We've all been there. You have a motivated financial buyer with plenty of dry powder. The TTM financials look beautiful. The multiple is right. Then, during the site visit, the buyer asks a simple question about a critical machine or a key client relationship, and your seller says, "Oh, I'm the only one who handles that. It's all in my head."

You can practically hear the air hissing out of the deal.

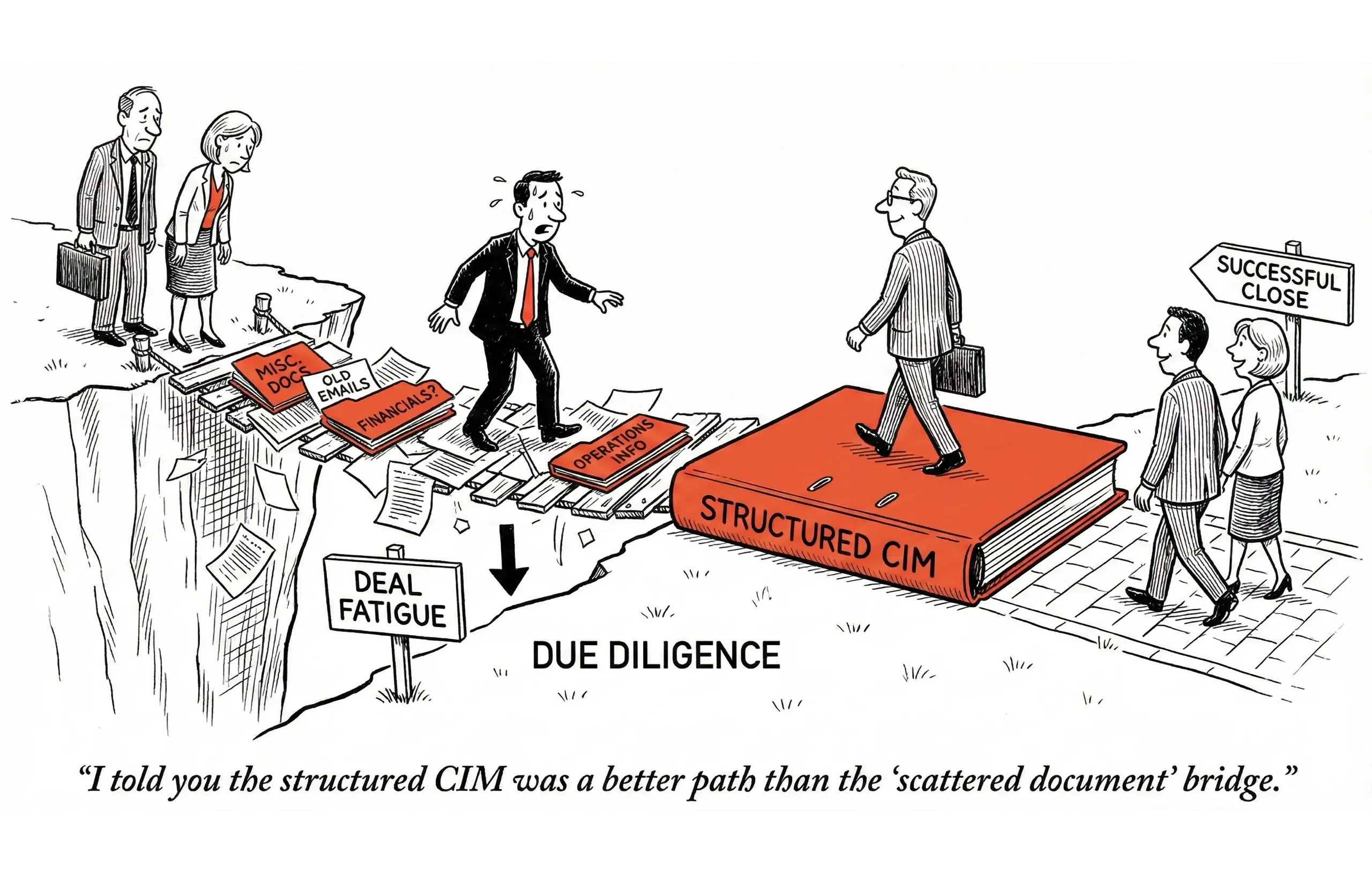

That sound is "transition risk" destroying your commission. According to industry data, inaccurate or incomplete information during due diligence is a top reason deals fall apart, often stemming from operational surprises that weren't disclosed early enough 1.

The CIM operations section isn't just a list of machinery and opening hours. It's your primary weapon against key man risk. A well-crafted operations section answers the one question keeping your buyer up at night: "Can this business run without the current owner?"

Why the CIM Operations Section Makes or Breaks Your Deal

Buyers aren't purchasing a job for the seller. They're buying a transferable cash flow machine. The operations section is where you prove that distinction exists.

A strong CIM operations section achieves three critical objectives:

- Proves Systemization: Shifts value from the owner's brain to documented company processes

- Mitigates Risk: Proactively addresses operational concerns before buyers uncover them in due diligence

- Justifies the Multiple: Documented businesses command higher premiums. Valuation experts confirm that strong process documentation reduces perceived buyer risk, directly increasing business valuation 2

Think of it as the "Bus Test" section. If the owner gets hit by a bus tomorrow, will the business generate the same cash flow the next day? Your operations presentation needs to confidently answer "yes."

Essential Components of a Strong CIM Operations Section

Daily Operations: Demonstrate Workflow Independence

Don't waste precious CIM space on basic hours of operation. Instead, use your CIM operations section to showcase systematic workflows that function independently of the owner.

The Wrong Approach:

"The business operates Monday through Friday, 9 AM to 5 PM. Employees arrive at 8:30 AM."

The Broker-Level Approach:

"The facility operates on a single shift, Monday through Friday. The morning workflow is automated: The Service Coordinator reviews the CRM dashboard at 7:30 AM and dispatches technicians. By the time the Owner arrives at 9:00 AM, daily logistics are already in motion. The Owner's role focuses on strategic planning and key account management, not operational firefighting."

This subtle shift tells buyers exactly what they need to hear: The owner isn't unlocking doors and making coffee. The system runs itself.

Business Processes and Standard Operating Procedures

When crafting your CIM operations section, Standard Operating Procedures (SOPs) are gold. They represent the "instruction manual" for the buyer's new investment. You don't need to include actual SOPs in the CIM (save those for the data room), but you must prove they exist and are documented.

Effective SOP Presentation Table:

Process | Owner (Title) | Frequency | Documentation Status |

|---|---|---|---|

Customer Intake | Front Desk Manager | Daily | Written SOP in Asana |

Quality Control | Shop Foreman | Per Job | Physical Checklists |

Inventory Management | Operations Manager | Weekly | Automated par-level reordering |

AP/AR Processing | Bookkeeper | Bi-Weekly | QuickBooks Workflow |

Broker Pro Tip: If your seller has undocumented "tribal knowledge," advise them to start recording Loom videos or creating process checklists immediately. This preparation pays dividends during the transition period and strengthens your CIM operations section dramatically.

Facilities and Real Estate: Address the Lease Risk Head-On

Real estate issues can kill deals faster than declining EBITDA. If the lease isn't transferable, you don't have a saleable business. Use your CIM operations section to be transparent about facilities and filter out buyers who can't handle the real estate requirements.

Must-Have Facility Information:

- Physical Specifications: Square footage, office/warehouse split, loading docks, production capacity

- Strategic Location: Proximity to transportation corridors, vendors, customer base

- Lease Terms: Expiration date, renewal options, transferability clauses, landlord relationship

- Condition Assessment: Be honest about deferred maintenance and CapEx requirements. Buyers will discover it during Quality of Earnings (QofE) or property inspection anyway, and surprises cost you at the negotiating table

Related: CIM Confidentiality: How to Protect Sensitive Business Information

Equipment and Assets: The Asset-Heavy Business Resume

For manufacturing, trucking, construction, and other asset-intensive businesses, the equipment section of your CIM operations section is the business resume. Present it professionally.

Equipment Presentation Template:

Asset Type | Count | Average Age | Condition | Est. Fair Market Value |

|---|---|---|---|---|

CNC Machines | 4 | 5 Years | Excellent | $450,000 |

Fleet Vehicles | 6 | 3 Years | Good | $180,000 |

Forklifts | 2 | 10 Years | Fair (Backup units) | $15,000 |

Narrative Framework:

"The Company maintains a disciplined equipment replacement cycle of 4 years, ensuring reliable operations and minimal maintenance downtime. The incoming buyer faces no immediate heavy CapEx requirements, and the well-maintained asset base supports consistent operational performance."

This approach in your CIM operations section demonstrates financial discipline and reduces perceived acquisition risk.

Supply Chain: Eliminate Single-Source Dependency Concerns

Nothing triggers buyer panic faster than discovering that 80% of raw materials come from a single supplier with no formal contract. Your CIM operations section should proactively address supply chain resilience.

Key Supply Chain Elements:

- Supplier Diversity: Highlight that no single supplier represents more than 10-15% of total spend (if true)

- Relationship Longevity: "Average supplier tenure exceeds 8 years, demonstrating stable, reliable partnerships"

- Payment Terms: Mention Net 30 or Net 60 terms, which speak to favorable working capital management

- Backup Sources: For critical inputs, note availability of alternate suppliers

The Team Section: Your Key Man Risk Defense

This is where your CIM operations section directly confronts the elephant in the room: Can this business survive without the current owner?

Organizational Structure Presentation

Visual organizational charts work best (titles only, no employee names in the CIM). The strategic narrative in your CIM operations section should highlight management depth between the owner and frontline operations.

Effective Narrative Strategy:

"The Operations Manager (5-year tenure) oversees all daily production scheduling and workflow optimization. The Lead Technician (8-year tenure) handles training and quality assurance for junior staff. The Owner's role has evolved to focus on strategic planning, key account relationship management, and business development rather than day-to-day operational management."

This positions the owner as a strategic asset, not an operational dependency.

Transition Risk Matrix

Be the broker who tackles transition risk head-on in your CIM operations section. This builds massive buyer confidence and differentiates you from competitors.

Role | Transition Risk Level | Mitigation Strategy |

|---|---|---|

Owner | High | 90-day active transition + 6-month consulting agreement |

Sales Manager | Medium | Long-term incentive plan (LTIP) recommended |

Operations Team | Low | Strong retention history; stable company culture |

Related: CIM Financial Section: How to Present Numbers That Close Deals

Strategic Information Disclosure: What to Include vs. Withhold

When developing your CIM operations section, you want to provide enough operational detail to solicit serious LOIs, but not so much that you expose trade secrets to competitors posing as buyers.

Include in Your CIM Operations Section:

- General process workflows and operational cadence

- Asset lists (blinded or anonymized if equipment is unique/identifiable)

- Facility highlights and lease term summaries

- Staff tenure, roles, and organizational structure

- Technology stack overview ("Cloud-based ERP," "Integrated CRM platform")

Reserve for Due Diligence Phase:

- Detailed customer lists with actual names and contact information

- Specific vendor contracts and pricing agreements

- Full unredacted lease agreements

- Individual employee names and exact compensation details

- Proprietary "secret sauce" intellectual property or processes

This strategic disclosure approach in your CIM operations section maximizes buyer interest while protecting seller confidentiality.

Common Operational Deal Killers to Address Proactively

Use your CIM operations section to preempt these common objections before they derail your transaction:

- "The owner is the face of the business."

- Solution: Emphasize institutional customer relationships, long-tenured sales team, or brand-driven sales rather than owner personality dependence

- "The equipment is outdated."

- Solution: Position aging assets as "value-add modernization opportunity" for strategic buyers, or adjust pricing to reflect deferred CapEx

- "Operations aren't computerized."

- Solution: If the business uses paper systems, emphasize the cleanliness and organization of manual records, then position digital transformation as an upside opportunity

How to Extract Operational Information from Difficult Sellers

Many business owners struggle to articulate their operational systems because they've run the business on autopilot for years. As the broker, you need a systematic approach to extract this information for your CIM operations section.

Effective Seller Interview Questions:

- "Walk me through a typical day from open to close."

- "If you were sick for two weeks, who handles what?"

- "What processes have you documented or trained others to perform?"

- "Which relationships or knowledge areas are truly unique to you versus transferable to staff?"

- "What operational changes has a new employee struggled to learn?"

These questions uncover both the systematic elements you'll highlight and the gaps you'll need to address in the transition plan section of your CIM operations section.

The ROI of a Strong CIM Operations Section

A comprehensive, well-structured CIM operations section delivers measurable benefits:

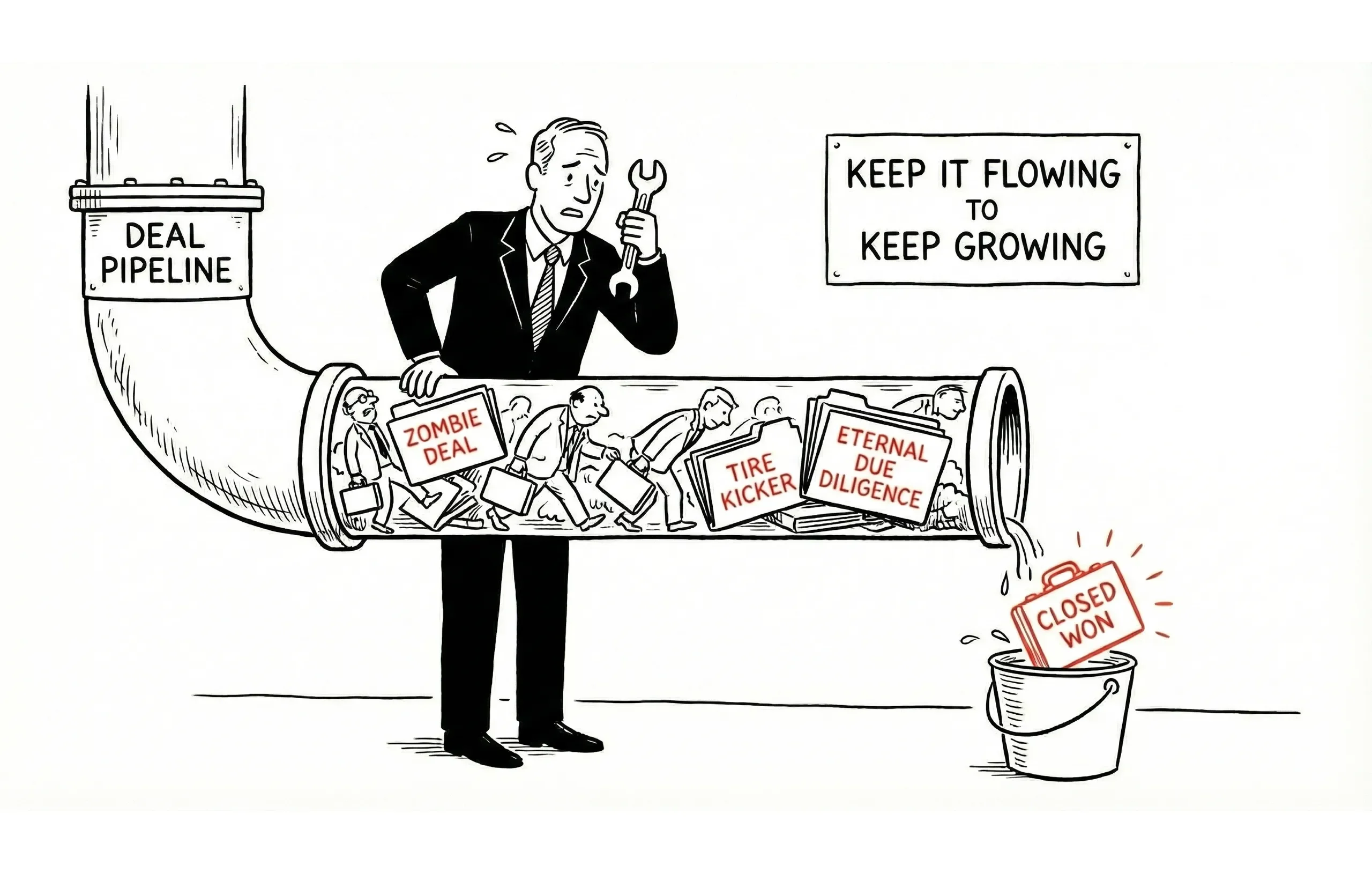

- Higher Valuations: Documented operational systems reduce perceived buyer risk, supporting premium multiples

- Faster Due Diligence: Proactive disclosure eliminates surprises and accelerates the diligence timeline

- Better Buyer Quality: Serious buyers appreciate transparency; tire kickers reveal themselves early

- Smoother Transitions: Documented processes and clear organizational structures facilitate seamless ownership transfers

- Fewer Renegotiations: When operational realities match CIM representations, buyers have less ammunition for price reductions

Conclusion: Turn Jobs into Businesses with Your CIM Operations Section

The CIM operations section is where you demonstrate that you're selling a business, not a job. By clearly documenting operational systems, physical assets, supply chain resilience, and management depth, you're effectively proving to buyers: This cash flow machine operates reliably whether the current owner is present or not.

That operational confidence is what moves deals from LOI to closing table.

Next Steps for Business Brokers:

Does your current CIM template effectively address key man risk? Are you extracting the right operational details from your sellers? The difference between a mediocre CIM operations section and an exceptional one often determines whether you close at the original multiple or renegotiate down after due diligence surprises.

Consider developing a standardized "Operational Assessment Questionnaire" for your sellers that systematically captures the information your CIM operations section requires. The upfront investment in operational discovery pays dividends throughout the transaction lifecycle.