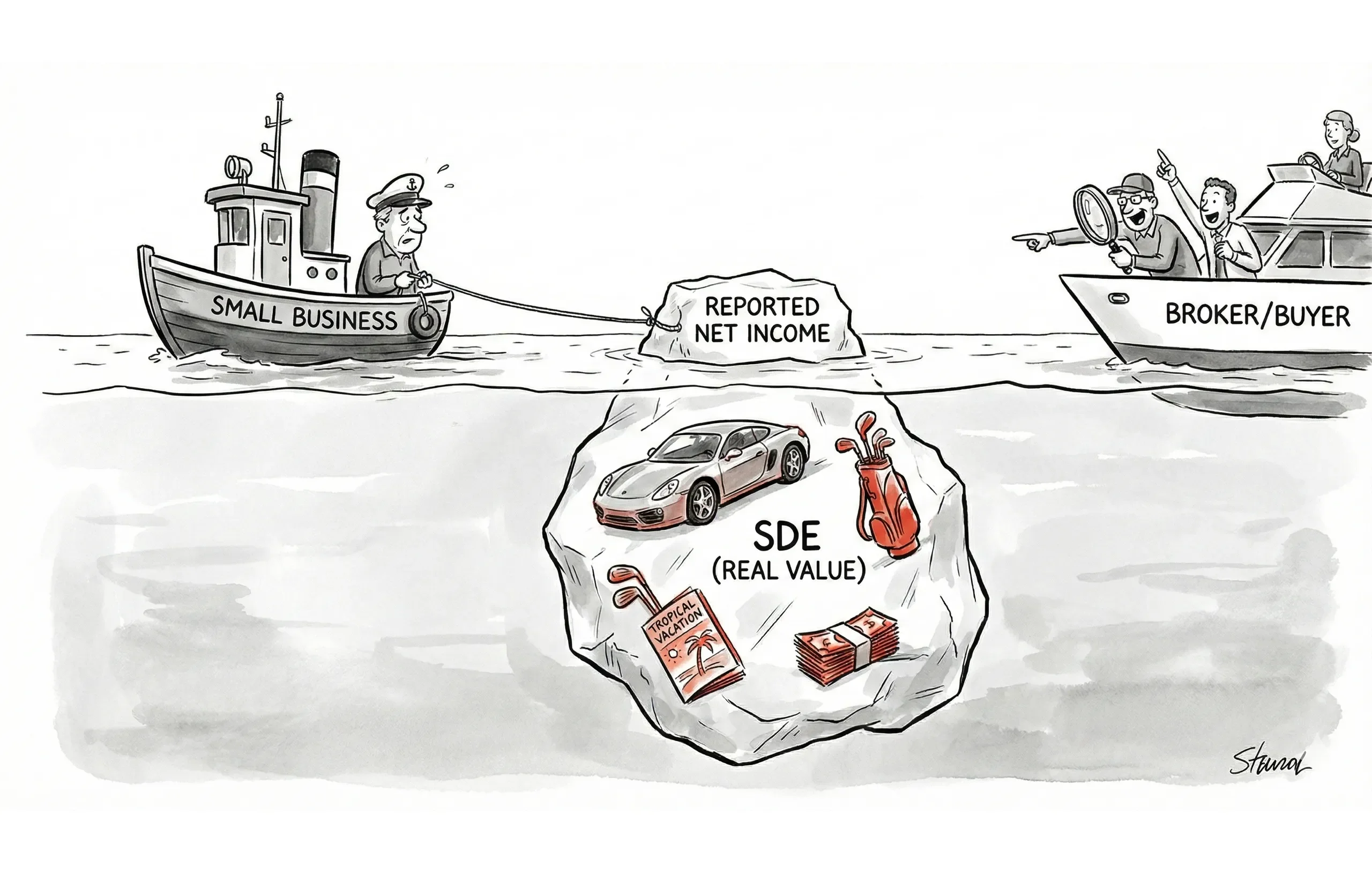

We’ve all seen it. You get a call from a seller who swears their business is a well-oiled machine. The financials look decent—solid SDE, consistent margins. You start the valuation process, maybe even line up a couple of eager buyers.

Then comes the site visit.

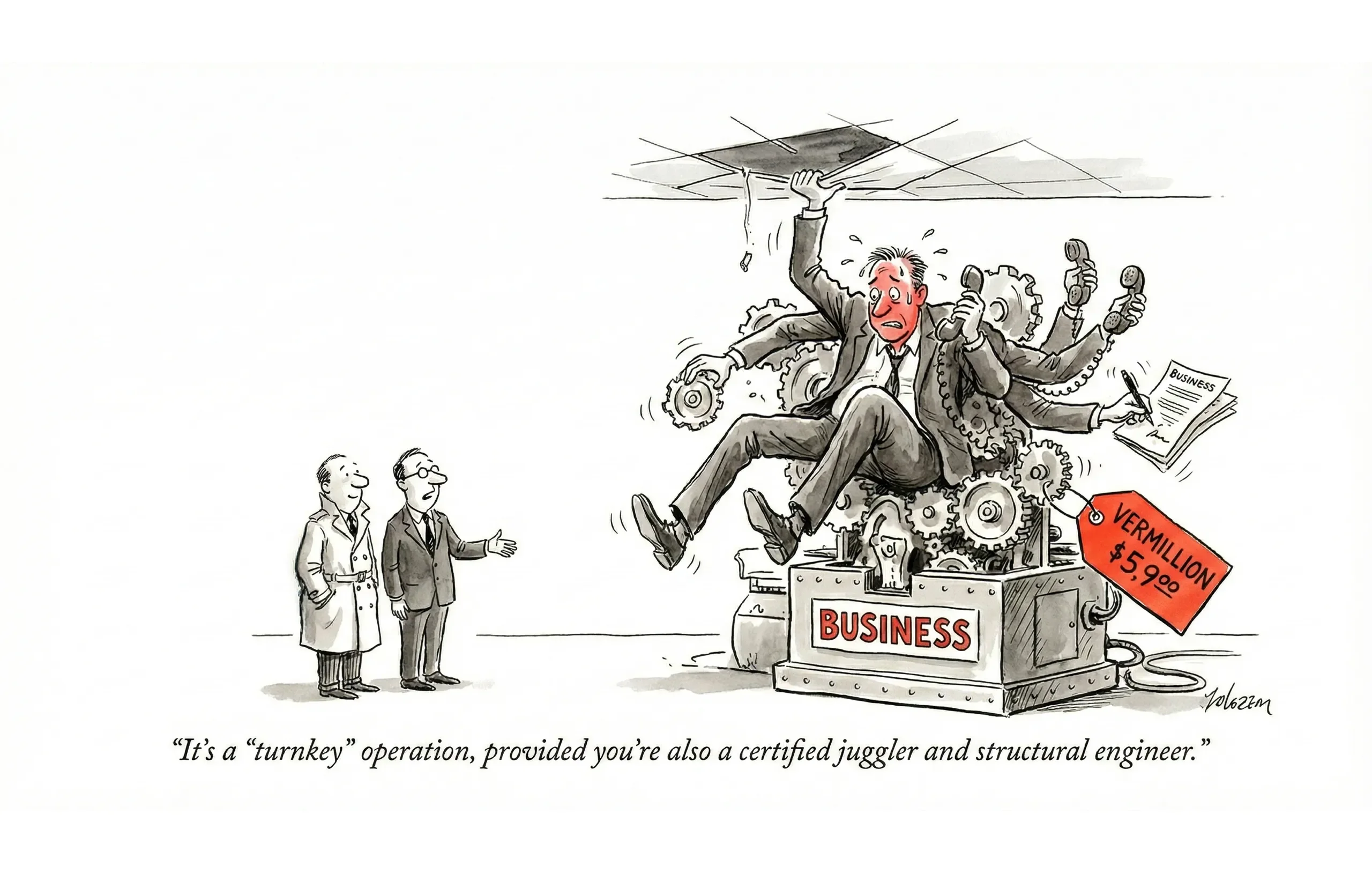

Every five minutes, an employee knocks on the door to ask where the inventory is. The phone rings, and the owner takes it because "clients only want to talk to me." You realize with a sinking feeling: This isn't a business; it's a high-paying job with overhead.

This is the "Helicopter Owner" problem, formally known as Key Person Dependency. It is perhaps the single biggest deal-killer in the lower middle market. According to the Exit Planning Institute, while 58% of owners plan to exit in the next five years, many are woefully unprepared, with businesses so reliant on them that they are effectively unsellable.

When a business relies heavily on one person—usually the owner—buyers don't see an asset; they see a transition risk. And they price it accordingly.

What is Key Person Dependency?

In our world, we talk about "transferability" constantly. Key person dependency is the exact opposite of transferability. It exists when the business's success relies disproportionately on a single individual's:

- Relationships - "The customers are my friends."

- Knowledge - "I know how to fix the legacy machine; it's not written down."

- Skills - "I close 90% of the deals."

- Reputation - "The brand is me."

If the owner gets hit by a bus (or just retires to Florida), the revenue stream evaporates. Buyers know this. As BizBuySell notes in their insight reports, risk is a primary driver of valuation multiples. High risk = low multiple.

Types of Dependency

Not all dependencies are created equal. As brokers, we need to diagnose which type of dependency we're dealing with to advise our clients correctly.

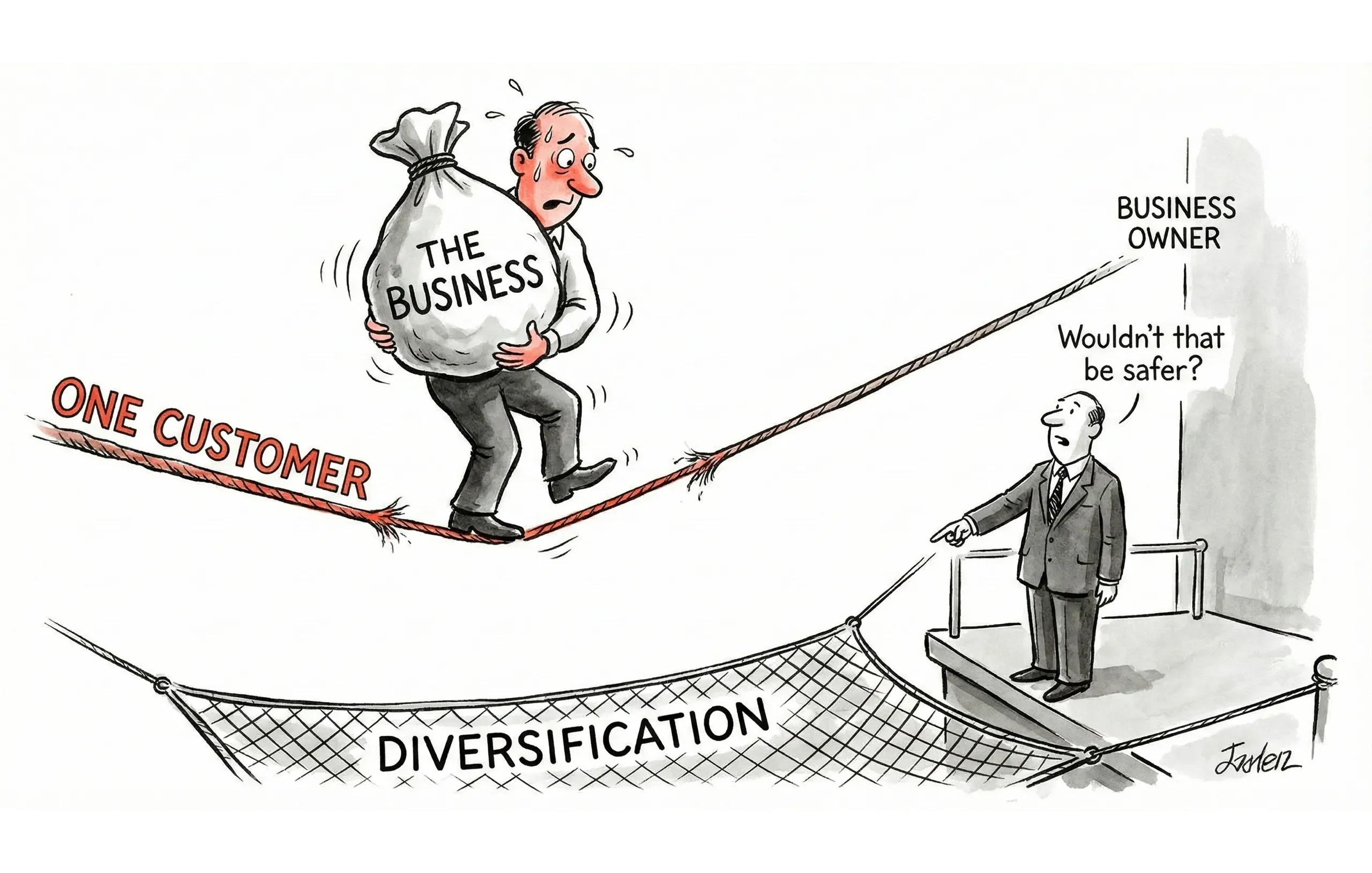

Customer Relationship Dependency

This is the most dangerous form. If the relationship walks out the door, so does the cash flow.

Indicator | Risk Level |

|---|---|

Owner handles all sales calls personally | High |

Customers call owner's personal cell | High |

No CRM; contacts are in the owner's phone | High |

"They buy from me, not the company" | Critical |

Operational Knowledge Dependency

This is the "Tribal Knowledge" trap. The business runs on information stored exclusively in the owner's brain.

Indicator | Risk Level |

|---|---|

No written SOPs (Standard Operating Procedures) | High |

Owner is the only one who handles "fires" | High |

Staff paralysis when owner is on vacation | High |

Pricing decisions are "gut feel" by owner | Medium |

Technical Skills Dependency

Common in specialized trades, engineering firms, or boutique agencies.

Indicator | Risk Level |

|---|---|

Owner performs the specialized delivery work | High |

No other staff has required licenses/certs | High |

Owner invented the proprietary product | Medium-High |

Industry expertise is concentrated in one person | Medium |

Sales/Revenue Generation Dependency

The "Rainmaker" problem. The owner is the best salesperson, and no one else comes close.

Indicator | Risk Level |

|---|---|

Owner generates 80%+ of new revenue | Critical |

No dedicated sales staff | High |

Owner's face/name is the primary marketing asset | Medium |

Industry relationships are personal, not corporate | High |

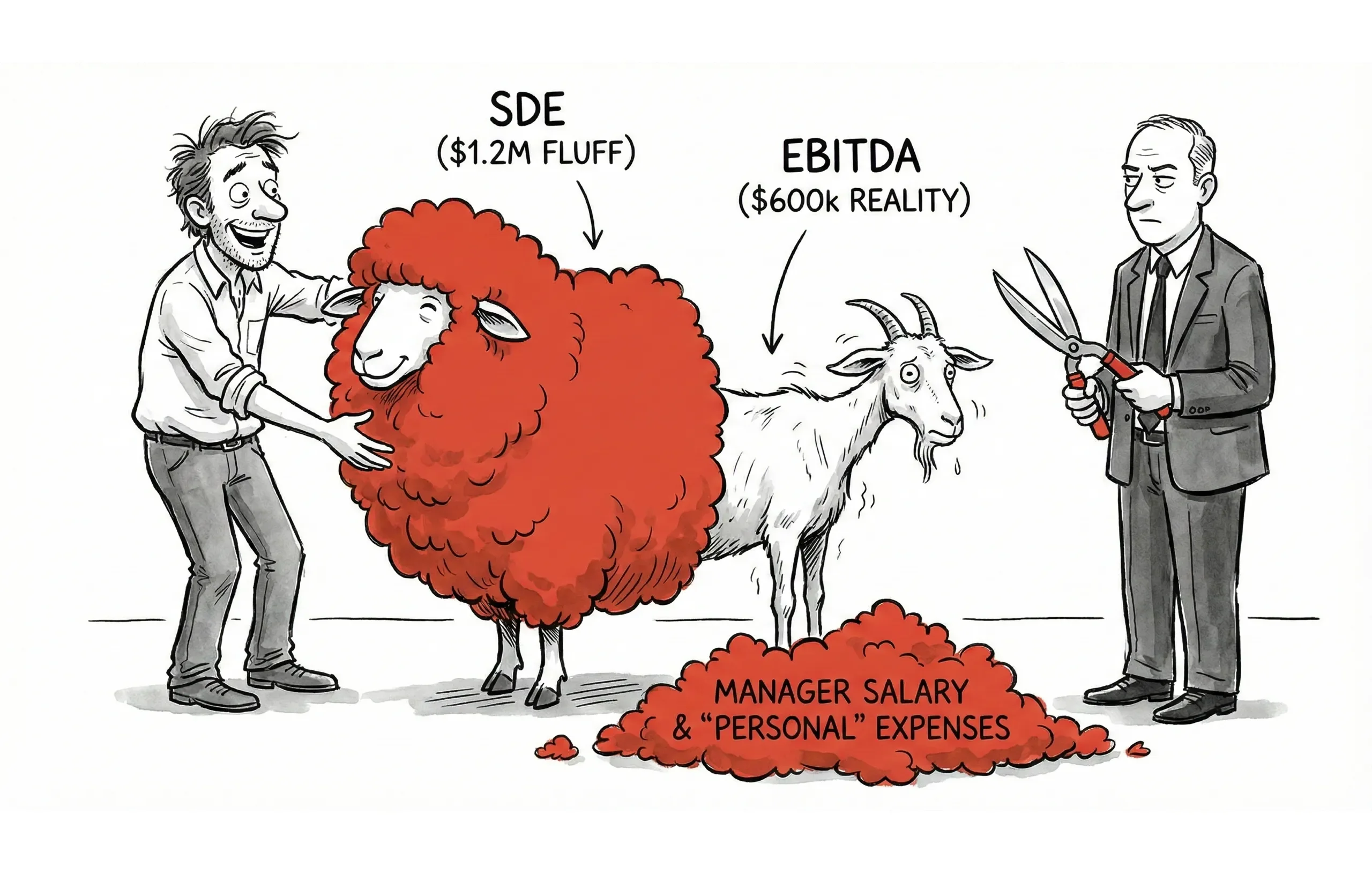

Quantifying the Impact: The "Discount"

When you're trying to explain to a seller why their business isn't worth a 4x multiple, show them the math. Buyers don't just subtract a random number; they adjust the risk premium in their heads.

A high "Key Person Risk" effectively raises the required rate of return, which lowers the multiple.

Typical Discount Ranges

Dependency Level | Multiple Impact | Description |

|---|---|---|

Low | No discount | Strong management team, documented SOPs, transferable contracts. |

Moderate | -0.25 to -0.5x | Some owner dependency, but trainable. Buyer sees "fixable" problems. |

High | -0.5 to -1.0x | Significant owner role. Buyer will require a long transition or heavy earnout. |

Critical | -1.0x+ or unsellable | Business = Owner. No transferable value exists. |

Example Impact

Let's look at two identical HVAC companies with $400,000 in SDE.

Business A (Turnkey):

- General Manager in place.

- Techs use iPads with documented workflows.

- Industry Multiple: 3.0x

- Valuation: $1,200,000

Business B (Owner-Reliant):

- Owner dispatches calls.

- Owner quotes every job.

- Adjusted Multiple: 2.25x (Key Person Discount applied)

- Valuation: $900,000

The Cost of Ego: $300,000.That's a 25% haircut simply because the owner refused to delegate.

Assessment Framework

Use this simple scorecard during your initial seller interview or valuation engagement. It helps move the conversation from "feelings" to "facts."

Dependency Scorecard

Rate each area 1-5 (1 = no dependency, 5 = critical dependency):

Area | Weight | Score (1-5) |

|---|---|---|

Customer relationships | 25% | __ |

Operational knowledge | 25% | __ |

Technical skills | 20% | __ |

Sales generation | 20% | __ |

Decision making | 10% | __ |

Total Weighted Score | 100% | __ |

Interpretation:

- 1.0-2.0: Sellable Asset. Minimal discount.

- 2.1-3.0: Manageable Risk. Expect a 0.25-0.5x discount or a standard transition period.

- 3.1-4.0: High Risk. Heavy discount (0.5-1.0x). Deal structure will likely be earnout-heavy.

- 4.1-5.0: Unsellable. The seller needs 12-24 months of consulting work before going to market.

Red Flags in Assessment

Watch out for these phrases during your initial calls. They are the "check engine lights" of a deal.

Immediate Concerns

- "My customers are loyal to me personally." (Translation: They will leave when you leave.)

- "It's faster if I just do it myself." (Translation: No processes exist.)

- "I work 60+ hours a week." (Translation: The business model is broken.)

- No second-in-command. (Translation: The buyer has to be the CEO on Day 1.)

- Owner's cell phone is on the business card. (Translation: Zero boundaries or delegation.)

Due Diligence Warning Signs

- Staff looks at the owner before answering simple operational questions.

- No one else has access to the bank accounts or supplier contacts.

- Financial decisions—even small ones—are bottlenecked at the owner's desk.

Mitigation Strategies

So, you've identified the problem. How do you help the client fix it?

If you catch this 12-24 months pre-sale, you can help them increase their multiple significantly.

For Sellers (Pre-Sale Preparation)

The "Vacation Test": Challenge your seller to take a two-week vacation completely off the grid. Whatever breaks while they are gone is exactly what they need to fix before listing the business.

Action | Impact on Valuation |

|---|---|

Hire/Promote a Manager | Demonstrates operational independence. Creates a "stay team" for the buyer. |

Document Processes (SOPs) | Turns "tribal knowledge" into a transferable asset. |

Transition Relationships | Introduce other staff to key accounts. Make the company the contact point. |

Delegate Decisions | Give staff budget authority. Stop being the bottleneck. |

For Deal Structure (When Dependency is High)

If the seller lists now despite the dependency, you need to structure the deal to bridge the trust gap.

- Earnouts: Tie a portion of the purchase price to client retention or revenue targets post-close. This aligns the seller's incentive with the buyer's risk.

- Extended Transition/Consulting: Instead of the standard 30-60 days, structure a 6-12 month consulting agreement where the seller actively transfers knowledge.

- Seller Note: A larger seller note signals confidence that the business won't collapse.

Buyer Perspective

To close the deal, you have to think like the person with the checkbook (and their lender).

What Buyers Fear

- Customer Churn: The "goodwill" evaporates the moment the introduction letter goes out.

- Operational Collapse: The buyer doesn't know the "secret handshake" to get product out the door.

- Staff Exodus: Employees were loyal to the person, not the paycheck or the culture.

What Mitigates Fear

- A Strong #2: A lieutenant who knows as much as the owner and is incentivized to stay.

- Written Playbooks: Proof that the business is a system, not a personality cult.

- Contracts: Long-term contracts that aren't tied to the owner's personal relationship.

Conclusion

Key person dependency is a valuation killer, but it's also a solvable problem. As brokers, our value isn't just in listing a business—it's in advising clients on how to make their business sellable.

By identifying these risks early and coaching sellers on mitigation, you don't just save the deal; you actively create wealth for your client.