Picture this: It's 4:00 PM on a Friday. You're getting ready to wrap up a solid week. You have a manufacturing listing with $2M in EBITDA that is getting serious traction. Then, your phone rings. It's the seller.

They aren't happy. In fact, they are furious.

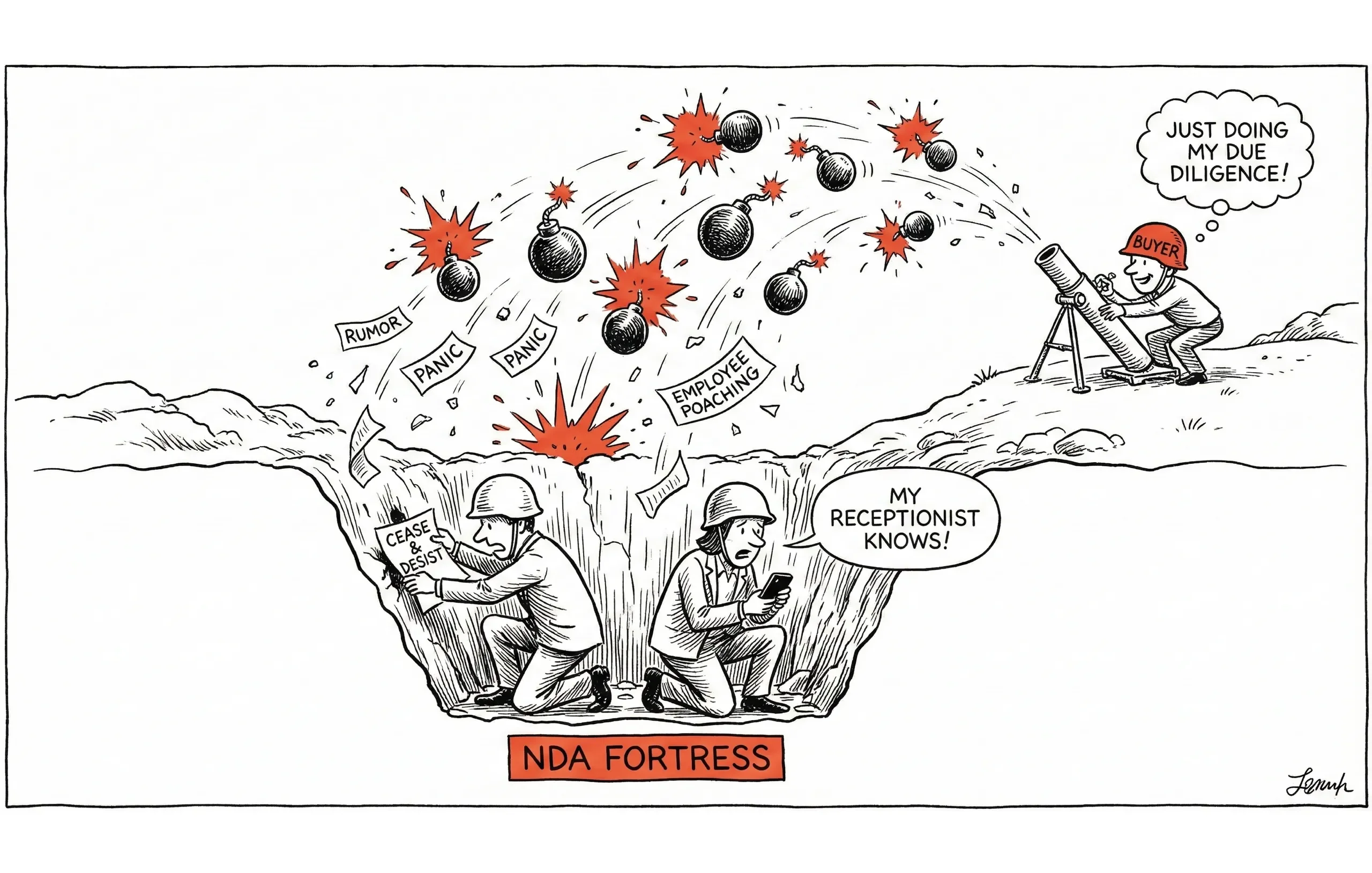

Why? Because a "buyer" you sent the CIM to two days ago just called the seller's front desk, asked a receptionist about the "upcoming sale," and spooked the key management team. Now, the rumors are flying, the staff is panicked, and the seller is questioning your competence.

That isn't just a bad day; that is a deal-killer. And unfortunately, most of us in the industry have a war story that sounds uncomfortably similar to this.

Confidentiality is the currency of our trade. If a seller can't trust us to keep their secrets, we have no business. According to the IBBA Market Pulse Report, confidentiality breaches are consistently cited as a top concern for sellers entering the market.

A solid business broker NDA is your first and most critical line of defense. Without a properly executed confidentiality agreement, you're exposing your seller, your reputation, and your commission to unnecessary risk. This guide walks you through creating an airtight business broker NDA workflow that protects your deals from inquiry to closing.

This guide isn't just about paperwork; it's about building a fortress around your deals so you can focus on getting to the closing table.

Business Broker NDA Fundamentals: Essential Elements

We often treat the business broker NDA as a checkbox item—just another hurdle to jump before sending the Confidential Information Memorandum (CIM). But in reality, a well-drafted business broker NDA is your first line of defense against "tire kickers" and competitors looking for a peek under the hood.

"It takes 20 years to build a reputation and five minutes to ruin it. If you think about that, you'll do things differently." — Warren Buffett

The Purpose of the Business Broker NDA

Beyond the legal jargon, the business broker NDA serves four practical purposes in the brokerage world:

- Stops the Loose Lips: It legally binds the potential buyer to keep their mouth shut.

- Seller Assurance: It proves to your client that you are vetting the people seeing their financials.

- Psychological Barrier: It signals to the buyer that this is a professional transaction, not casual conversation.

- Legal Remedy: If they do leak the info, you have standing to sue (though we all hope it never comes to that).

Standard Business Broker NDA Elements

Your business broker NDA needs to be airtight. Here is what needs to be in there:

Element | Content | Why It Matters |

|---|---|---|

Parties | Buyer name, Broker, Seller (often anonymized initially) | Defines who is actually on the hook. |

Definition | What constitutes confidential info | Prevents "I didn't know that was secret" excuses. |

Obligations | How info must be treated | Sets the rules (e.g., "do not contact employees"). |

Duration | How long obligations last | Usually 2–5 years, depending on the deal size. |

Exclusions | What isn't covered | Publicly known info doesn't count. |

Remedies | Consequences of breach | The "teeth" of the agreement (injunctions, damages). |

No-Contact Clause | Explicit prohibition on direct contact | Prevents buyers from bypassing the broker. |

Return/Destruction | Materials must be returned if deal fails | Ensures info doesn't linger after negotiations end. |

Types of Business Broker NDAs

Not all business broker NDAs are created equal. Understanding which type to use in different scenarios is crucial:

1. Unilateral (One-Way) NDA This is the most common type in business brokerage. The buyer agrees to keep information confidential, but the broker and seller have no reciprocal obligation. Use this for standard buyer inquiries where you're sharing financial information about the business.

2. Mutual (Two-Way) NDA Occasionally used when both parties will be sharing sensitive information. For example, if a strategic buyer wants to share their acquisition criteria or proprietary expansion plans with you to determine fit. Less common in main street brokerage, more common in mid-market and lower middle market deals.

3. Multi-Party NDA Used when multiple parties (buyer groups, financing partners, advisors) need access to confidential information. This creates binding obligations across all signatories and is typically used in more complex transactions.

For most main street and lower middle market deals, the unilateral business broker NDA is your go-to document.

Business Broker NDA Template Checklist

When drafting or reviewing your business broker NDA, ensure these critical clauses are present:

Pro Tip: Many brokers make the mistake of using generic NDAs not tailored to business sales. A business broker NDA should specifically address CIM distribution, site visit protocols, and seller anonymity during the early stages of inquiry.

Business Broker NDA Workflow: From Inquiry to CIM Access

A sloppy workflow is where mistakes happen. If you are manually emailing PDFs without tracking who has what, you are playing with fire. You need a standardized business broker NDA process that moves a buyer from "Curious" to "Cleared."

The Standard Process

Think of this as your funnel. You are filtering out the noise to find the "dry powder."

- Buyer Inquiry: The lead comes in via a listing site.

- Initial Qualification: Do a basic screen. Do they have the funds? Is their background relevant? Don't send a business broker NDA to someone who can't buy.

- Business Broker NDA Delivery: Send the digital NDA via DocuSign, HelloSign, or PandaDoc.

- Execution: Use e-signatures for speed and tracking. Wet signatures are a relic.

- Verification & Filing: Crucial Step. Check that the signature matches the name and title. Store the signed business broker NDA in the listing folder immediately.

- Access Grant: Only now do they get the CIM.

- Tracking: Log exactly what was sent and when in your business broker NDA tracking system.

Common Business Broker NDA Mistake #1: Sending the CIM simultaneously with the NDA. This defeats the entire purpose. Make execution of the business broker NDA a hard gate before any confidential information is released.

Business Broker NDA Tracking System Best Practices

When you are juggling 15 active listings and 40 prospective buyers, you cannot rely on your memory to know who signed what business broker NDA. You need a system.

According to a study by Salesforce, high-performing sales teams are 2.8x more likely to use AI and automated tracking tools than underperforming teams. The same logic applies to brokers; organization equals revenue.

Essential Business Broker NDA Tracking Fields

Whether you use a specialized Broker CRM or a robust spreadsheet, you need these columns:

Field | Purpose |

|---|---|

Buyer Name | Who are we talking to? |

Buyer Email | Primary contact for NDA execution. |

Buyer Entity | Individual, LLC, or Corporation signing? |

Listing Name | Which business is this for? |

Business Broker NDA Version | Did they sign the updated one with the new no-contact language? |

Date Sent | When did you deliver the NDA? |

Date Signed | When did they execute? (Track lag time for buyer seriousness) |

Expiration Date | When does the confidentiality obligation end? |

Info Shared | Did they get just the CIM, or Level 3 due diligence materials? |

Follow-up Date | When to check in if they haven't executed. |

Best Practice: Set a 72-hour follow-up rule. If a buyer hasn't signed your business broker NDA within three days of receiving it, they're likely not serious. Send a polite reminder, and if there's still no response, move on to qualified buyers.

Information Sharing Protocols: The "Drip Feed" Method

One of the biggest mistakes rookie brokers make is the "Data Dump." They get a signed business broker NDA and immediately send over tax returns, customer lists, and employee org charts. Don't do this.

Information should be released in stages based on the buyer's commitment level. We call this the Drip Feed.

Access Levels

- Level 1: Public (The Teaser)

- Trigger: Initial Inquiry.

- Content: Blind profile, general region, revenue/EBITDA ranges. No names, no addresses.

- Level 2: Confidential (The CIM)

- Trigger: Signed Business Broker NDA + Proof of Funds.

- Content: The full story, historical financials, normalized earnings (SDE/EBITDA), "add-backs" schedule.

- Level 3: Restricted (Due Diligence)

- Trigger: Signed Letter of Intent (LOI) + Deposit.

- Content: Tax returns, bank statements, lease agreements.

- Level 4: Sensitive (Deep Dive)

- Trigger: Late-stage Diligence / Pre-Closing.

- Content: Customer concentration lists (often anonymized), key employee contracts, proprietary IP.

Best Practices for Sharing Confidential Information

- Watermarking: Every PDF you send should have the buyer's name and the date stamped on it. If that document leaks, you know exactly who did it.

- Data Rooms: For Level 3 and 4, stop using email attachments. Use a Virtual Data Room (VDR) like ShareFile, Box, or Dropbox with permission controls. It allows you to revoke access if the deal falls apart.

- The "No-Contact" Rule: Reiterate in every email that the buyer is strictly prohibited from contacting the owner, employees, or customers directly—even if they've signed the business broker NDA. Repetition reinforces the boundary.

- Read Receipts: Use email tracking tools (HubSpot, Mailtrack) to confirm the buyer actually opened your materials.

Pro Tip: Include a clause in your business broker NDA that allows you to immediately revoke access and demand return/destruction of materials if the buyer violates any terms. This gives you leverage without needing to file a lawsuit.

Breach Prevention: Spotting the Leaks

Even with the best business broker NDA paperwork, human error happens. Here is how to mitigate the risk and spot a breach before it becomes a disaster.

Common Risk Points

- Accidental Reply-All: It happens more than you think. A buyer forwards your CIM to their "team" and accidentally includes your seller.

- The "Partner" Loophole: A buyer shares the CIM with their "investor partner" who hasn't signed a business broker NDA.

- Digital Security: Sending unencrypted sensitive data over public Wi-Fi or using personal email accounts.

- Verbal Leaks: The buyer casually mentions the business opportunity at an industry networking event.

Warning Signs of Business Broker NDA Violation

If a buyer starts quoting specific employee names they shouldn't know, or if a competitor suddenly knows details about your seller's lease terms, you have a leak.

Other Red Flags:

- Seller reports unusual questions from customers or suppliers

- Industry rumors about the business being for sale

- Competitor starts aggressively recruiting seller's key employees

- Buyer asks questions that indicate they've spoken to seller's employees directly

Mitigation: If you suspect a business broker NDA breach, immediately revoke data room access and schedule a call with the buyer to remind them of their legal exposure. Sometimes a stern reminder of the "Remedies" clause in the business broker NDA is enough to plug the hole.

If the breach is serious (e.g., buyer contacted employees), document everything and consult with your attorney immediately about sending a cease-and-desist letter.

Common Business Broker NDA Mistakes to Avoid

After seeing hundreds of confidentiality disasters, here are the most common mistakes brokers make with their business broker NDA process:

Mistake #1: Generic Templates

Using a real estate NDA or generic confidentiality agreement instead of a business broker NDA specifically designed for business sales. These lack critical clauses like non-circumvention and no-contact provisions.

Solution: Invest in a business broker NDA template reviewed by an attorney familiar with business brokerage transactions. The $500-$1,000 you spend upfront will save you from deal disasters later.

Mistake #2: No Proof of Authority

Accepting a signature without verifying the signer has authority to bind the entity. Someone signs "John Smith, ABC Holdings LLC," but they're not actually an officer or member of ABC Holdings.

Solution: For entity signers (LLCs, corporations), request proof of authority—either a certificate of good standing showing the signer as an officer, or a resolution authorizing the individual to sign on behalf of the entity.

Mistake #3: Treating the Business Broker NDA as "Just Paperwork"

Not explaining the importance of the business broker NDA to buyers. They sign without reading, then claim ignorance when they violate terms.

Solution: Include a brief phone call or email explaining the key provisions—especially the no-contact rule—before sending the business broker NDA. This creates accountability and shows you're serious about enforcement.

Mistake #4: No Follow-Up System

Sending business broker NDAs and forgetting to follow up. Buyers who are serious will execute quickly. Those who drag their feet are often tire-kickers.

Solution: Implement the 72-hour follow-up rule mentioned earlier. If they haven't signed within three days, they're likely not qualified or serious.

Mistake #5: Failing to Update Your Business Broker NDA

Using the same business broker NDA template for years without updating it to reflect new technologies (VDRs, e-signatures) or changes in state law.

Solution: Have your attorney review and update your business broker NDA annually. Laws change, and so do buyer tactics.

Post-Deal Confidentiality

The deal cycle doesn't end when the wire hits. Your business broker NDA obligations continue.

If the Deal Closes: Remind the buyer that while they now own the data, they still have obligations regarding the transaction details (purchase price, terms) if those weren't meant to be public. Some business broker NDAs include post-closing confidentiality about deal terms to protect seller privacy.

If the Deal Doesn't Close: This is where brokers often drop the ball. If a deal dies:

- Revoke Access: Shut down their VDR login immediately.

- The "Kill" Letter: Send a formal email reminding them that the business broker NDA is still in effect and requesting they destroy or delete all provided materials. Keep a copy for your records.

- Archive: Keep that signed business broker NDA for at least 5 years. If that buyer uses the info to compete with your seller six months later, you will need it for enforcement.

Business Broker NDA Enforceability: Will It Hold Up?

A common question: "Is my business broker NDA actually enforceable, or is it just a scare tactic?"

The short answer: It depends on your state and how your business broker NDA is drafted.

Factors That Affect Enforceability

1. Reasonable Scope Courts generally uphold business broker NDAs that have reasonable:

- Duration (2-5 years is typical)

- Geographic scope (if applicable)

- Definition of confidential information

2. Consideration The buyer must receive something of value in exchange for signing. Access to the CIM and potential business opportunity is usually sufficient consideration.

3. Specificity Vague business broker NDAs get thrown out. Saying "any information" is confidential won't fly. You need to specifically define what information is protected.

4. State Law Variations Some states (California, for example) have stricter rules about non-solicitation and non-compete provisions. Make sure your business broker NDA is compliant with your state's requirements.

Pro Tip: Include a "severability clause" in your business broker NDA. This means that if one provision is found unenforceable, the rest of the agreement remains valid.

What Happens If Someone Violates Your Business Broker NDA?

Your remedies typically include:

- Injunctive Relief: Court order to stop the violation

- Monetary Damages: Compensation for losses caused by the breach

- Attorney's Fees: If your business broker NDA includes this provision

However, litigation is expensive and time-consuming. The real value of a business broker NDA is deterrence—making buyers think twice before violating confidentiality.

Frequently Asked Questions About Business Broker NDAs

How long should a business broker NDA last?

For most main street and lower middle market transactions, 2-3 years is standard. Larger deals ($5M+ enterprise value) may warrant 3-5 years. The key is making the duration long enough to protect the seller from competitive harm but short enough that courts will enforce it.

Should I require an NDA before sharing the teaser/blind profile?

No. The teaser is designed to be shared publicly without requiring a business broker NDA. It contains only general information (industry, region, revenue/EBITDA ranges) with no identifying details. Requiring a business broker NDA at this stage creates unnecessary friction and slows down your funnel.

Reserve the business broker NDA for when you're ready to share the CIM, which contains identifying information and detailed financials.

What if a buyer refuses to sign my business broker NDA?

Walk away. A buyer who won't sign a reasonable business broker NDA is either:

- Not serious about the acquisition

- Planning to use the information for competitive purposes

- Not sophisticated enough to understand business acquisition norms

None of these are buyers you want in your deal pipeline.

Can I use the same business broker NDA for all my listings?

Yes, with one important caveat: You should have a master business broker NDA template, but customize the "Definition of Confidential Information" section for each listing. For example, if one business has particularly sensitive IP or customer concentration issues, call those out specifically.

Do I need a lawyer to draft my business broker NDA?

Absolutely yes. While you can find business broker NDA templates online, having an attorney draft or review your template is a critical investment. A poorly drafted business broker NDA can be worse than no NDA at all—it gives you false confidence while providing zero legal protection.

Expect to pay $500-$1,500 for a custom business broker NDA template that you can reuse across multiple transactions. That's cheap insurance compared to the cost of a confidentiality breach.

Should my business broker NDA be mutual or one-way?

For 99% of main street transactions, use a one-way (unilateral) NDA where only the buyer has confidentiality obligations.

The rare exception is when you're sharing your proprietary processes, buyer databases, or marketing strategies with a potential partner or buyer who wants insight into your brokerage operations. In those cases, a mutual NDA makes sense.

Wrapping Up

Managing confidentiality isn't the most glamorous part of being a business broker, but a well-executed business broker NDA is the foundation of your integrity and deal success. By implementing a systematic workflow, using proper tracking systems, and maintaining smart technology safeguards, you protect your seller, your deal, and your reputation.

Key Takeaways:

- Use a business broker NDA specifically designed for business sales—not generic templates

- Implement a hard gate: No NDA execution = No CIM access

- Track every business broker NDA with detailed fields in your CRM or spreadsheet

- Stage information release (teaser, CIM, due diligence, sensitive data)

- Follow up within 72 hours if an NDA isn't executed

- Immediately revoke access if a business broker NDA is violated

- Archive signed NDAs for at least 5 years post-transaction

The brokers who treat business broker NDA management as a critical business process—not just paperwork—are the ones who build reputations for integrity, earn seller referrals, and avoid costly confidentiality disasters.

![CIM Template for Business Brokers: Professional Format & Structure [2026]](https://d1pdxhu5fo8gl6.cloudfront.net/media/cim-template-business-broker_2025_Dec_1.webp)

![How to Prepare Financials for Sale: Broker's Guide + Checklist [2026]](https://d1pdxhu5fo8gl6.cloudfront.net/media/organize-financial-records_2025_Dec_3.webp)