It's the scenario every broker dreads: You land a solid Main Street listing with clean financials and a reasonable multiple. You blast the teaser to your entire email list of 5,000 "buyers."

By Tuesday, your inbox is flooded. But it's not with LOIs. It's with 50 inquiries from people asking basic questions already answered in the teaser. Meanwhile, the one qualified strategic buyer—the one with the dry powder and the synergy to pay full ask—is buried somewhere in your Spam folder or lost in the noise.

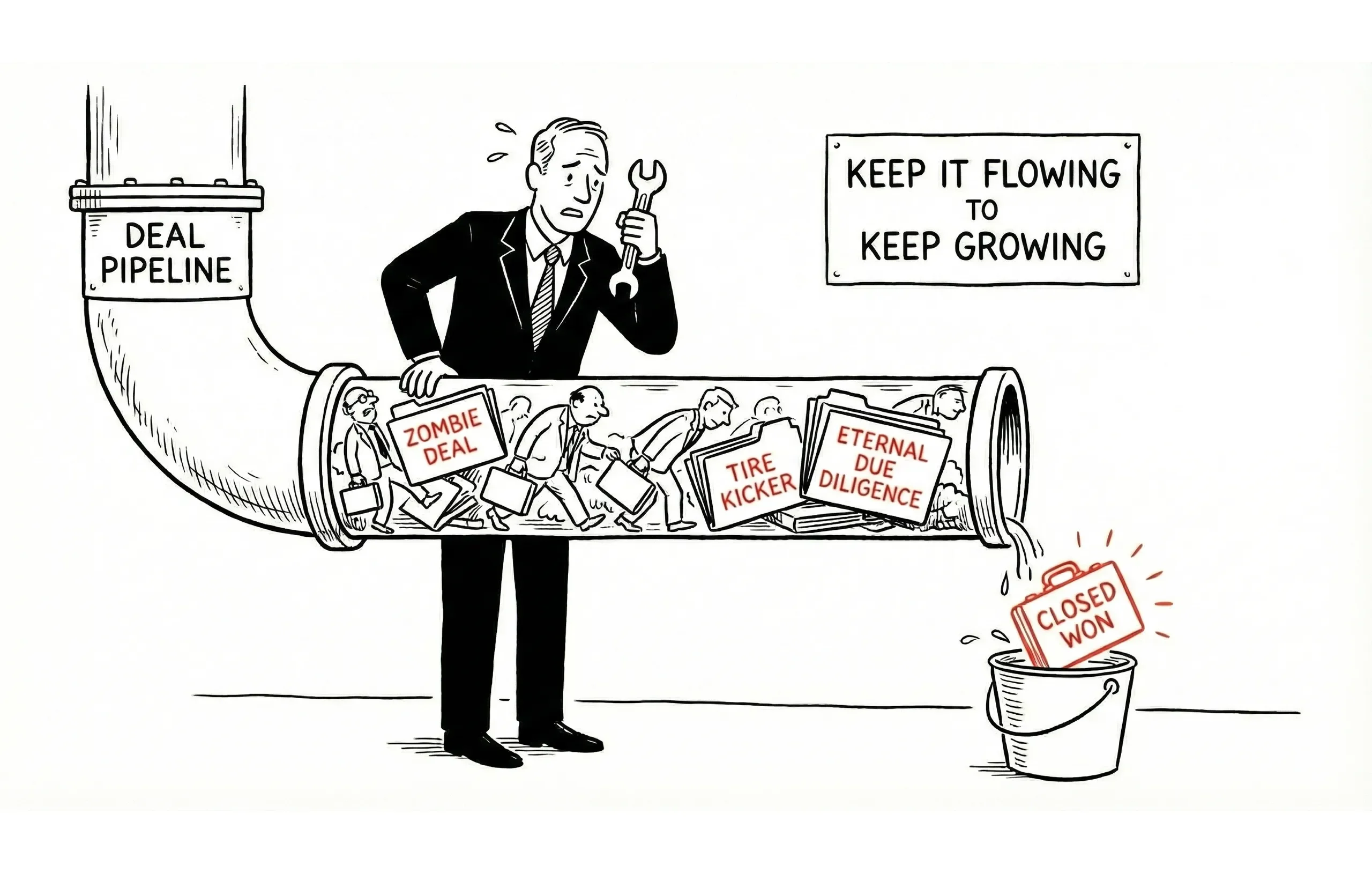

Your business buyer database is either your greatest asset or your biggest time suck. In an industry where 90% of individuals who begin the search to buy a business never actually complete a transaction (Diomo), the ability to filter the "tire kickers" from the serious acquirers is what separates top producers from the rest of the pack.

A well-maintained database doesn't just store names; it accelerates deal matching and protects your most valuable resource: your time. This is why professional brokers use structured deal management systems instead of ad-hoc email lists.

What is a Business Buyer Database?

A business buyer database is a structured CRM system that stores qualified buyer contacts, financial profiles, investment criteria, and engagement history. Unlike a static spreadsheet, a professional business buyer database allows brokers to instantly match new listings with pre-qualified acquirers based on industry, liquidity, and timeline.

The difference between a list and a database:

- List: Names and emails in Excel with no qualification data

- Business buyer database: Queryable CRM with qualification status, POF verification, automated segmentation, and engagement tracking

For brokers managing 10+ active listings, a searchable business buyer database reduces time-to-match from days to minutes. The brokers closing 15+ deals annually aren't manually searching spreadsheets—they're running CRM queries that return 5-10 perfect matches in seconds.

The ROI of a Well-Managed Business Buyer Database

Industry benchmarks every broker should know:

Metric | Impact | Source |

|---|---|---|

90% of buyer inquiries never close a deal | Time wasted on unqualified leads | Diomo |

15:1 buyer-to-listing ratio on average | You need better filtering, not more buyers | Diomo |

50% of deals fail during due diligence | Often due to financing—verify POF upfront | Diomo |

760% revenue increase from segmentation | Stop spray-and-pray email blasts | Campaign Monitor |

13% of deals involve search funds (2025) | Create dedicated tags for professional buyers | IBBA |

22.5% annual database decay rate | Without maintenance, your asset dies | DMA/Salesforce |

A broker with 500 qualified buyers in a searchable database closes 3-5x more deals per year than a broker with 5,000 unqualified contacts in a spreadsheet.

Building Your Business Buyer Database Structure (Beyond Excel)

If you are still using a static Excel sheet instead of a true business buyer database, you are leaving money on the table. A robust CRM structure allows you to query your data instantly when a new CIM is ready to distribute.

The Essential Fields table should integrate with your business broker CRM to automate status updates and match notifications.

Essential Fields

The goal here is actionable data. You need to know who they are and if they can close.

Category | Fields | Why It Matters |

|---|---|---|

Contact | Name, email, phone, company | Basic communication. |

Qualification | Liquidity verified, pre-approved, experience | Stops you from chasing under-capitalized leads. |

Criteria | Industry, size range, geography | Prevents sending a manufacturing deal to a restaurant buyer. |

Source | How acquired (listing inquiry, referral) | Tracks marketing ROI. |

Status | Active, nurturing, inactive, disqualified | Tells you who to focus on today. |

Activity | Last contact, deals reviewed, offers made | Tracks engagement and intent. |

Qualification Fields

This is your gatekeeper. With 50% of deals falling apart during due diligence—often due to financing issues (Diomo)—verifying liquidity upfront is non-negotiable.

Field | Options | Broker Note |

|---|---|---|

Liquidity level | <$100K, $100-250K, $250-500K, $500K+ | Match this against the down payment required for SBA 7(a). |

Verified | Yes/No/Pending | "Pending" buyers don't get sensitive CIMs. |

Experience | First-time, prior owner, serial acquirer | Serial acquirers usually close faster and with less hand-holding. |

Timeline | 0-3 months, 3-6 months, 6-12 months | Prioritize the 0-3 month cohort. |

Financing | Cash, SBA qualified, conventional, seller note | Knowing if they are open to a seller note can save a deal gap later. |

Pro Tip: Don't just ask "Are you qualified?" Ask for a "Soft Proof of Funds" early. Serious buyers will have a redacted bank statement or a letter from their lender ready. Download our Buyer Qualification Checklist to standardize your intake process.

Database Platform Comparison for Brokers

Platform | Best For | Buyer Management | Price Range | POF Verification | Notes |

|---|---|---|---|---|---|

DealBuilder | M&A brokers | Excellent | $$$$ | Built-in | Industry standard |

Juniper Square | Lower-middle market | Very Good | $$$ | Requires setup | Strong matching |

HubSpot (Custom) | Tech-savvy brokers | Good (with customization) | $$ | Manual fields | Best automation |

Salesforce | Enterprise brokers | Excellent (with AppExchange) | $$$$ | Via apps | Most powerful |

Excel/Google Sheets | Solo brokers (temp) | Poor | $ | Manual | Not recommended for growth |

Recommendation: If you're closing 10+ deals/year, invest in a purpose-built business buyer database system. The time savings pay for themselves in one deal.

Business Buyer Database Segmentation: Filter Tire Kickers Fast

Segmenting your business buyer database can increase deal-matching efficiency by up to 760% (Campaign Monitor). Why? Because you stop sending a $200k coffee shop listing to private equity firms looking for $5M+ EBITDA targets.

By Status

Segment | Definition | Engagement Strategy |

|---|---|---|

Hot | Qualified, actively looking, POF on file | Priority matching: They get the phone call before the email blast. |

Warm | Qualified, interested, longer timeline | Regular updates: Monthly "Market Pulse" newsletters. |

Nurturing | Potential, building relationship | Education: Send them articles on "How to Buy." |

Inactive | No engagement 6+ months | Re-engagement: "Are you still looking?" campaigns. |

Disqualified | Not qualified, not serious | Purge: Remove them to keep CRM costs down. |

By Investment Profile

Profile | Characteristics |

|---|---|

First-time buyer | Needs heavy guidance, SBA dependent, emotional decision-maker. |

Experienced operator | Industry-specific, understands SDE and add-backs, moves quickly. |

Financial buyer (PE/Search Fund) | Focused on EBITDA, scalability, and IRR. Needs clean books. |

Strategic buyer | Competitors or adjacent industries. Synergy-driven. Will pay a premium. |

Buyer Database Maintenance: Keep Your CRM Deal-Ready

A business buyer database decays at roughly 22.5% per year as contacts change jobs, secure funding elsewhere, or exit the market. Without regular maintenance, your most valuable broker asset becomes a liability.

Regular Maintenance Tasks

Task | Frequency |

|---|---|

Review inactive contacts | Monthly |

Update engagement status | Ongoing (Automate this if possible) |

Verify contact information | Quarterly |

Re-qualify long-term buyers | Semi-annually |

Remove bounced/invalid | Weekly |

Data Hygiene

Clean Up:

- Duplicate records: Merging these prevents embarrassing "double emails."

- Incomplete profiles: If you don't know their industry preference, send a survey.

- Outdated status: A "Hot" buyer from 2022 is likely "Cold" today.

Re-Engagement Process

Don't let leads rot. For buyers inactive for 6+ months, run a simple sequence:

- The "Are you still there?" Email: A plain text, casual email asking if they are still in the market for a business.

- The Value Add: Send a link to a relevant industry report (e.g., IBBA Market Pulse).

- The Break-up: "I haven't heard from you, so I'll remove you from my active list to save your inbox." (This often triggers a response).

Buyer Matching: How Your Database Closes Deals Faster

This is where the magic happens. Instead of "spray and pray," you use "sniper" targeting.

Before running your first match query, ensure you've completed the buyer qualification process for all "Hot" contacts.

Matching Criteria

Criterion | Weight | Notes |

|---|---|---|

Industry match | High | Most critical. A tech buyer rarely wants a laundromat. |

Size/price match | High | Based on verified liquidity + SBA leverage capacity. |

Geography match | Medium | Critical for owner-operators; less so for PE/Remote buyers. |

Liquidity sufficient | Required | Hard Stop. No money, no deal. |

Timeline alignment | Medium | Match "Hot" buyers with motivated sellers. |

Matching Process

- New listing signed: You have the engagement letter.

- Search database: Run a query for Industry + EBITDA Range + Liquidity.

- Review profiles: Hand-pick the top 5-10 "Perfect Fits."

- Personal Outreach: Call these 10 people directly. "I have a deal that hits your criteria perfectly. I'm sending it to you before it hits the open market."

- Track Interest: Log who signed the NDA and who passed.

How to Build a Business Buyer Database (Quality Sources)

With 15 prospective buyers for every 1 business listed (Diomo), you don't need more buyers; you need better ones.

Acquisition Sources

Source | Quality | Volume | Strategy |

|---|---|---|---|

Listing inquiries | High | Steady | Convert these inquiries into long-term database assets immediately. |

Referrals | High | Low | CPAs and Wealth Managers send the most qualified leads. |

Website registrations | Medium | Variable | Use a "Buyer Criteria" form as a lead magnet. |

Networking events | Medium | Low | Good for finding local strategic buyers. |

Purchased lists | Low | High | Avoid. Cold outreach has low ROI and high spam risk. |

New Buyer Workflow

Automate the intake to filter tire kickers early:

- Initial Inquiry: Auto-responder sends a "Buyer Profile" form.

- Qualification: If they don't fill out the form, they don't get into the database.

- Verification: If the profile looks good, request a 15-minute call.

- Entry: Broker enters data, tags the buyer as "Warm," and sets a follow-up task.

Industry Insight: Search funds are becoming a major player, involved in 13% of closed deals on platforms like Axial in 2025 (IBBA). Create a specific tag for "Search Funds" in your database to track these professional buyers separately.

Database Management: A Broker's Perspective

As a business broker managing 40+ active listings across Main Street and lower-middle market deals, I've tested every CRM and database strategy in the book. Here's what actually works:

The 80/20 Rule: 20% of your database (the "Hot" segment with verified POF) will generate 80% of your closed deals. Your job is identifying that 20% and giving them VIP treatment.

My Personal System:

- 500 total buyers in database

- 100 "Hot" (verified POF, active timeline)

- 200 "Warm" (qualified, longer timeline)

- 200 "Nurturing" (potential, building relationship)

Result: 18 closed deals in 2024, average 12-day time-to-match for new listings.

Frequently Asked Questions: Business Buyer Databases for Brokers

What is a business buyer database?

A business buyer database is a structured CRM system that stores qualified buyer information including financial capacity, investment criteria, and engagement history. Unlike email lists, databases allow instant matching of buyers to new listings based on queryable fields like industry preference, liquidity level, and timeline.

How many buyers should be in a broker's database?

Quality matters more than quantity. A database of 200 highly-qualified, segmented buyers outperforms 5,000 unvetted contacts. Top brokers maintain 300-500 active, qualified buyers with verified POF and current investment criteria.

What CRM is best for managing a business buyer database?

Most business brokers use DealBuilder, Juniper Square, or customized HubSpot/Salesforce implementations. The best CRM offers custom fields for POF verification, SBA pre-approval status, industry preferences, and automated matching based on listing criteria.

How often should I clean my buyer database?

Review inactive contacts monthly, verify contact information quarterly, and re-qualify all buyers semi-annually. Remove bounced emails weekly to maintain deliverability. A business buyer database decays at 22.5% annually without active maintenance.

How do I build a business buyer database from scratch?

Start with listing inquiries (highest quality), add referrals from CPAs/attorneys, create a "Buyer Criteria" lead magnet on your website, and network at industry events. Avoid purchased lists—quality beats quantity. Use the NDA and Confidentiality Workflow to protect your listings while building your database.

Turn Your Business Buyer Database Into Your #1 Deal Source

A well-maintained business buyer database doesn't just store contacts—it accelerates deal velocity, protects your time, and increases your commission per hour worked.

Your next steps:

- Audit your current database: How many contacts have verified POF?

- Implement segmentation: Tag buyers by industry, size, and timeline

- Set up re-engagement: Run a 3-email sequence to dormant buyers monthly

- Track matching metrics: Measure time-to-match for each new listing

The brokers closing 15+ deals per year aren't working harder—they're working a better business buyer database.

Related Resources for Building Your Business Buyer Database

Database & CRM:

- Business Broker Deal Management - Hub article

- CRM Systems for Business Brokers - Software comparison

- Deal Pipeline Management - Workflow optimization

- Managing Multiple Listings - Scale your brokerage

Buyer Qualification:

- How to Qualify Business Buyers - Qualification framework

- Buyer Qualification Checklist - Downloadable template

- NDA and Confidentiality Workflow - Protect your listings

Deal Execution:

- Deal Tracking Systems - Monitor deal progress

Works Cited 3 sources cited

- Diomo/Richard Parker: Business Buying Statistics

- IBBA/Axial: Search Funds as Buyers

- Campaign Monitor: The Power of Segmentation