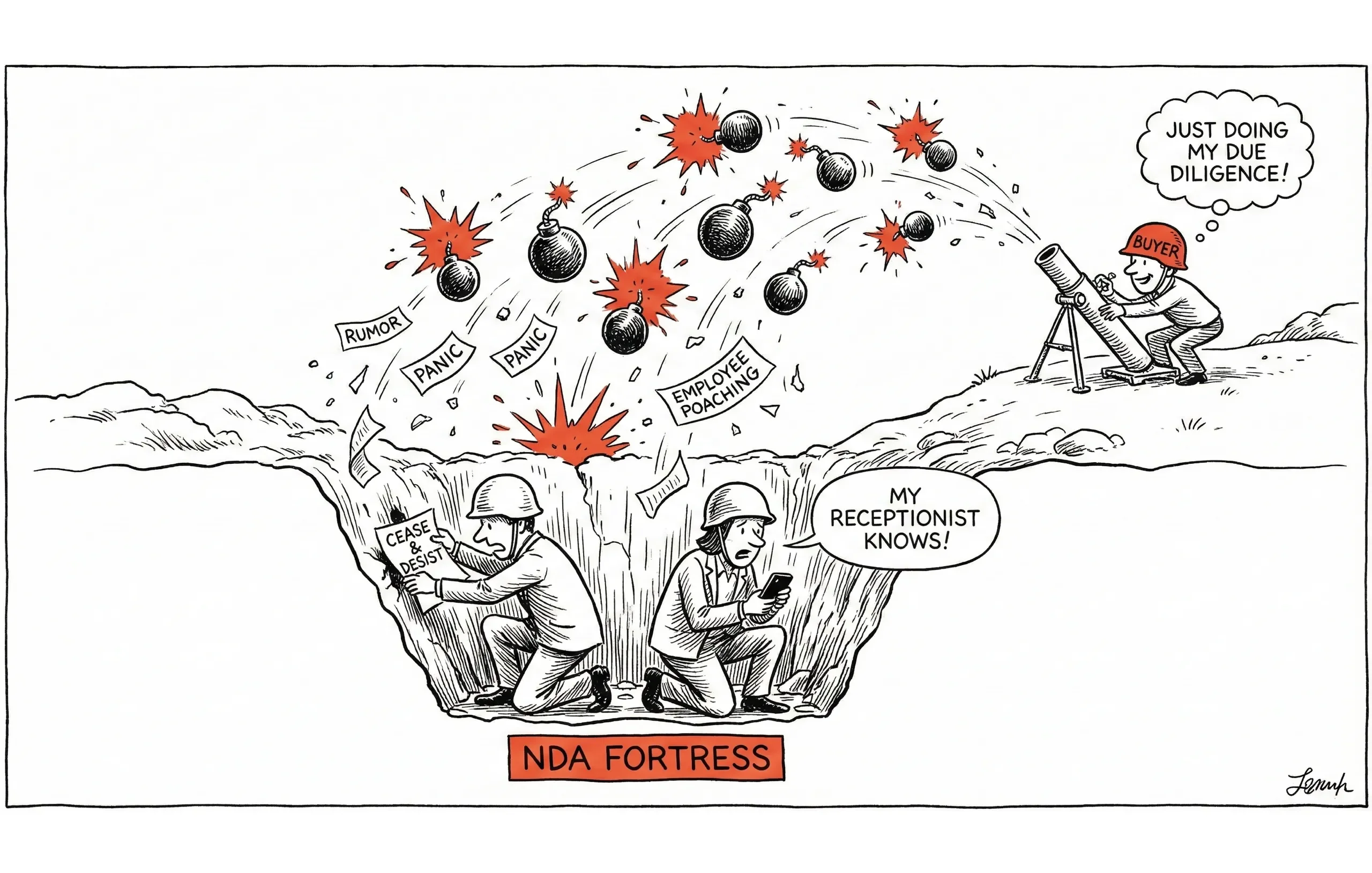

We’ve all been there. You have a signed LOI, the buyer is capitalized, and the seller is already mentally spending their exit check. Then comes the dreaded call during the 11th hour of due diligence.

"We found a problem with the inventory valuation," the buyer says. Or maybe, "Those 'one-time' add-backs look suspiciously recurring."

Suddenly, your perfect deal is on life support. The buyer wants a retrade, or worse, they're walking away entirely.

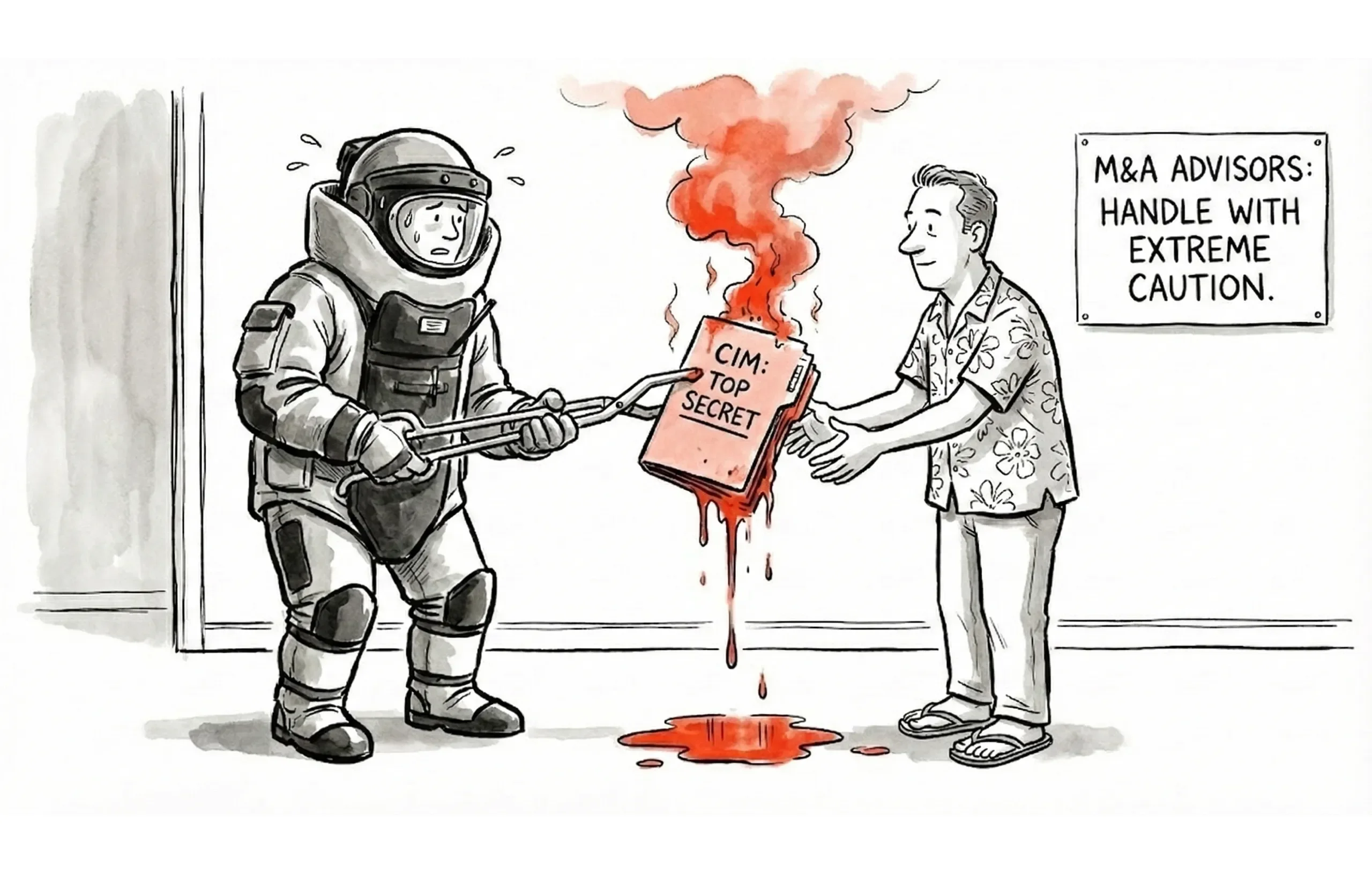

Financial due diligence is where deals go to die—or where they get bulletproofed. It is the most intensive part of the investigation process, verifying that the earnings represented in the CIM (Confidential Information Memorandum) are accurate, sustainable, and truly support the purchase price.

According to Harvard Business Review, between 70% and 90% of M&A deals fail to meet their financial objectives or fall apart during the process [1]. Furthermore, financial discrepancies discovered during this phase can lower a company's valuation by up to 30% [2].

As Geoffrey Cullinan, former PE Director at Bain, famously said: "Deal-making is glamorous; due diligence is not." [3]. But for us brokers, due diligence is where we earn our commission.

This checklist is your shield against the deal-killers.

Related: Business Sale Due Diligence: Complete Guide

Core Financial Documents for a Small Business Sale

The first step is moving the seller away from "shoebox accounting" and into a data room that instills confidence. If the documents look messy, the buyer assumes the business is messy.

Tax Returns (3-5 Years)

Tax returns are the "source of truth" for most buyers because it's what the seller told the government they made.

Document | Purpose |

|---|---|

Federal tax returns | Official income verification |

State tax returns | State income/sales tax compliance |

All schedules | Complete picture (Schedule C, E, etc.) |

K-1s (partnerships) | Owner distributions and partner alignment |

Analysis focus: Compare tax return income to the CIM representations. If the tax returns show a loss but the CIM shows a $500k profit, your explanation of add-backs needs to be airtight.

Financial Statements

Document | Purpose |

|---|---|

Profit & Loss (3-5 years) | Revenue and expense trends |

Balance Sheet | Asset/liability verification |

Cash Flow Statement | Cash generation vs. accounting profit |

Monthly detail (2 years) | Seasonality, trends (TTM analysis) |

Analysis focus: Consistency is key. Do the margins fluctuate wildly month-to-month? That screams "bookkeeping error" to a buyer.

Bank Statements

This is where the rubber meets the road. "Cash doesn't lie."

Document | Purpose |

|---|---|

Business bank statements (12 months) | Cash flow verification |

Merchant account statements | Credit card revenue (Stripe, Square, etc.) |

PayPal/online payment records | Digital revenue verification |

Analysis focus: Deposits must match reported revenue. If there's a 10% variance, you're looking at a potential deal-breaker or a massive clawback on price.

Revenue Verification

Buyers are terrified of buying a "falling knife." They need to know the quality of the revenue is as high as the quantity.

Revenue Analysis Checklist

Customer Concentration

A business with one client paying the bills isn't a business; it's a subcontractor.

Concentration | Risk Level |

|---|---|

No customer > 10% | Low |

Largest customer 10-20% | Moderate |

Largest customer 20-30% | High (Deal structure likely changes to Earn-out) |

Largest customer > 30% | Critical (Financing may be impossible) |

Revenue Recognition

- When is revenue recorded? ensure they aren't booking deposits as revenue immediately.

- Cash vs. accrual basis? Most small businesses run on cash, but mid-market buyers think in accrual. Be ready to bridge that gap.

- Deferred revenue handling? Crucial for SaaS or service contracts.

- Contract revenue recognition? Percentage of completion vs. completed contract.

Expense Verification

This is where you find the "fat" to trim—or the hidden costs the seller "forgot" to mention.

Operating Expenses

Category | Verification Method |

|---|---|

Payroll | Match to payroll records (ADP/Gusto reports), W-2s |

Rent | Match to lease agreement (Check for escalations!) |

Insurance | Match to policies (Will premiums spike for a new owner?) |

Utilities | Review statements |

Supplies | Spot check invoices |

Professional fees | Review invoices (Are they legal fees for a lawsuit?) |

Owner-Related Expenses

The "lifestyle" expenses. These are your standard add-backs, but they must be proven.

Category | Verification |

|---|---|

Owner compensation | W-2, pay stubs |

Owner benefits | Health insurance statements, 401(k) matching |

Vehicle expenses | Registration, mileage log (Is the "company car" a luxury SUV?) |

Travel/entertainment | Receipts, credit card statements (Business or vacation?) |

Personal expenses | Documentation review (Cell phones, family members on payroll) |

SDE Verification

Seller's Discretionary Earnings (SDE) is the number we sell, but it's also the number buyers attack first. Over-aggressive add-backs are the fastest way to lose credibility.

Add-Back Validation

For each add-back, verify:

Common Add-Back Issues

Issue | Resolution |

|---|---|

No documentation | Reduce or eliminate (Buyers will zero this out immediately) |

Inflated amounts | Adjust to actuals found in the GL |

Non-discretionary items | Remove (e.g., "marketing" that drives 50% of leads) |

Continuing expenses | Don't add back |

Balance Sheet Review

The P&L tells the story of the past; the Balance Sheet tells the health of the present.

Asset Verification

Asset | Verification |

|---|---|

Cash | Bank statements |

Accounts receivable | Aging report (Is 20% >90 days? That's bad debt, not an asset.) |

Inventory | Physical count, valuation method (FIFO/LIFO matters here) |

Equipment | Physical inspection, condition (Is the machinery near end-of-life?) |

Vehicles | Titles, condition |

Liability Review

Surprise liabilities kill deals faster than declining revenue.

Liability | Verification |

|---|---|

Accounts payable | Vendor statements |

Accrued expenses | Supporting detail (Unpaid commissions, bonuses) |

Loans/notes | Loan agreements (Prepayment penalties?) |

Deferred revenue | Customer contracts (The buyer effectively inherits a debt to perform work) |

Tax obligations | Tax returns, filings (Sales tax nexus issues are common) |

Working Capital Analysis

This is the most common point of friction at the closing table. The seller wants to strip the cash; the buyer needs enough in the tank to operate day one.

Current Assets:

- Accounts Receivable

- Inventory

- Prepaid Expenses

Current Liabilities:

- Accounts Payable

- Accrued Expenses

- Deferred Revenue

Normal Working Capital

You must establish a "PEG" or "Target Working Capital" early to avoid a fight at closing.

- Average of last 12 months: Usually the fairest metric.

- Typical for business operations: Does the business need seasonal spikes in inventory?

- Adjust at closing: The purchase price is adjusted dollar-for-dollar based on the actual vs. target.

Red Flags for Small Business Acquisition

If you spot these, pause the deal. Better you find them than the buyer's Quality of Earnings (QofE) team.

Financial Red Flags

Red Flag | Concern |

|---|---|

Tax returns ≠ financials | Accuracy issues (and potential fraud) |

Revenue declining | Business trajectory is negative ("Catching a falling knife") |

Margins eroding | Profitability risk (Costs rising faster than prices) |

AR aging > 60 days | Collection problems or fake revenue |

Large cash transactions | Verification difficulty (Lenders hate this) |

One-time revenue in SDE | Sustainability question (Did they sell a truck and call it income?) |

Documentation Red Flags

Red Flag | Concern |

|---|---|

Missing documents | What's being hidden? |

Reluctance to share | Transparency issues (kills trust instantly) |

Documents don't match | Inconsistency suggests incompetence or deceit |

Outdated information | Relevance (Running a deal on 6-month old data is impossible) |

![CIM Template for Business Brokers: Professional Format & Structure [2026]](https://d1pdxhu5fo8gl6.cloudfront.net/media/cim-template-business-broker_2025_Dec_1.webp)