If you’ve been in the brokerage game for more than a minute, you’ve felt the shift. The buyer pool isn’t just private equity groups and serial entrepreneurs anymore. The "Silver Tsunami" of retiring Baby Boomers has triggered a responding wave on the demand side: the First-Time Buyer.

Current data indicates that first-time buyers now represent approximately 39% of Main Street business acquisitions[1] Furthermore, a staggering 42% of today's buyers identify as "corporate refugees"—professionals fleeing the 9-to-5 grind to buy their independence[2]

For brokers, this demographic presents a paradox. They are often well-capitalized and highly motivated, yet they lack the "street smarts" of deal-making. They require more education, more hand-holding, and a different qualification playbook. But if you dismiss them, you are ignoring nearly half the market.

This guide covers how to effectively qualify first-time buyers, filter out the "tire kickers," and set the serious contenders up for a successful close.

Understanding First-Time Small Business Buyers

The modern first-time buyer isn't just a "dreamer." They are often sophisticated professionals making a calculated career pivot. You are likely encountering:

- Corporate refugees: Mid-to-senior level managers (ages 40-59) facing ageism or burnout, seeking to buy a job they can't be fired from[4]

- Early retirees: Individuals with a nest egg who aren't ready to stop working but want to work on their own terms.

- Career changers: Professionals moving from high-stress sectors like tech or finance into tangible "Main Street" businesses.

- Returning professionals: Those re-entering the workforce after sabbaticals or family leave, preferring ownership over employment.

Common Profiles

To qualify them effectively, you need to understand their "operating system." Here is how their backgrounds typically translate to business ownership:

Profile | Characteristics | Considerations |

|---|---|---|

Corporate Executive | Strong management skills, high expectations for data/reporting. | May underestimate operational demands (e.g., "Where is the IT department?"). |

Technical Professional | Deep expertise in one area (engineering, code, law). | May lack business management breadth; prone to "analysis paralysis." |

Sales Professional | Relationship skills, revenue focus, comfortable with risk. | May overlook operational details or compliance issues. |

Recent Graduate (MBA) | Theoretical knowledge, high enthusiasm (Search Fund model). | Needs practical business experience; often lacks personal liquidity. |

What Motivates First-time Business Buyers

Unlike strategic buyers looking for synergy, first-time buyers are driven by lifestyle and legacy. Their primary motivations include autonomy, income replacement, and escaping corporate politics.

However, their concerns are just as personal: fear of failure and the loss of a steady paycheck. As legendary broker Len Krick once noted about buyers: "There are three things a Buyer has to get out the deal... (1) enough money to service the debt... (2) enough left over to live, and (3) a decent return on the cash they invest"[5]

Unique Challenges with First-Time Buyers

First-time buyers aren't just smaller versions of PE firms; they have a completely different set of psychological hurdles.

Challenge 1: Unrealistic Expectations

The problem:Many first-timers have been influenced by "buy a business with no money down" influencers. They often underestimate:

- The Timeline: A serious search typically takes 6 to 12 months, with some targeted searches extending up to 18 months[6]

- Capital Needs: It’s not just the purchase price; it’s the working capital, closing costs (avg 2-3%), and legal fees.

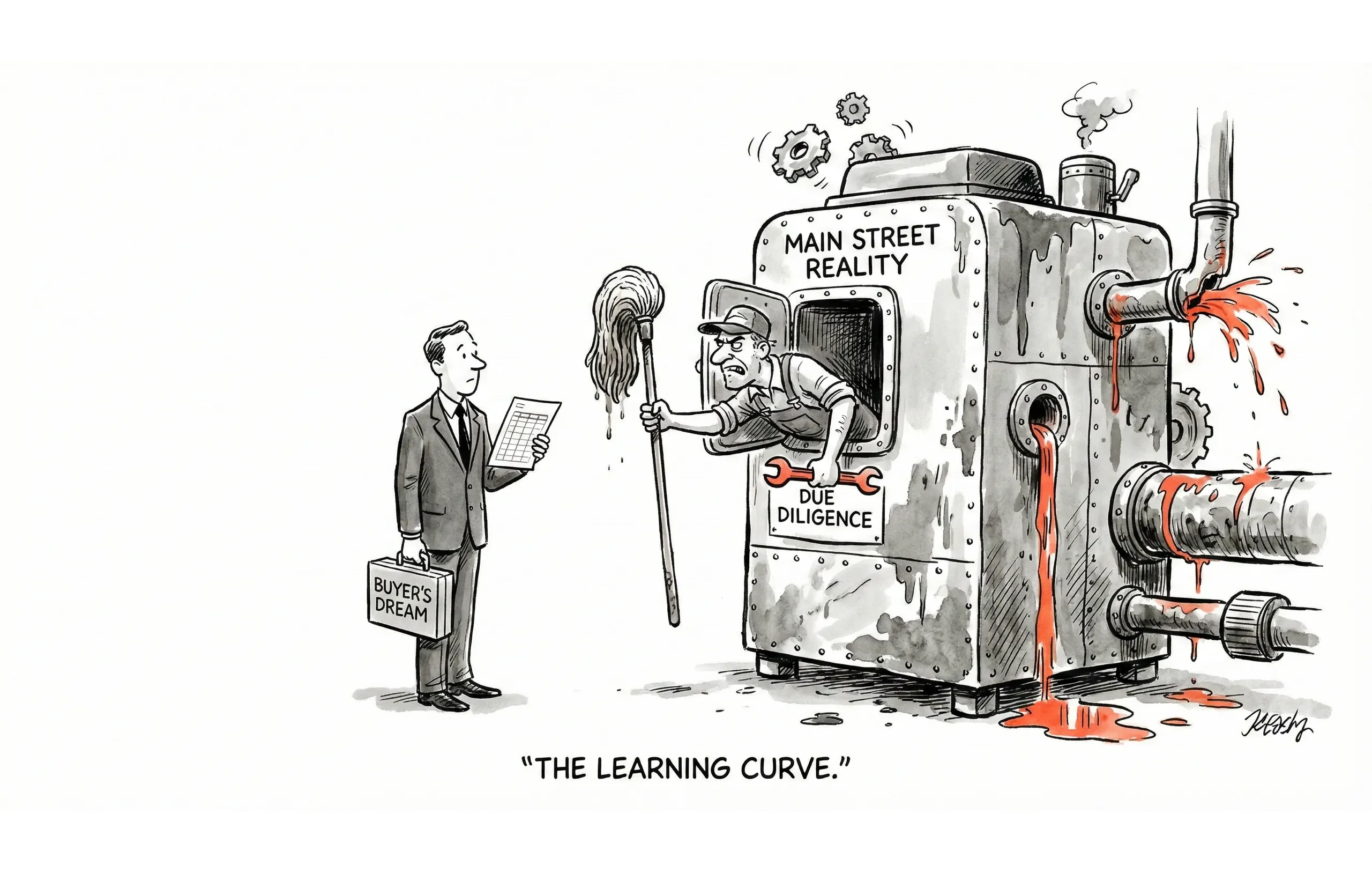

- Due Diligence Intensity: They expect a clean corporate data room; they get a shoebox of receipts.

How to address:Set expectations in the first meeting. If they think they will be operating in 60 days, correct them immediately.

Challenge 2: Emotional Decision-Making

The problem:For a corporate refugee, this isn't just a transaction; it's their life savings. They may fall in love with a business that has terrible financials or get cold feet over minor diligence findings. As one industry expert noted, they often “fall in the trap of trying to investigate and pursue every business currently on the market... this scattered and unfocused method seldom works”[7]How to address:Act as the steady hand. Normalize the emotional rollercoaster. When they panic, remind them of their initial "Buy Box" criteria.

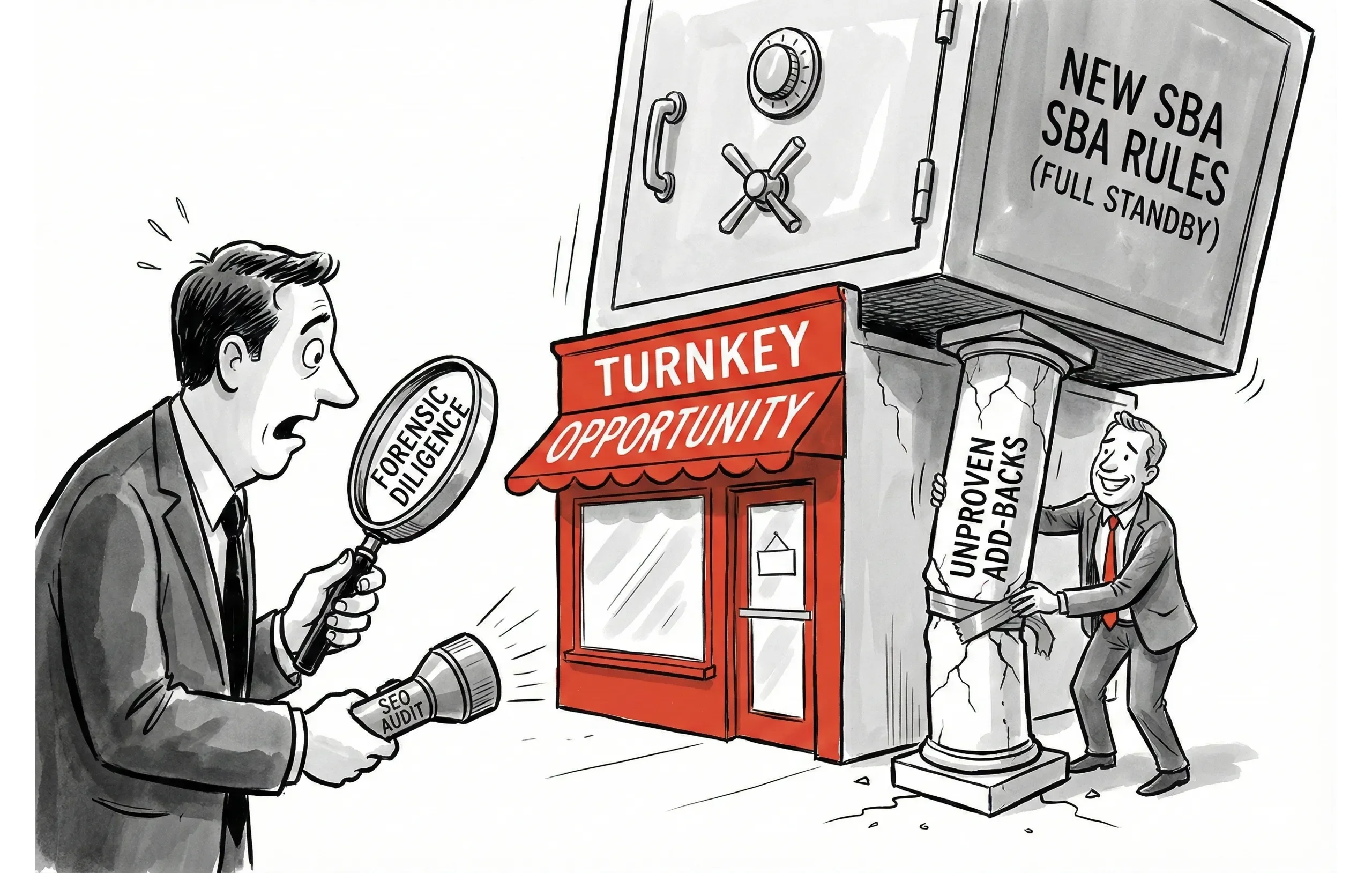

Challenge 3: Limited Understanding of What They're Buying

The problem:First-time buyers often struggle with the mechanics of the deal. They may not understand the difference between an asset sale and a stock sale, or why "Seller’s Discretionary Earnings" (SDE) adds back the owner's personal auto lease.How to address:Educate as you go, but don't become their unpaid consultant. Ensure they have a deal team (CPA and attorney) early. If they are relying on you for legal advice, that is a liability red flag.

Challenge 4: Financing Naivety

The problem:Most first-time buyers assume getting a business loan is like getting a mortgage. It isn't. They often:

- Don't understand SBA 7(a) equity injection requirements (minimum 10%)[8]

- Haven't calculated their post-closing liquidity (lenders want to see you have cash after the down payment).

- Underestimate the interest rate environment (Prime + Spread can push rates to 10-11% in 2025)[9]

How to address:Require SBA pre-qualification before showing sensitive offering memorandums.

Qualification Adjustments for First-Time Buyers

You can't use the same yardstick for a Corporate Refugee as you do for a Private Equity firm. Here is how to adjust your filter.

Standard Criteria Still Apply

- Proof of Funds: Do they have the liquid cash?

- Authority: Can they sign the check?

- Motivation: Is there a compelling reason to buy now?

Enhanced Screening Areas

For first-time buyers, you need to dig deeper into four specific areas:

1. Total Capital PictureIt’s not enough to cover the down payment.

- Ask: "Have you calculated your total capital requirements including living expenses for the first 6 months?"

- Reality Check: A 10% down payment on a $1M business is $100k, but they likely need $200k-$250k accessible to cover closing costs, working capital, and the inevitable "transition dip" in revenue.

2. Support Network

- Ask: "Who is on your deal team?"

- Red Flag: If their attorney is their "cousin who does family law," they are not ready. They need M&A-specific counsel.

3. Realistic Expectations

- Ask: "How many hours a week do you expect to work in Year 1?"

- Red Flag: If they answer "20 hours," they are looking for passive income, not a Main Street acquisition.

4. Commitment Level

- Ask: "What is your backup plan if you don't find a business?"

- Insight: If their backup plan is "I'll just stay at my job," they are likely a tire kicker. The best buyers are those who have already left or have a hard exit date.

First-Time Buyer Questions to Add to Your Script

Process understanding:

- "Have you researched the business acquisition process?"

- "What timeline are you expecting from search to close?" (Look for the 6-12 month reality check).

- "Do you have professional advisors lined up?"

Financial preparation:

- "Have you spoken with an SBA lender about pre-qualification?" (Tip: Lenders like Live Oak Bank can pre-qualify quickly 8).

- "Does your spouse/partner fully understand and support this plan?" (Spousal veto kills deals at the 11th hour frequently).

Commitment check:

- "How long have you been looking?" (If >2 years, they may never buy).

- "Have you made offers before? Why didn't they close?"

What Not to Automatically Disqualify

Don't be too quick to judge. Some "red flags" are actually just "green flags" in disguise.

Lack of Acquisition Experience

Every buyer was a first-time buyer once. As long as they have relevant transferrable skills (e.g., P&L responsibility, sales management), they can learn the deal mechanics.

Corporate Background

Corporate refugees bring sophistication. They understand KPIs, they are used to reporting, and they often have deep pockets from 401(k) rollovers (ROBS). 42% of buyers are corporate refugees 2—if you disqualify them, you lose half your leads.

Need for Financing

Needing a loan is normal. SBA 7(a) loans fund the vast majority of transactions under $5M. Focus on creditworthiness, not cash-on-hand for the full purchase price.

Questions and Concerns

A buyer who asks tough questions about customer concentration or lease terms is serious. The buyer who nods at everything and asks nothing is the one who will ghost you.

Setting Expectations

The Acquisition Timeline

Help them visualize the marathon they are running.

Phase | Duration | Activities |

|---|---|---|

Search | 2-6 months | Finding and evaluating opportunities (avg search for generalist is 13-18 months 6). |

Qualification | 2-4 weeks | Initial evaluation, NDA, CIM review. |

LOI | 2-4 weeks | Negotiation. Note: Only ~20% of LOIs get countersigned[6] |

Due Diligence | 4-8 weeks | Deep investigation (Financial, Operational, Legal). |

Financing | 4-8 weeks | SBA approval (runs parallel to DD). |

Closing | 2-4 weeks | Legal documentation and funding. |

Transition | 1-6 months | Seller training and handoff. |

Total: 6-12 months from serious search to operating independently.

The True Cost Picture

Ensure first-time buyers understand total costs beyond the asking price:

Cost Category | Typical Amount |

|---|---|

Down Payment | 10-20% of purchase price (SBA minimum is 10%)[8] |

Working Capital | 5-10% of revenue (critical for cash flow). |

Closing Costs | 2-3% of purchase price (legal, SBA fees, etc.). |

Due Diligence | $15,000-$50,000 (Quality of Earnings report, legal review). |

Living Expenses | 3-6 months (salary replacement during transition). |

The Effort Required

Be brutally honest:

- Due Diligence is a job: It requires digging through bank statements and contracts.

- The First Year is the hardest: Transition shock is real. They will be the CEO, but also the janitor if the cleaning crew quits.

Helping First-Time Buyers Succeed

Education Resources

Don't just sell; teach. Send them articles on:

- How SBA 7(a) loans work (and the 2025 fee changes).

- The importance of "Quality of Earnings" (QoE).

- Sample due diligence checklists[10]

Professional Referrals

Build your own "deal team" of vendors to refer:

- Lenders: SBA Preferred Lenders (PLP) who can close in 45-60 days.

- Attorneys: Transactional lawyers, not litigators.

- Accountants: CPAs who understand "add-backs" and SDE.

Ongoing Support

Check in regularly. A first-time buyer who goes silent is usually spiraling. A quick call to explain that "yes, it's normal for the landlord to be slow with the lease assignment" can save a deal.

Red Flags Specific to First-Time Buyers

Concerning Patterns

Watch out for these deal-killers:

- Unrealistic confidence: "I managed a $50M budget at GE, this $2M HVAC company will be easy." (They don't realize the $50M budget came with a staff of 20).

- Insufficient preparation: No proof of funds, no accountant, just "looking around."

- Misaligned expectations: Expecting the business to run itself (absentee ownership) immediately.

- Lack of partner buy-in: If they say, "My wife/husband doesn't really know I'm doing this," stop. You are wasting your time.

Questions to Uncover Issues

- "What research have you done about owning a business?"

- "How does your spouse feel about risking the house collateral for an SBA loan?"

- "What will you do if the top client leaves the day after closing?"

Case Study: Successful First-Time Buyer

Background

Sarah, 45, was a VP of Marketing at a Fortune 500 company. She fits the classic "Corporate Refugee" profile: seeking independence, wanting to build equity, and burned out on corporate politics. She targeted a B2B marketing services firm.

Red Flags Identified

- No acquisition experience: She had never done a deal.

- No banking relationships: She didn't have a commercial banker.

- Spouse initially hesitant: Her partner was risk-averse.

Mitigating Factors

- Transferable Skills: Strong P&L management and leadership experience from her corporate role.

- Liquidity: She had $400k in liquid assets (enough for a solid down payment and buffer).

- Coachability: She engaged a transaction attorney and CPA early upon the broker's advice.

- Adaptability: She agreed to a longer seller transition period to mitigate the "key person" risk often found in agencies[11]

Qualification Adjustments Made

- Spousal Buy-In: The broker required Sarah’s spouse to attend a meeting to discuss the risks and the financing structure, ensuring alignment.

- Lender Connect: The broker introduced Sarah to an SBA lender immediately for pre-qualification to prove viability.

- Education: The broker walked her through a "mock closing" statement so she understood the cash requirements.

Outcome

Sarah closed on a $1.2M marketing agency. The seller stayed on for 6 months to transition key accounts. Under Sarah's leadership, the business grew 15% in the first year by applying her corporate marketing strategies to the smaller firm.

Frequently Asked Questions

Should I spend as much time with first-time buyers?

Yes, if they are qualified. With 39% of the market being first-timers 1, ignoring them is bad business. A qualified first-timer is often more motivated than a tire-kicking strategic buyer.

How do I know if a first-time buyer is serious?

Look for Skin in the Game. Have they spent money on a valuation or legal counsel? Do they have a specific "Buy Box"? Have they produced a Proof of Funds without hesitation?

What if a first-time buyer gets cold feet?

This is usually a knowledge gap. Ask, "What specific risk is worrying you?" Often, it's something solvable (e.g., fear of losing a customer). Address the specific fear with data or deal structure (e.g., an earn-out).

Should I recommend first-time buyers start with smaller deals?

Not necessarily. Smaller deals often have more operational risk (buying a job) than larger ones. A first-time buyer with management experience is often safer buying a $1M+ EBITDA business with a management layer than a $100k SDE job-shop.