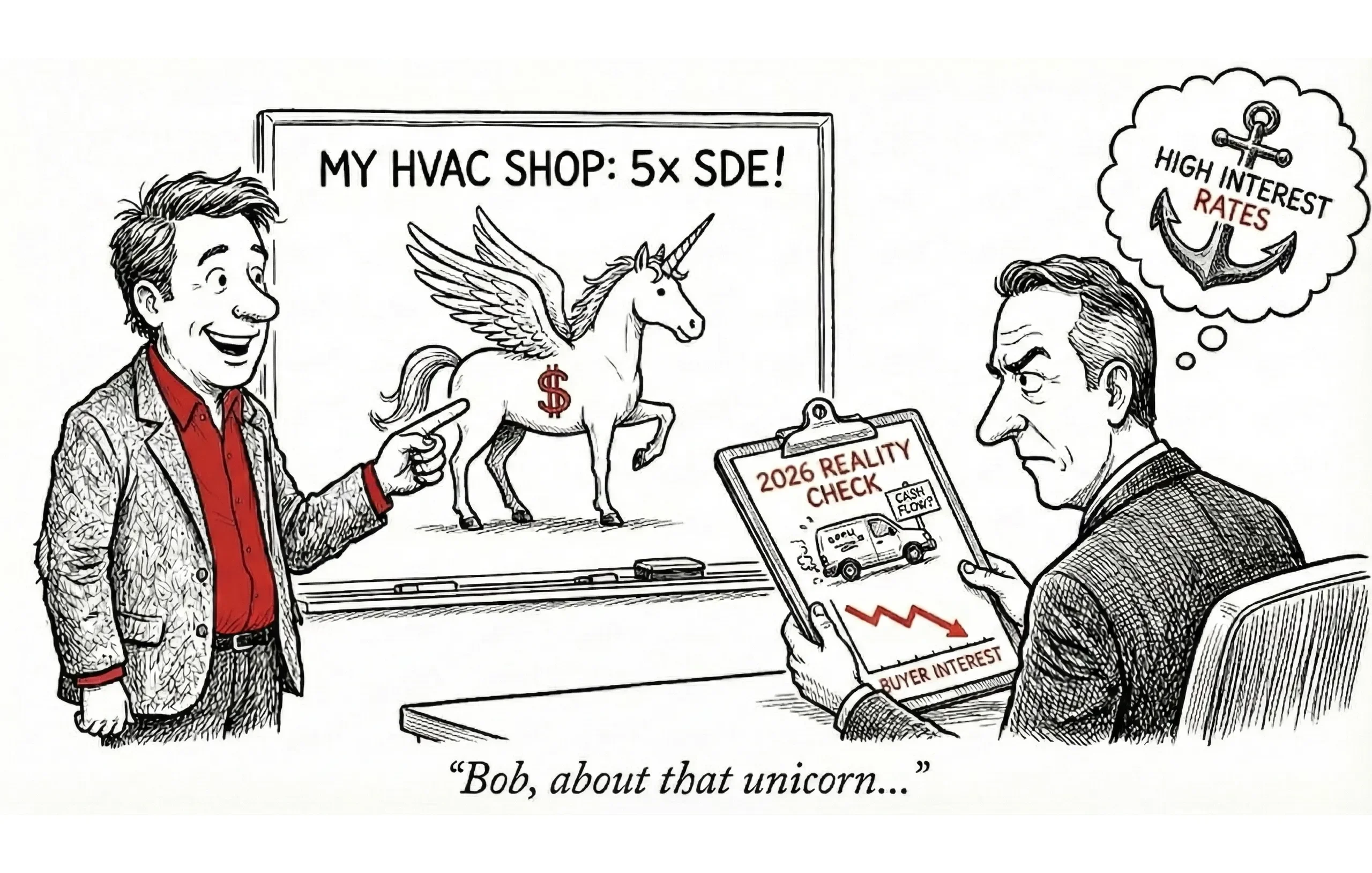

We’ve all been there. You’re sitting across from a seller who swears their business is worth $2 million because their top-line revenue is strong. Then you open the tax returns, and the net income is... negative.

The seller smiles and says, "Oh, don't worry about that. My accountant is a wizard. I make plenty of money; I just don't show it."

This is the "Napkin Math Nightmare," and it’s where deals go to die. According to the IBBA Market Pulse Report, "poor financials" and "unrealistic seller expectations" remain the top deal killers for Main Street transactions year after year.

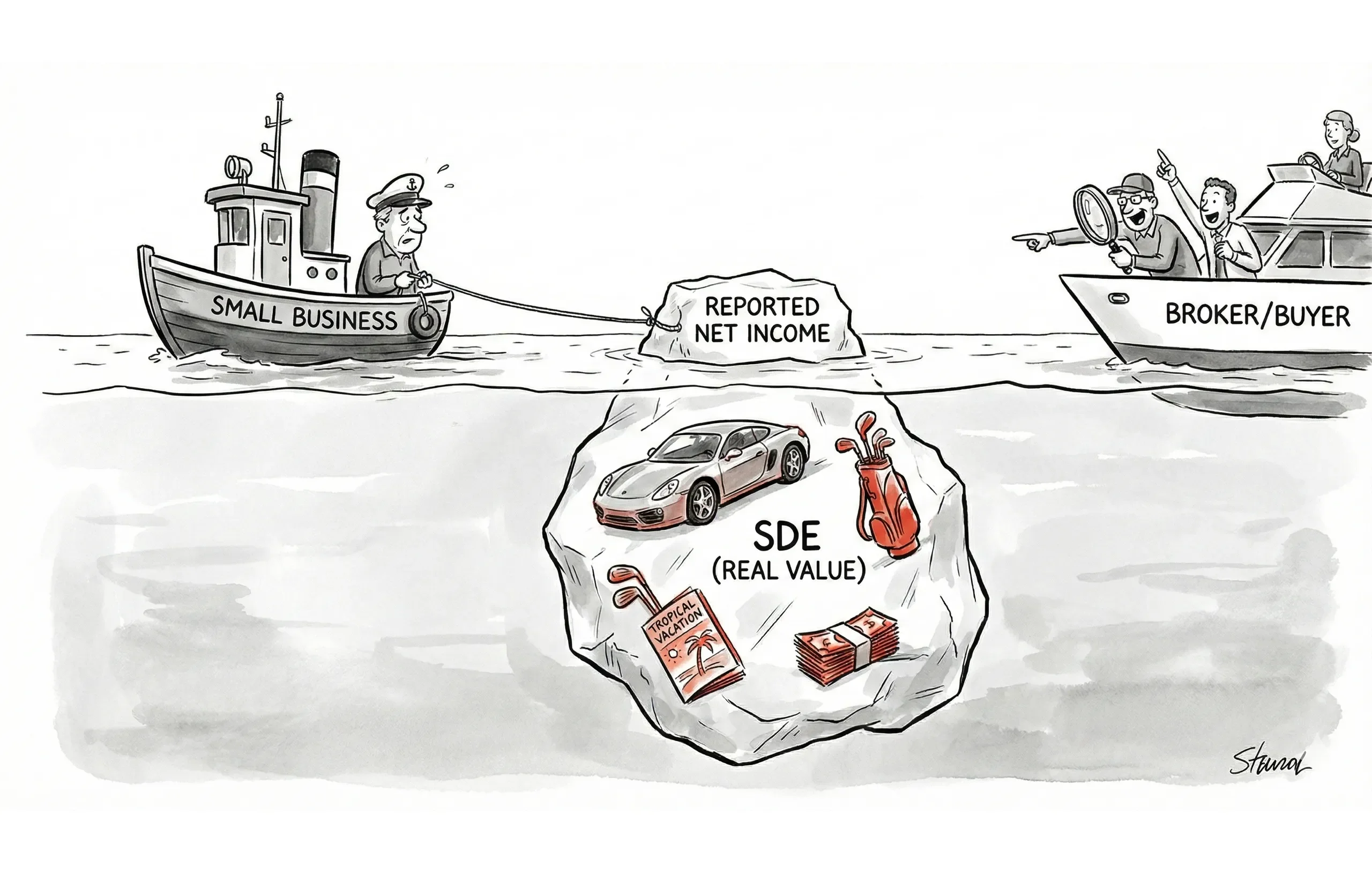

As brokers, our job is to bridge the gap between "tax minimization" and "maximization of value." The tool we use to build that bridge is Seller's Discretionary Earnings (SDE).

Related: Small Business Valuation Methods: The Complete Guide

SDE Definition: The "Real" Number

Seller's Discretionary Earnings (SDE) is the primary valuation metric for Main Street businesses (typically those with under $5M in revenue). It recasts the financial statements to show the total financial benefit available to a single, full-time owner-operator.

In plain English, SDE answers the buyer's most critical question: "If I buy this business, work 40 hours a week, and pay myself a salary, how much cash will this machine actually generate for me?"

The formula is straightforward, but the application is an art form:

Why SDE Matters

- For Valuation: It is the denominator for your multiple. A business with $100k in Net Income might have $350k in SDE. That's the difference between a $300k listing and a $1M listing.

- For Lenders: The SBA cares about debt service coverage. They need to know the SDE can cover the loan payments and leave enough for the buyer to feed their family.

- For Buyers: It distinguishes "buying a job" from "buying an investment."

The Calculation: The Art of "Add-Backs"

Calculating SDE is often called "recasting" the financials. This is where you separate the business expenses from the owner's lifestyle choices.

1. Start with Net Income

Pull the Net Income (Profit/Loss) directly from the tax return or P&L. This is your baseline.

2. Add Back Owner's Compensation

If the owner pays themselves a W-2 salary, add it back.

- Include: Salary, bonuses, employer payroll taxes, health insurance, and retirement contributions (401k match).

- Note: Only add back compensation for one owner. If there are two active partners and the buyer will replace both, you only add back one salary (or adjust for the cost to hire a replacement manager).

3. Add Back Interest & Non-Cash Expenses

- Interest: The buyer will have their own debt structure; the seller's loan costs are irrelevant to the business's operational performance.

- Depreciation & Amortization: These are accounting concepts, not cash outflows. Add them back (unless there is a heavy, recurring CAPEX requirement, which we discuss in "pitfalls").

4. Add Back Discretionary & Personal Expenses

This is where you earn your commission. You need to identify every dollar the business spent on the owner’s personal benefit.

- Vehicles: The "company truck" that is actually a Range Rover used for school runs.

- Travel: The "board meeting" in Hawaii.

- Family: The teenage son on payroll who doesn't actually show up to work.

- Perks: Country club dues, personal cell phones, life insurance.

5. Add Back One-Time (Non-Recurring) Expenses

Expenses that will not happen again under a new owner.

- Lawsuit settlements.

- One-time consulting fees (e.g., website redesign).

- Disaster repairs (e.g., flood damage not covered by insurance).

Example: The "Country Club" Recast

Let's look at a hypothetical company, ABC Services, LLC. On paper, they only made $125,000. But the owner, Bob, lives very comfortably. Here is how we find the real value.

ABC Services, LLC - SDE Calculation

Line Item | Amount | Category | Notes |

|---|---|---|---|

Net Income (Tax Return) | $125,000 | Baseline | Starting Point |

+ Owner's Salary (W-2) | $95,000 | Comp | Bob's base pay |

+ Payroll Tax | $7,268 | Comp | Employer portion only |

+ Health Insurance | $18,000 | Comp | Family plan |

+ 401(k) Match | $4,750 | Comp | Discretionary match |

+ Company Vehicle | $12,000 | Personal | Lease on personal SUV |

+ Personal Travel | $4,500 | Personal | "Strategic planning" in Vegas |

+ Country Club Dues | $6,000 | Personal | "Networking" |

+ Spouse's Salary | $15,000 | Discretionary | Spouse does no work |

+ Depreciation | $22,000 | Non-Cash | Asset write-offs |

+ Interest Expense | $8,500 | Financing | Seller's old loan |

+ Legal Settlement | $12,000 | One-Time | Old vendor dispute |

= Seller's Discretionary Earnings | $330,018 | Total | The Real Number |

The Result: Bob's business isn't generating $125k; it's generating $330k. At a 2.75x multiple, the valuation jumps from roughly $340k (based on Net Income) to $907k.

The Trap: What NOT to Add Back to SDE

Brokers often get in trouble by being too aggressive. If you add back expenses that are actually necessary for operations, savvy buyers (and their diligence teams) will tear your valuation apart.

"If your numbers don't add up—or worse, can't be verified—you're dead in the water." — Business Acquisitions

Do NOT Add Back:

- Market Rent: If the seller owns the building and pays themselves $0 rent, you must subtract a fair market rent expense. The buyer will have to pay rent.

- Necessary CAPEX: If the delivery trucks need replacing every 4 years, that depreciation isn't just a "paper loss"—it's a real future cash cost.

- "One-Time" Expenses that Repeat: If the seller has a "one-time" legal fee every single year, it's not one-time. It's a recurring cost of doing business.

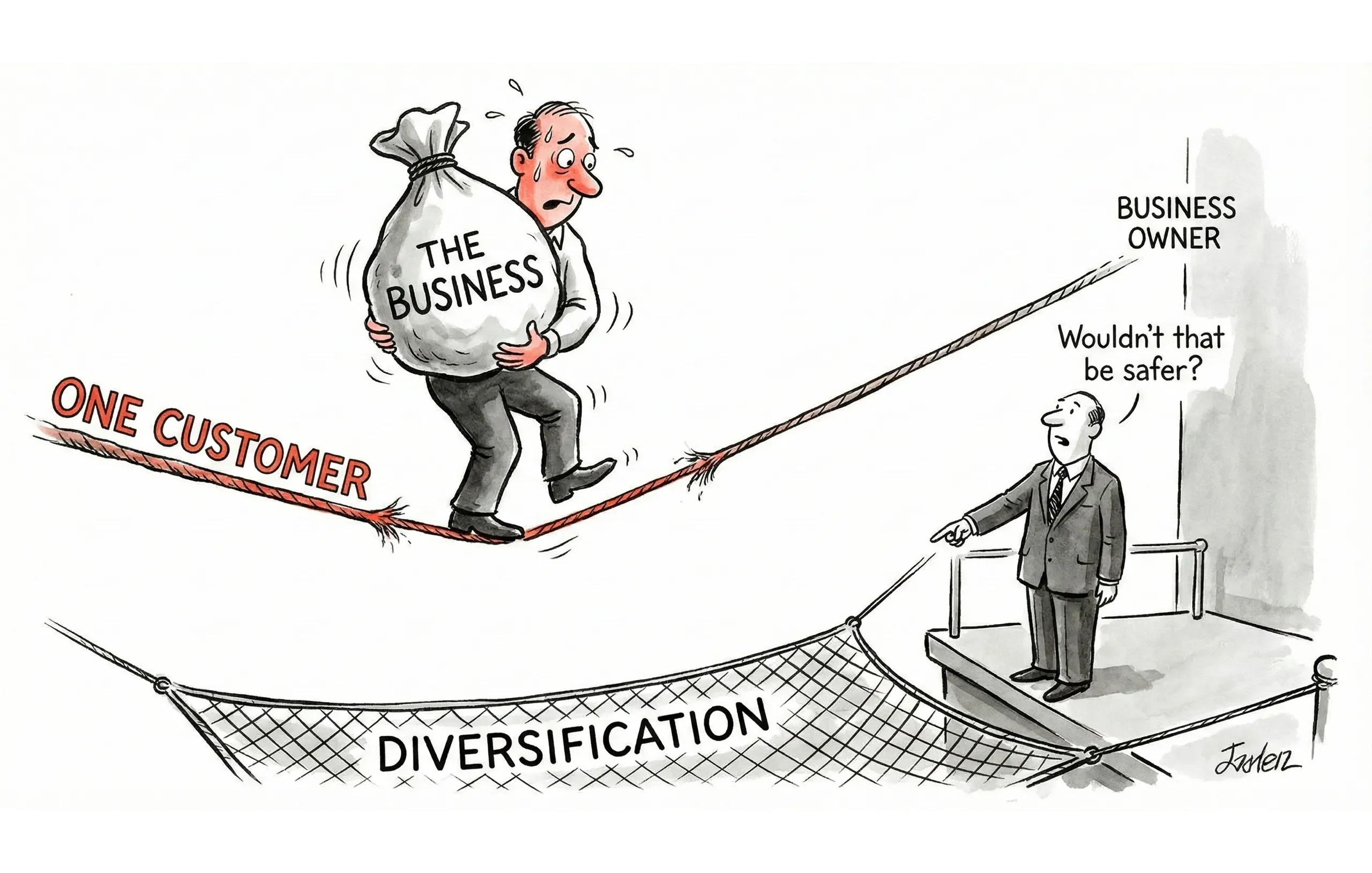

- Underpaid Employees: If the seller is paying their key manager $40k but the market rate is $80k, you might actually need a negative adjustment (reducing SDE) to account for the risk of that employee leaving.

Documentation: The "Audit-Proof" Standard

You cannot just claim an add-back; you must prove it. When a buyer asks, "How do I know this trip to Cabo was personal?", you need the receipt and the calendar.

The "Clean Financials" Boost:Research suggests that businesses with transparent, clean financials can command a 20-30% premium on sale price. Conversely, messy books are the fastest way to invite a "haircut" on the offer price during due diligence.Required Evidence:

- Owner Salary: W-2s and Payroll Summary reports.

- Personal Expenses: General Ledger (GL) detail showing the specific transaction, cross-referenced with receipts.

- Inventory: Physical count records (for COGS adjustments).

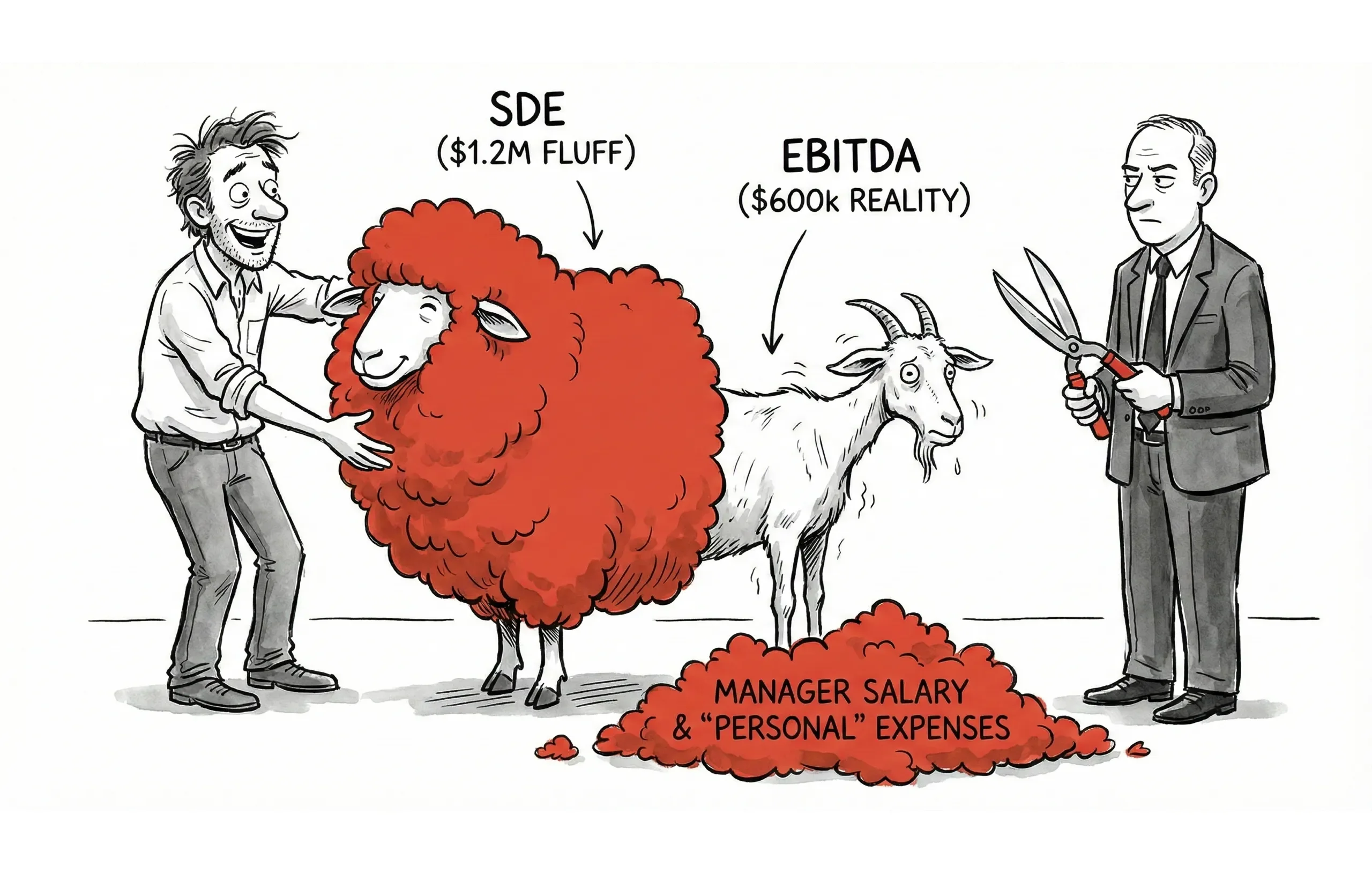

SDE vs. EBITDA: Know Your Audience

A common question from sellers is: "Why aren't we using EBITDA?"

- SDE is for Main Street (Owner-Operator model). It assumes the buyer will work in the business.

- EBITDA is for Lower Middle Market (Investor model). It assumes the buyer will hire a GM to run the business.

If you use SDE for a $10M revenue company, private equity buyers will laugh you out of the room. If you use EBITDA for a local pizza shop, you're undervaluing the asset. Know the difference.

Conclusion: Clarity Closes Deals

SDE is more than just a math problem; it is a storytelling tool. It tells the story of the business's true potential, stripped of the tax strategies used by the previous owner.

By presenting a defensible, well-documented SDE calculation, you protect your seller’s asking price and give buyers the confidence to sign the LOI.