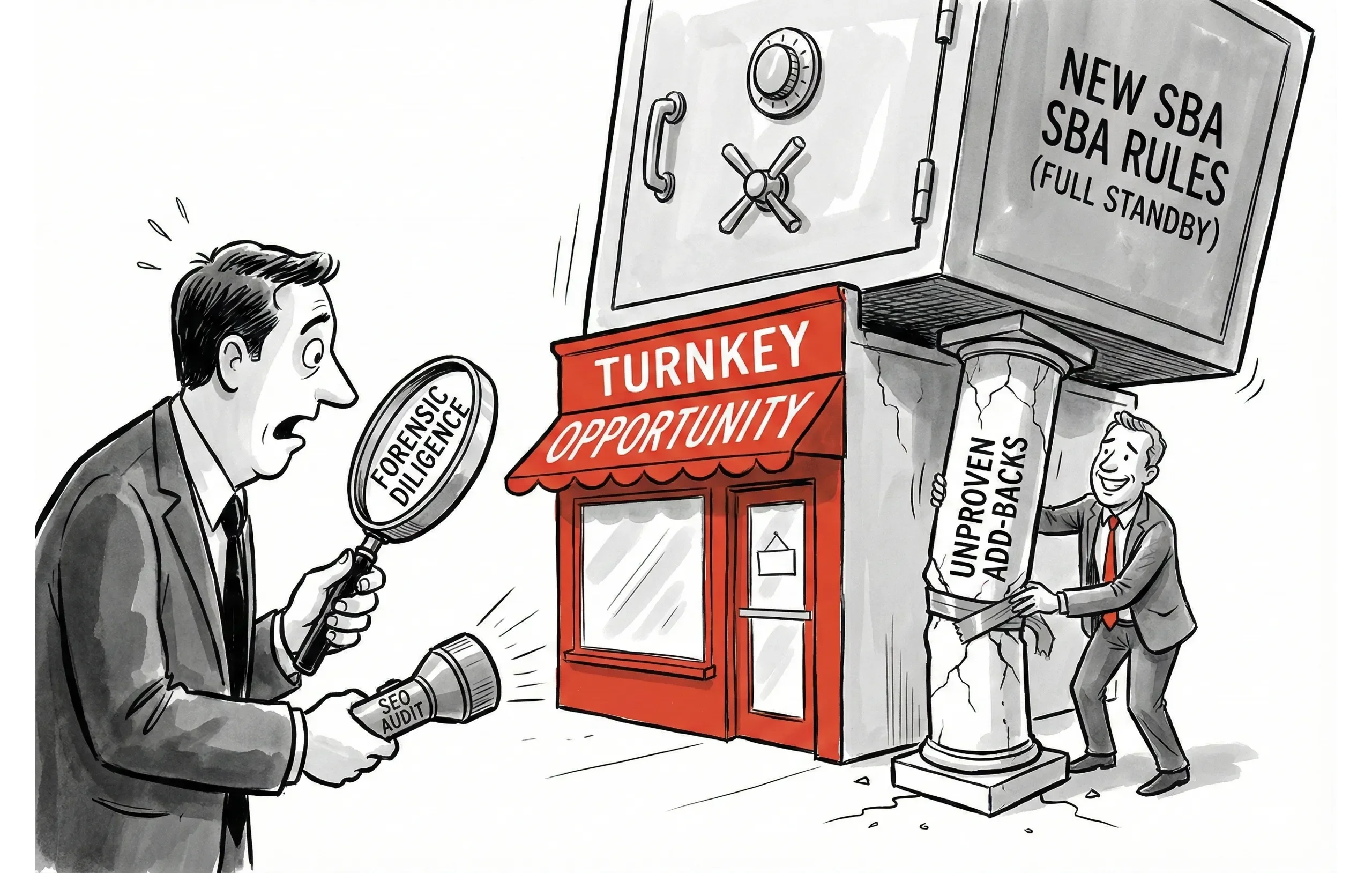

When you have a niche listing—say, a specialized B2B manufacturing plant—generic marketing won't cut it. You need to go outbound.

LinkedIn Prospecting

Forget the spammy automation. Use a "Peer-to-Peer" approach.

The "Soft Ask" Template:

Subject: Acquisition Opportunity: [City] Manufacturer

Hi [Name],

I noticed your firm has been active in the [Industry] space.

I'm currently representing a specialized manufacturer in [Region] doing $1.5M EBITDA that fits your buy-box for [Specific Capability].

Not a mass blast—just thought this aligned with your portfolio. Open to a 5-minute chat to see if it's worth sending the NDA?

Best,

[Your Name]

Cold Emailing Strategic Buyers

Strategic buyers (competitors or related industries) often pay the highest multiples because they can realize synergies (cutting costs, cross-selling).

- Identify: Use NAICS codes to find businesses in adjacent verticals.

- Value Prop: Focus on growth. "This acquisition would instantly add 20% market share in [Region]."

Referral Network Development

Your referral partners are busy professionals. They don't need "coffee chats"; they need value.

Key Referral Sources

Source | The Hook (Why they refer) |

|---|---|

CPAs | They fear losing the client after the sale. Assure them the buyer will likely keep them on. |

Wealth Managers | They need to deploy capital. A business acquisition is a high-yield alternative asset. |

SBA Lenders | They have pre-qualified buyers with no deal. You are solving their volume problem. |

"You can't steal it twice." – Len Krick, Sunbelt Business Brokers

Experienced brokers know that protecting the referral source is paramount. If a wealth manager sends you a buyer, you treat that buyer like royalty, or that channel dries up forever.

Matching Buyers to Listings

This is where the art meets the science.

Proactive Matching

When you sign a listing, don't just hit "publish."

- The "First Look" List: Pull the 10 best matches from your database.

- The Call: Pick up the phone. "I just signed a deal that screams your name. I haven't listed it yet. Want a peek?"

- The FOMO: legitimate scarcity drives action. Being "first in line" is a powerful psychological hook for serious buyers.

Matching Criteria

- Skill Set Transfer: Does this corporate refugee actually have the skills to run a plumbing company? If not, you're setting them up for failure (and yourself for a broken deal).

- Financial Reality: If a buyer has $200k in liquid cash, don't show them a $3M deal unless they have heavy backing.

Measuring Sourcing Effectiveness

If you aren't tracking where your closed deals come from, you're flying blind.

Metrics to Track

Metric | Insight |

|---|---|

Inquiry-to-NDA Ratio | High volume but low NDAs? Your listing copy is misleading or your lead source is low quality. |

NDA-to-LOI Ratio | If this is low, your CIM might be scaring people off, or the price is wrong. |

Source of Closed Deals | Did your last 3 closings come from BizBuySell or your personal network? Invest accordingly. |

Optimizing Based on Data

If you find that 80% of your closings come from 20% of your referral partners (the Pareto Principle), stop buying generic leads and start taking those partners to lunch.