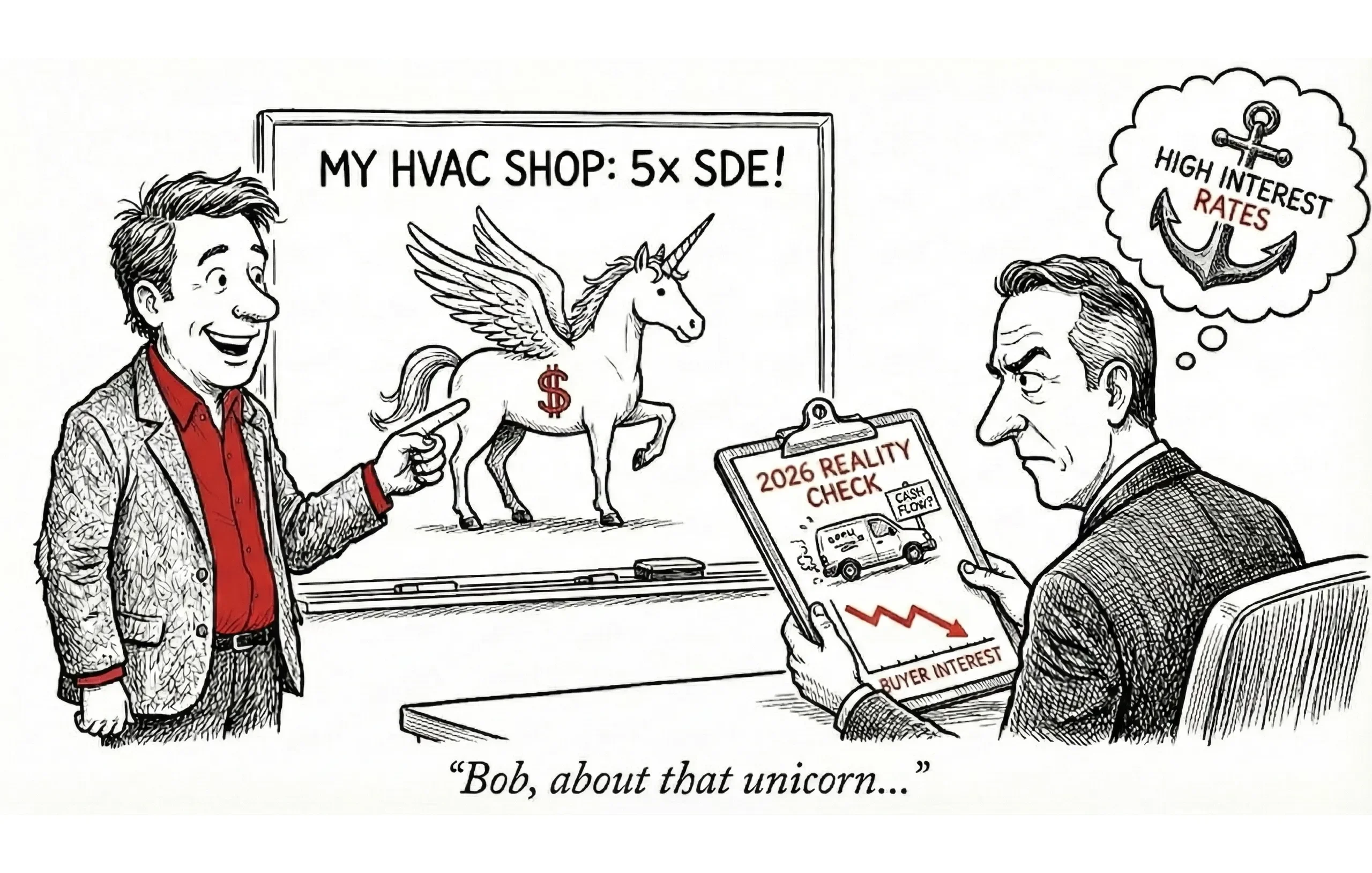

We've all been there. You're sitting across from a seller who has built a "fantastic" business. The top-line revenue is strong, the brand is recognizable, and they're ready to retire to Boca. You take the listing, confident you can find a buyer.

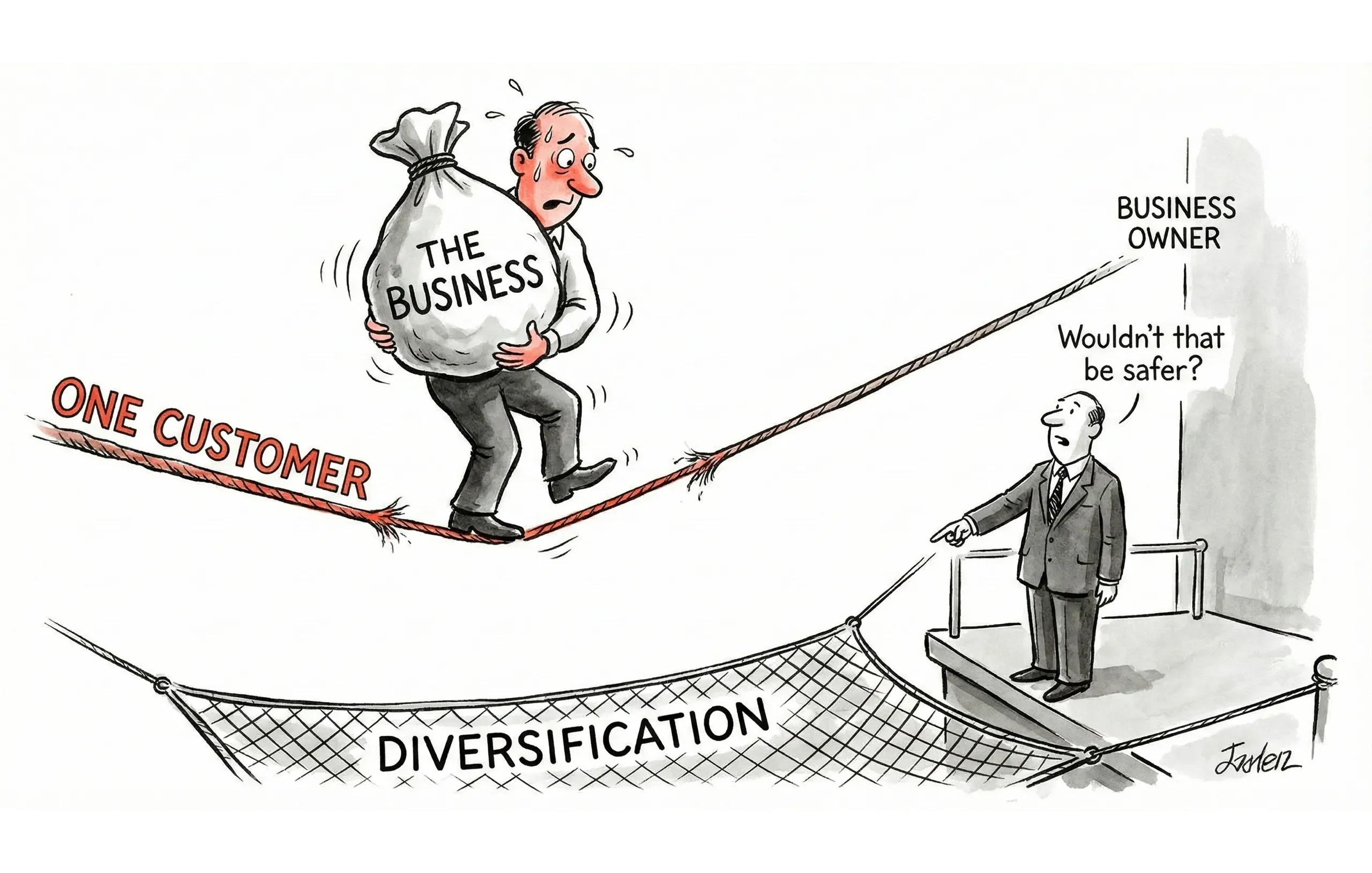

Then the LOIs start rolling in—or rather, they don't. The private equity groups pass immediately. The individual buyers turn into "tire kickers" who ghost you after the first management meeting. Why? Because once they popped the hood during due diligence, they found a business that was 90% dependent on the owner's brain and 60% dependent on a single customer.

The "perfect" deal dies on the vine, and you're left explaining to a frustrated client why the market isn't valuing their life's work the way they do.

Here's the truth: you can increase business value before selling by 10-30% with strategic preparation. This isn't about cosmetic improvements or accounting tricks. It's about engineering the business to be sellable—addressing the specific risk factors and value drivers that buyers actually pay premiums for.

Strategic preparation means transforming a business from "owner-dependent job" to "turnkey asset." A well-prepared business commands premium multiples simply by avoiding the discounts buyers apply for risk.

4 Ways to Increase Business Value Before Selling

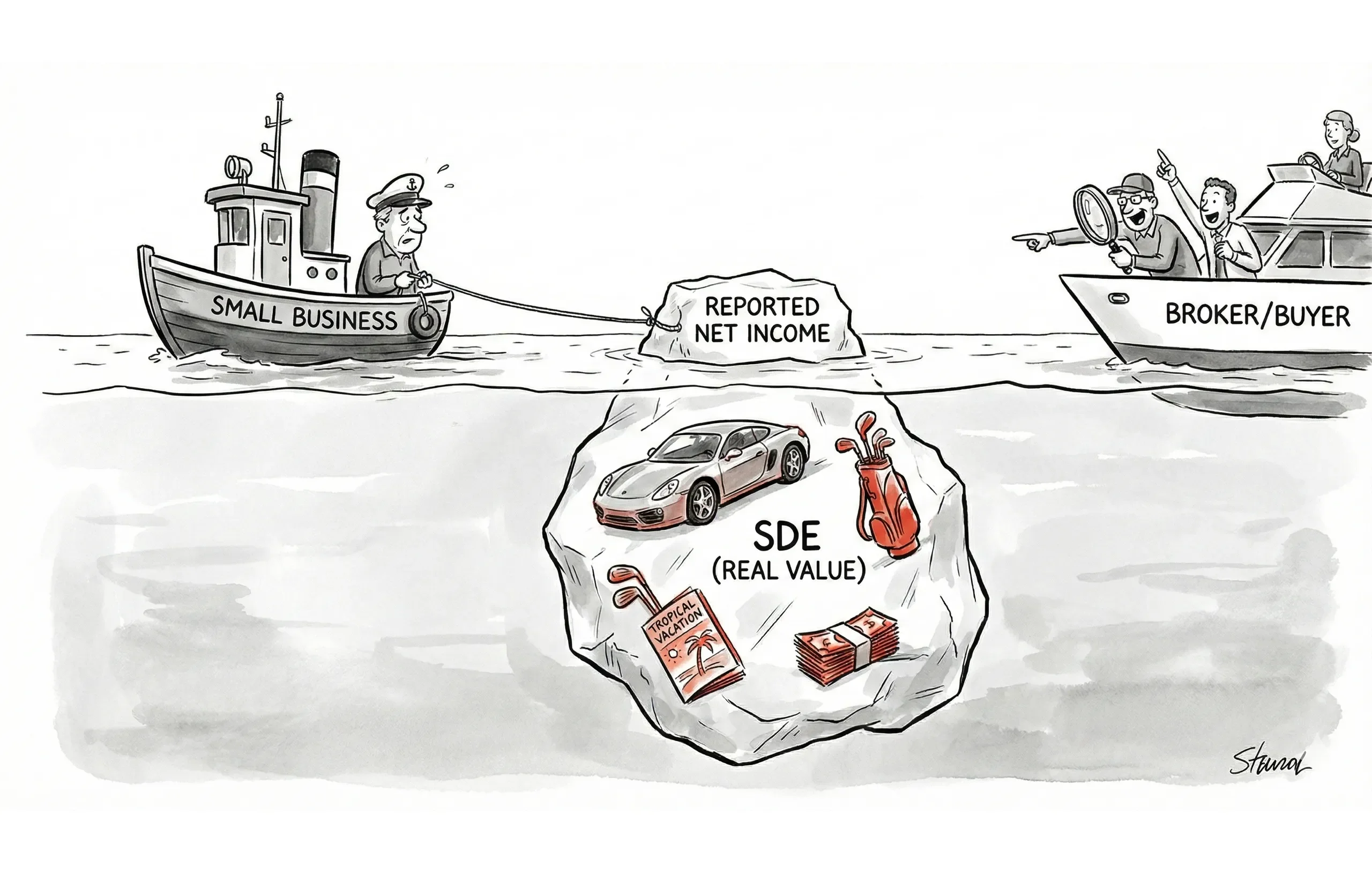

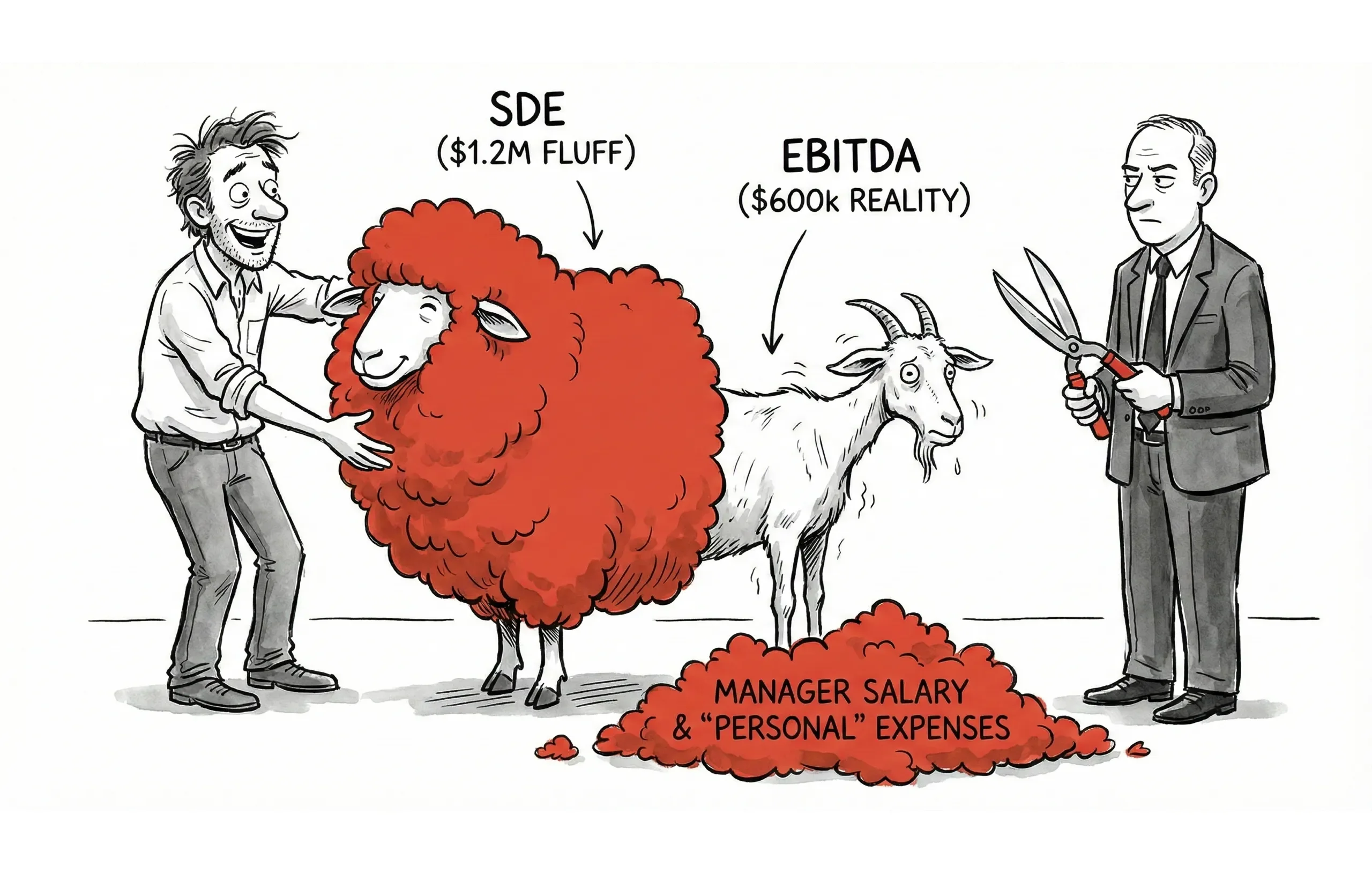

To help a seller increase business value before selling, focus on four key pillars. These aren't theoretical concepts—they're the levers that directly impact SDE (Seller's Discretionary Earnings) and the multiple applied to it.

1. Revenue Enhancement

Buyers love growth, but they pay premiums for quality growth. The goal isn't just top-line expansion; it's creating "sticky" revenue that survives ownership transition.

Strategy | Impact on Business Value |

|---|---|

Grow top line | Increases absolute value based on revenue multiples |

Add recurring revenue | Multiple premium: Recurring revenue (SaaS, retainers, maintenance contracts) trades at 5-10x higher multiples than transactional revenue |

Diversify revenue | Risk reduction: Spreading income across industries protects against market downturns |

Secure long-term contracts | Revenue visibility: Multi-year agreements give buyers confidence in future cash flows |

Improve customer retention | Increases Customer Lifetime Value (LTV), a key private equity metric |

Value Impact: Revenue quality improvements can boost business value by 0.5-1.0x the current multiple.

2. Margin Improvement

We live and die by the add-backs, but the cleaner the P&L is before we start normalizing, the higher the buyer trust. Strong margins signal pricing power and operational efficiency—two factors that directly increase business value.

Strategy | Impact on Business Value |

|---|---|

Increase prices | Direct SDE boost: Often the fastest way to enhance business value without adding CAPEX |

Reduce COGS | Margin expansion: Better gross margins (>50%) signal market dominance |

Cut unnecessary expenses | SDE improvement: Trimming subscriptions and unused services flows straight to bottom line |

Negotiate vendor terms | Working capital: Extended payment terms improve cash flow—a huge buyer plus |

Improve efficiency | Operational leverage: More revenue per employee demonstrates scalability |

Value Impact: Margin improvement of 5-10 percentage points can increase business value by 15-25% at the same revenue level.

3. Risk Reduction

Risk is the silent deal killer. According to industry experts, buyers will often cut offers by 20–30% if they perceive financial or operational risks, such as untrustworthy numbers or high customer concentration. Source: Capsule CRM.

The fastest way to increase business value before selling is often simply removing the discounts buyers apply for concentration, dependency, and uncertainty.

Strategy | Impact on Business Value |

|---|---|

Reduce customer concentration | Multiple improvement: Getting any single client below 20% of revenue removes the "concentration discount" (typically 0.25-0.5x) |

Diversify suppliers | Supply security: Mitigates supply chain disruption risk |

Reduce owner dependency | Transition confidence: Proves the business has transferability—critical for SBA financing |

Lock in lease terms | Facility security: 5+ year lease (or owned property) essential for location-based businesses |

Secure key employees | Operational stability: Retention bonuses or phantom equity keep talent through transition |

Value Impact: Eliminating concentration and dependency risks can increase business value by 0.5-1.0x the baseline multiple.

4. Operational Enhancement

A business that runs on systems—not the owner's "gut feeling"—is a business that sells at premium multiples. Operational excellence signals that the business is a scalable asset, not a glorified job.

Strategy | Impact on Business Value |

|---|---|

Document all processes | Transferability: SOPs are the "instruction manual" for the new owner |

Build management layer | Owner independence: A GM or management team means the buyer acquires a business, not a 60-hour workweek |

Implement systems (CRM/ERP) | Scalability: Technology infrastructure shows growth capacity |

Improve quality metrics | Customer retention: High Net Promoter Scores validate product/service quality |

Update equipment/facilities | Reduced CAPEX: Eliminates immediate post-close capital requirements |

Value Impact: Operational systems and management depth can boost business value by 0.5-1.0x, particularly for service businesses.

Top 3 Strategies to Increase Business Value Fast

If your client has 12-24 months before they want to list, focus their energy on these three "multiple expanders." These deliver the highest ROI on time invested.

1. Convert to Recurring Revenue

One-off sales are fine, but recurring revenue is the holy grail. Businesses with high recurring revenue (software, subscriptions, service contracts) command multiples 5x to 10x higher than comparable transactional businesses because the revenue is predictable and "baked in" for the buyer. Source: Raincatcher.

How to Increase Business Value with Recurring Revenue:

- Convert break-fix clients to maintenance contracts

- Transition project work to monthly retainers

- Introduce subscription or membership models

- Offer prepaid annual service packages

Value Impact: +0.5-1.0x multiple Timeline: 6-12 months to show trend

2. Eliminate Customer Concentration

Customer concentration is a deal-breaker for lenders, SBA banks, and sophisticated buyers. As a rule of thumb, no single customer should represent more than 20-25% of revenue. If a buyer sees 40% of revenue tied to one client, they see existential risk that requires massive earn-outs or discounts to mitigate. Source: Strategic M&A Advisors.

How to Increase Business Value Through Diversification:

- Launch aggressive new customer acquisition campaigns

- Expand into adjacent market segments

- Enter new geographic territories

- Proactively "fire" or reduce reliance on whale clients

Value Impact: +0.25-0.5x multiple Timeline: 12-18 months to rebalance revenue mix

3. Build Management Independence

If the owner is the business, the business has minimal transferable value. "Owner-reliant companies stall growth... and risk spikes and multiples fall." Source: Efficiency Edge.

Buyers want a cash-flowing asset, not a full-time job running someone else's company. The more the business can operate without daily owner involvement, the higher the value.

How to Increase Business Value by Reducing Dependency:

- Hire or develop a General Manager with P&L authority

- Delegate all operational decisions to management team

- Document institutional knowledge (SOPs, client relationships, vendor contacts)

- Reduce owner time to <20 hours/week for 6+ months pre-sale

Value Impact: +0.5-1.0x multiple Timeline: 12-24 months to build and prove management capability

When to Start: Timeline to Increase Business Value

Most sellers ask: "How long does it take to increase business value before selling?" The answer: 12-24 months minimum for meaningful, verifiable improvement.

Buyers pay premiums for trends, not one-time spikes. You need at least 2-3 quarters of financial performance showing the improvements to overcome buyer skepticism.

Recommended 12-Month Value-Building Timeline

Months 1-3: Foundation

- Clean up financial statements

- Document all operational processes

- Identify top 3 value gaps (concentration, dependency, margins)

Months 4-6: Revenue Quality

- Launch customer diversification initiatives

- Convert transactional clients to recurring contracts

- Secure long-term agreements with key customers

Months 7-9: Operational Excellence

- Implement CRM/ERP systems

- Hire or promote General Manager

- Reduce owner time in business by 50%

Months 10-12: Margin & Risk

- Optimize pricing and margins

- Lock in lease or key supplier contracts

- Address any remaining red flags (litigation, compliance, etc.)

Proof Period (Months 12-15):

- Let improvements "season" in the financials

- Demonstrate sustainability of changes

- Build 3-4 quarters of trend data

By month 15-18, you're ready to go to market with a business that commands premium multiples.

Common Mistakes That Decrease Business Value

Just as there are proven strategies to increase business value before selling, there are "value destroyers" that sellers often stumble into during the final stretch.

Action | Why It Decreases Business Value |

|---|---|

Cutting marketing spend | Revenue decline: "Coasting" to the finish line signals downward trends to buyers |

Deferring maintenance | Equipment risk: Buyers spot deferred maintenance in inspection and deduct 150-200% of fix cost from offers |

Losing key employees | Capability loss: Workforce instability during due diligence is a massive red flag |

Neglecting customer service | Revenue risk: Churning customers pre-sale destroys the value you've built |

Short-term cost cuts | Operational degradation: Slashing costs to artificially inflate EBITDA backfires when buyers see operational cracks |

Announcing the sale | Stakeholder panic: Vendors, employees, and customers get nervous, creating instability |

Bottom Line: Sellers who try to "sprint to the finish" often destroy more value than they create. The businesses that command premium multiples are the ones that maintain momentum through the sale process.

Key Takeaways: How to Increase Business Value Before Selling

Increasing business value before selling isn't about gimmicks or financial engineering. It's about systematically addressing the risk factors buyers discount for and building the value drivers they pay premiums for.

The Four Pillars:

- Revenue Enhancement: Quality > quantity (recurring revenue, diversification, contracts)

- Margin Improvement: Clean P&L with strong gross margins (>50%) and SDE growth

- Risk Reduction: Eliminate concentration, dependency, and uncertainty

- Operational Excellence: Systems, processes, and management independence

The Timeline: Start 12-24 months before listing to allow improvements to "season" in the financials and demonstrate sustainability.

The Payoff: Well-executed value enhancement delivers 10-30% higher sale prices and attracts multiple qualified buyers—transforming a "hard to sell" listing into a competitive bidding situation.

As brokers, our job isn't just to market businesses; it's to help sellers engineer them for maximum value. When you can walk a client through this roadmap and execute it together, you're not just a transaction facilitator—you're a trusted advisor who delivers life-changing outcomes.

Ready to prepare your next listing? Start with our comprehensive business sale preparation checklist.

Frequently Asked Questions

How much can you realistically increase business value in 12 months?

With focused execution, sellers can typically increase business value by 10-30% through strategic improvements in revenue quality, margin enhancement, and risk reduction. The businesses that achieve the high end of this range focus on recurring revenue conversion (0.5-1.0x multiple improvement) and eliminating customer concentration (0.25-0.5x improvement).

What's the fastest way to increase business value before selling?

The fastest value builders are: (1) converting existing customers to recurring contracts (6-9 months to show trend), (2) reducing customer concentration below 20% per client (12-18 months), and (3) improving SDE margins by 5-10 percentage points through pricing and efficiency (6-12 months). These deliver measurable multiple improvements faster than building new revenue streams.

Should I delay the sale to increase business value, or sell now?

Run the math. If customer concentration exceeds 30%, owner dependency is high, or SDE margins are below 15%, you're likely facing a 20-40% discount from optimal value. Delaying 12-18 months to increase business value typically nets more after-tax proceeds—even accounting for another year of ownership stress. Exception: if the business is in decline or the seller has health concerns, sell now.

Can you increase business value too quickly?

Yes. Buyers are skeptical of sudden improvements in the 6 months before listing. They assume it's financial engineering or unsustainable cost-cutting. To increase business value credibly, you need 2-3 quarters of consistent trend data showing the improvements are real and lasting. This is why the 12-24 month timeline is optimal.

Related Resources

- How to Prepare a Business for Sale - Complete hub article

- Business Sale Preparation Checklist - Step-by-step guide

- Customer Concentration Risk: Impact on Business Value - Deep dive on concentration discounts

- Key Person Dependency Discount - How dependency affects multiples

- SDE Multiples by Industry - Industry benchmarks

- Financial Records Organization - Getting books ready for due diligence