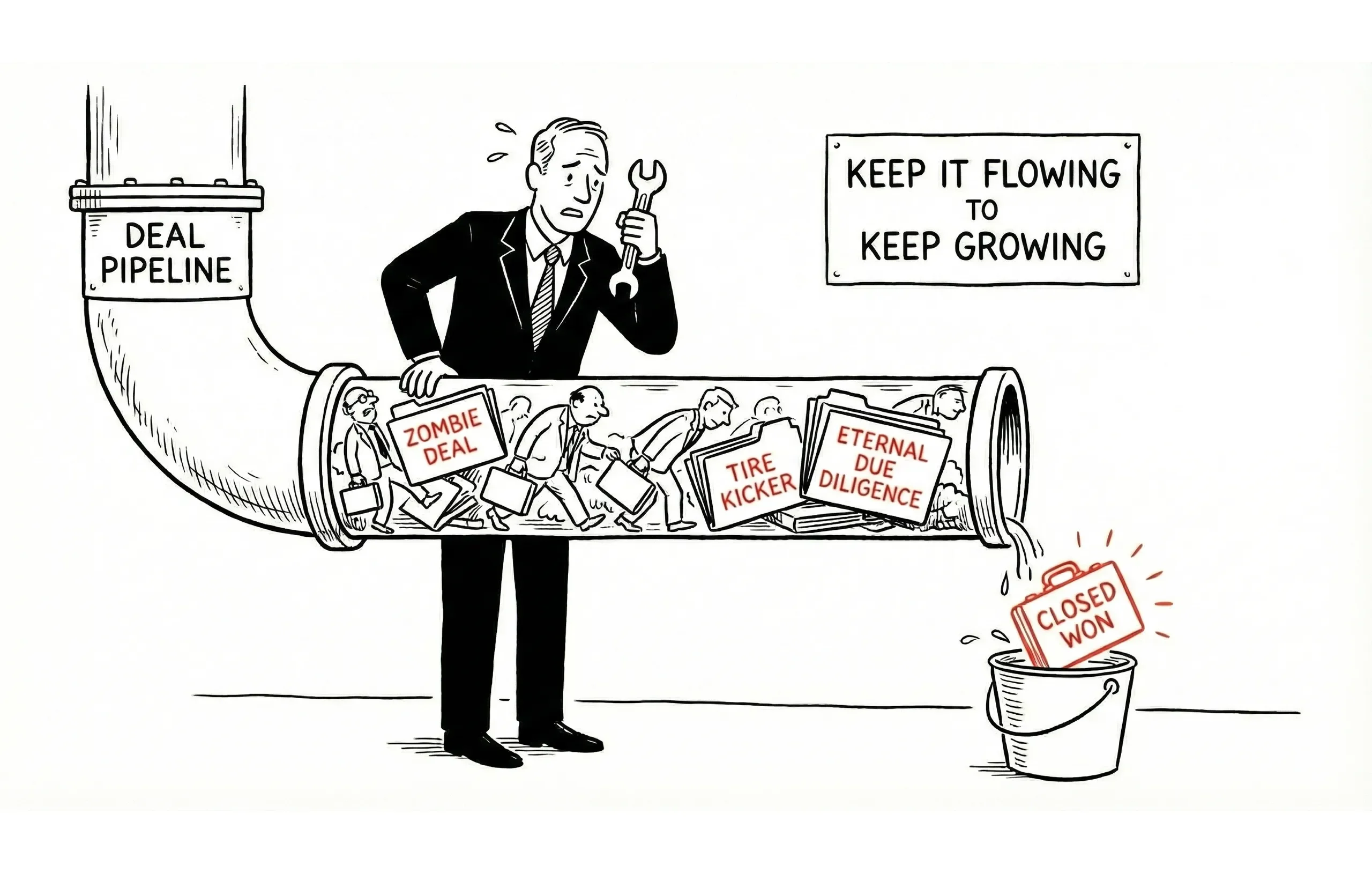

We've all had that one deal. Let's call it "The Zombie."

It was a manufacturing listing with solid add-backs and a seller who swore they were ready to retire. You had an LOI signed within 30 days. You were mentally spending the commission. Then, due diligence dragged. The buyer's financing got "complicated." The seller decided to take a three-week vacation during the QofE (Quality of Earnings) audit.

Six months later, the deal wasn't dead, but it certainly wasn't alive. It was just... lingering in your business broker pipeline, eating up your bandwidth and giving you false hope for your Q4 forecast.

A well-structured business broker pipeline provides visibility into your entire book of business, helps identify stalled deals (like The Zombie) before they infect your forecast, and enables accurate revenue prediction. Whether you're managing 5 deals or 50, your pipeline is the difference between hitting your numbers and scrambling at quarter-end.

This guide covers how to build and manage an effective business broker pipeline that keeps the "tire kickers" out and the serious closers moving.

Business Broker Pipeline Stages: Definitions & Exit Criteria

If your business broker pipeline stages are just "Listed" and "Sold," you're flying blind. To keep velocity high, you need granular stages with strict exit criteria. This prevents "hopium"—the dangerous belief that a deal is further along than it actually is.

Standard Business Broker Pipeline Stages

Stage | Definition | Exit Criteria |

|---|---|---|

Prospect | Initial contact with potential seller | Engagement signed |

Engaged | Signed engagement, gathering info | CIM complete, ready to list |

Active Marketing | Listed and actively marketing | LOI accepted |

Under Offer | LOI signed, in due diligence | DD complete, ready to close |

Closing | Final documentation and coordination | Transaction closed |

Closed Won | Successfully closed | Commission collected |

Closed Lost | Withdrawn or terminated | Reason documented |

Stage Probability Weighting

Forecasting isn't guessing; it's math. By assigning probabilities to each stage in your business broker pipeline, you can calculate your "Weighted Pipeline Value." This tells you if you actually have enough dry powder to hit your revenue goals or if you're just busy being busy.

Stage | Typical Close Probability |

|---|---|

Prospect | 10-20% |

Engaged | 30-40% |

Active Marketing | 50-60% |

Under Offer | 70-80% |

Closing | 90-95% |

Business Broker Pipeline Metrics & KPIs

Your business broker pipeline isn't just a CRM view—it's a revenue forecasting engine. "You can't manage what you don't measure." It's a cliché because it's true. According to research cited by Salesgenie, organizations that effectively manage their sales pipelines see a 28% higher revenue growth rate. Conversely, flying by the seat of your pants is a recipe for a dry quarter.

Key Performance Indicators

Metric | Formula | Target |

|---|---|---|

Conversion rate | Deals advancing ÷ Deals in stage | Stage-dependent |

Stage velocity | Avg days in stage | Minimize |

Win rate | Closed won ÷ Total closed | 60-70% |

Pipeline value | Sum (Deal value × Probability) | Revenue goal |

Business Broker Pipeline Health: Warning Signs & Metrics

A healthy pipeline isn't just full; it's moving. The IBBA Q3 2024 Market Pulse Report highlighted that while deal flow increased, many deals stalled due to election uncertainty. This makes monitoring "Time in Stage" critical.

Healthy Pipeline Signs:

- Balanced distribution across stages (you aren't top-heavy with prospects and empty on closings).

- Deals moving forward regularly.

- New prospects entering consistently.

- Reasonable time in each stage (benchmarked against the industry average of 6 to 12 months to sell a business).

Warning Signs:

- The Bulge: Too many deals stuck in "Active Marketing" or "Under Offer."

- The Drought: No new prospects entering while you focus solely on closing one big deal.

- The Drift: Excessive time in any stage.

- The Drop: Declining conversion rates.

Industry Reality Check: Data suggests that only about 50% of businesses under contract actually make it to closing. If your personal win rate is hovering there, you are average. To be elite, you need to disqualify bad deals earlier in the "Engaged" stage.

Managing Your Business Broker Pipeline

The old adage "Time kills all deals" is the broker's law of gravity. Your business broker pipeline is only valuable if deals are moving through it. Friction is the enemy.

Advancing Deals

From Stage | Key Actions to Advance |

|---|---|

Prospect | Seller education, valuation discussion (Set realistic expectations early). |

Engaged | Document collection, CIM completion (Get the add-backs specifically documented now, not later). |

Active | Buyer matching, showing coordination. |

Under Offer | DD facilitation, issue resolution (Pre-empt the financing hurdles). |

Closing | Documentation completion, third-party coordination. |

Identifying Stalled Deals

How do you spot a Zombie Deal before it eats your brain? A healthy business broker pipeline requires regular review for deals that have stopped moving.

Review triggers:

- Over 2x average days in stage: If your average "Under Offer" time is 60 days, and this one is at Day 125, it’s a red alert.

- No activity in 14+ days: Radio silence from a buyer usually means they found another shiny object.

- Missing key milestones: Did they miss the financing commitment date?

- Communication gaps: Is the seller taking three days to reply to simple emails?

Action steps:

- Identify root cause: Is it financing? Valuation? Or just "cold feet"?

- Develop action plan: Get the lender on the phone or schedule a face-to-face with the seller.

- Communicate with stakeholders: "We are off track. Here is what needs to happen to get back on."

- Set deadline for movement: "We need the updated P&L by Friday or we risk losing the buyer."

- Consider withdrawal if unresolvable: Sometimes, firing a client is the most profitable thing you can do.

Business Broker Pipeline Visualization & Dashboard Setup

You shouldn't need a spreadsheet degree to know where your money is. Visualizing your business broker pipeline helps you spot bottlenecks instantly.

Pipeline Views

View | Purpose |

|---|---|

Kanban board | Visual stage progression (Great for dragging and dropping deals). |

List view | Detailed deal information (Best for deep dives into data). |

Calendar view | Timeline and deadlines (Crucial for DD expiry dates). |

Dashboard | Aggregate metrics (Your morning coffee view). |

Essential Dashboard Elements

- Deal count by stage

- Total pipeline value (Weighted vs. Unweighted)

- Average days in stage

- This week's activity

- Deals requiring attention (The "Red Zone")

- Commission forecast

Building Your Business Broker Pipeline: 30-Day Implementation

Week 1: Foundation

- Define your 6-7 pipeline stages with specific exit criteria

- Assign probability weights based on your historical close rates

- Document your current deals into the new stage framework

Week 2: Metrics & Tracking

- Set up your dashboard with key metrics (deal count, weighted value, velocity)

- Establish baseline benchmarks for your average time in each stage

- Create a weekly pipeline review ritual (Monday mornings work well)

Week 3: Movement Protocols

- Define specific actions required to advance deals from each stage

- Create email templates and checklists for common stage transitions

- Set up automated alerts for deals exceeding average stage duration

Week 4: Optimization

- Analyze where deals are stalling and adjust qualifying criteria

- Refine probability weights based on actual conversion data

- Train any team members on the new pipeline management system

Most brokers see a 20-30% improvement in forecast accuracy within 60 days of implementing a structured business broker pipeline.

Real-World Example: Pipeline Health Turnaround

A Chicago-based broker came to us with a $2.3M pipeline but couldn't explain why she wasn't closing deals. Her business broker pipeline had 18 deals, but 12 were stuck in "Active Marketing" for 90+ days.

The diagnosis: She was listing every business that came her way, regardless of marketability. Her pipeline was bloated with unsellable deals.

The fix: We implemented strict engagement criteria (minimum $500K EBITDA, clean books, motivated seller). She cut 8 deals from her pipeline immediately.

The result: Within 60 days, her remaining 10 deals had higher velocity. She closed 3 deals in Q4 vs. 1 the previous quarter. Her weighted pipeline value dropped from $2.3M to $1.1M, but her actual closings doubled.

The lesson: A healthy business broker pipeline isn't about quantity—it's about quality and movement.

Frequently Asked Questions About Business Broker Pipelines

How many deals should be in a business broker pipeline?

A healthy business broker pipeline should have 3-4x your quarterly revenue goal in weighted pipeline value. For example, if you need $100K in commissions, you should have $300-400K in weighted pipeline value across all stages.

What is the average time for a deal to move through a business broker pipeline?

Industry data shows 6-12 months from listing to close. However, elite brokers maintain a 4-6 month average pipeline velocity by qualifying aggressively in the early stages.

What's a good win rate for a business broker pipeline?

Industry average is 50% of deals under contract close. Top-performing brokers achieve 70%+ win rates by disqualifying bad deals earlier in the pipeline.

How often should I review my business broker pipeline?

Review your pipeline daily for deal movement, weekly for stage velocity and stalled deals, and monthly for overall pipeline health and forecasting accuracy.

What tools do business brokers use to manage their pipeline?

Most business brokers use specialized CRMs like DealBuilder, Pandadoc, or adapted platforms like HubSpot with custom pipeline stages for M&A deal flow.

Related Resources

Deal Management:

- Business Broker Deal Management - Complete deal lifecycle guide

- Deal Tracking Systems - Software and tools comparison

- CRM for Business Brokers - CRM selection and implementation

- Managing Multiple Listings - Scaling your pipeline

Buyer & Seller Management:

- Buyer Database Management - Building and segmenting your buyer pool

- NDA & Confidentiality Workflow - Protecting deal integrity