We’ve all been there. You sign the engagement letter on a pristine manufacturing deal—$2M EBITDA, clean books, a seller who actually understands "add-backs" without flinching. You draft a killer CIM, slap a generic teaser on a few free listing sites, and wait for the phone to ring.

And you wait.

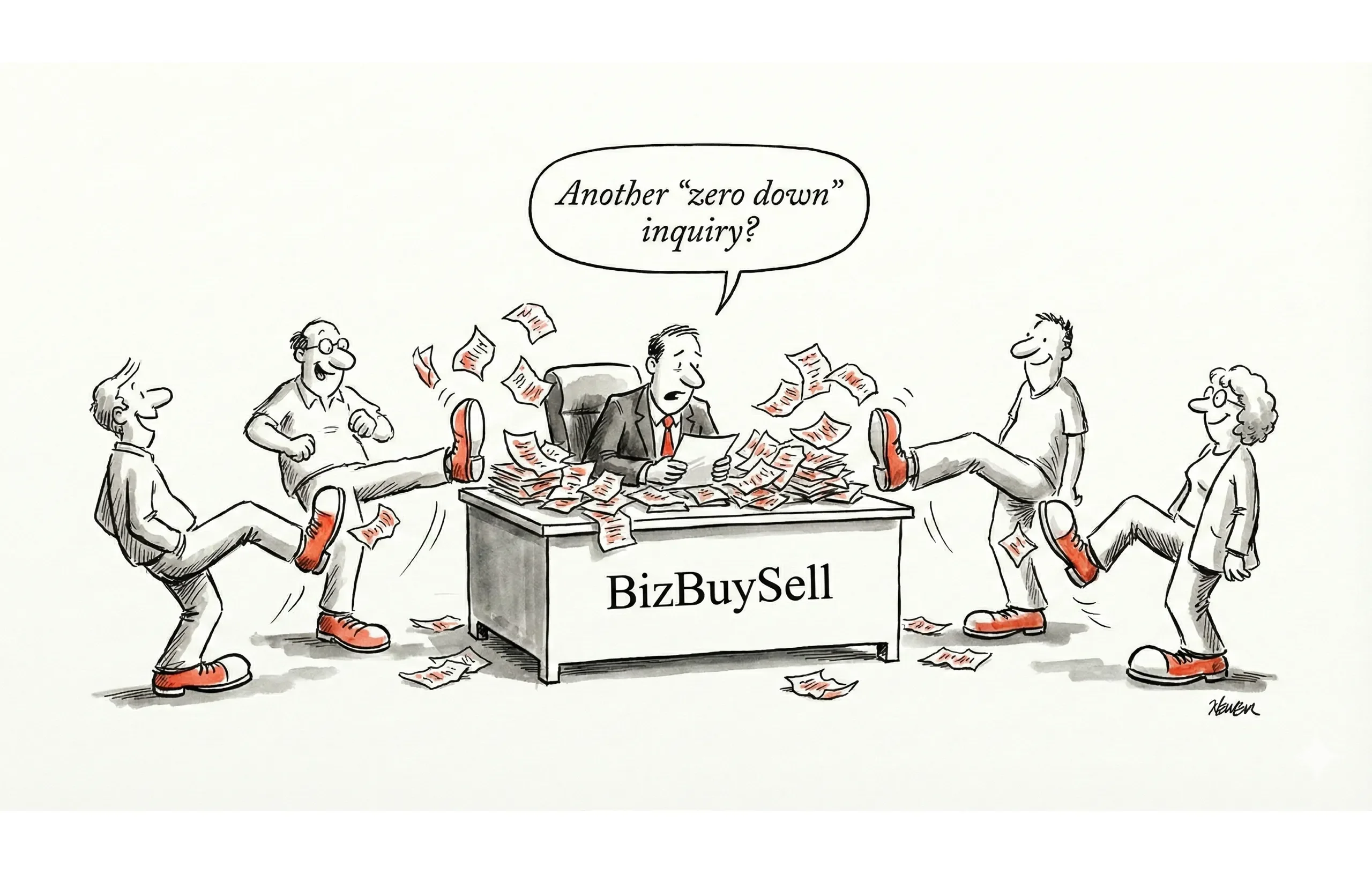

Or worse, the phone does ring, but it’s just a parade of "tire kickers"—corporate refugees with zero liquidity and a dream, or competitors fishing for data.

In the brokerage world, your time is your inventory. As industry veteran Len Krick famously said, "Listings are not a business broker's 'inventory.' Your time is your 'inventory.'" If you’re parking your deals on the wrong platforms, you aren't just losing visibility; you’re burning the one asset you can’t get back.

Choosing the right marketplace isn't just about traffic; it's about intent. This guide cuts through the noise to help you deploy your marketing budget where the real "dry powder" is sitting.

Major Listing Platforms to List a Business for Sale

The digital landscape for business acquisitions is top-heavy, but ignoring the smaller players can cost you the perfect strategic buyer. Here is the breakdown of the marketplaces that matter.

BizBuySell

Overview: The 800-pound gorilla of the industry. If you aren't here, do you even have a listing?

Factor | Details |

|---|---|

Monthly visitors | 3.5M+ (Source) |

Active listings | 65,000+ annually (Source) |

Best for | Main Street to Lower Mid-Market |

Pricing | Subscription-based |

Buyer quality | High volume, Mixed quality |

Pros:

- Unmatched Reach: With over 3.5 million monthly visits, it is the primary search engine for business buyers.

- Data Rich: Their comparable data and Insight Reports are industry standards.

- SEO Dominance: They consistently rank top 3 for almost every "business for sale" keyword.

Cons:

- The Noise: The volume brings the "tire kickers." You will need a rigorous vetting process to filter out the dreamers from the check-writers.

- Cost: Subscriptions can get pricey for high-volume brokerages.

Broker's Take: BizBuySell is non-negotiable for 90% of Main Street deals. It's where the volume is. As Adam Pratt of Atlantic Business Brokers noted in a recent market report, "There are not enough listings for all the buyers," and most of those buyers are starting their search here.

BizQuest

Overview: Often viewed as the "cleaner," slightly more upscale cousin to BizBuySell (and owned by the same parent company, CoStar).

Factor | Details |

|---|---|

Monthly visitors | 500K+ |

Active listings | 20,000+ |

Best for | Mid-market deals |

Pricing | Subscription-based |

Buyer quality | Generally higher |

Pros:

- Quality Traffic: While the volume is lower, the user interface often attracts a more serious, sophisticated buyer demographic.

- Less Clutter: Your listing is less likely to get buried under hundreds of "coin laundry" ads.

Cons:

- Smaller Pool: You cannot rely on BizQuest alone; it works best as a tandem strategy with BizBuySell.

Learn more: BizBuySell vs. BizQuest Comparison

BusinessBroker.net

Overview: A platform that feels more "B2B" than "B2C," heavily focused on the broker community and franchise sales.

Factor | Details |

|---|---|

Monthly Visitors | 200,000+ buyers (Source) |

Focus | Broker community & Franchises |

Best for | Co-brokering & Franchise Resales |

Buyer quality | Professional |

Broker's Take: This is a solid place to find other brokers for co-brokering opportunities. If you have a deal that requires a specific geographic partner or industry specialist, this network is valuable.

LoopNet

Overview: The king of Commercial Real Estate (CRE).

Factor | Details |

|---|---|

Focus | Real estate |

Best for | RE-included deals (Gas stations, Hotels, Manufacturing plants) |

Pricing | Premium |

Buyer quality | RE Investors / Developers |

Best for: Businesses where the Real Estate is the main course, and the business is the gravy. If you are selling a restaurant with the building, list here. If you are selling a SaaS company, stay away.

BusinessesForSale.com

Overview: The global connector.

Factor | Details |

|---|---|

Coverage | Global (Strong in UK/Europe/Australia) |

Monthly Visitors | 1.3M+ (Source) |

Best for | International buyers / Relocatable businesses |

Pricing | Pay-per-listing options |

Broker's Take: Don't sleep on this if you have a manufacturing or tech listing that could appeal to an overseas buyer looking for a U.S. foothold (E-2 Visa candidates).

Platform Selection Guide for Business Acquisitions

One size does not fit all. Here is how to allocate your marketing dollars based on the deal profile.

By Deal Size

Deal Size | Recommended Platforms |

|---|---|

Under $250K | BizBuySell, BizQuest. Volume is the game here. You need to cast a wide net to find that individual owner-operator. |

$250K - $1M | BizBuySell, BizQuest, BusinessBroker.net. This is the sweet spot for SBA buyers. Ensure your "Adjusted Net Income" is clearly highlighted. |

$1M - $5M | All major platforms + Direct Outreach. At this level, you are hunting for PEG (Private Equity Group) bolt-ons or high-net-worth individuals. Public listings support the credibility, but the buyer might come from your private database. |

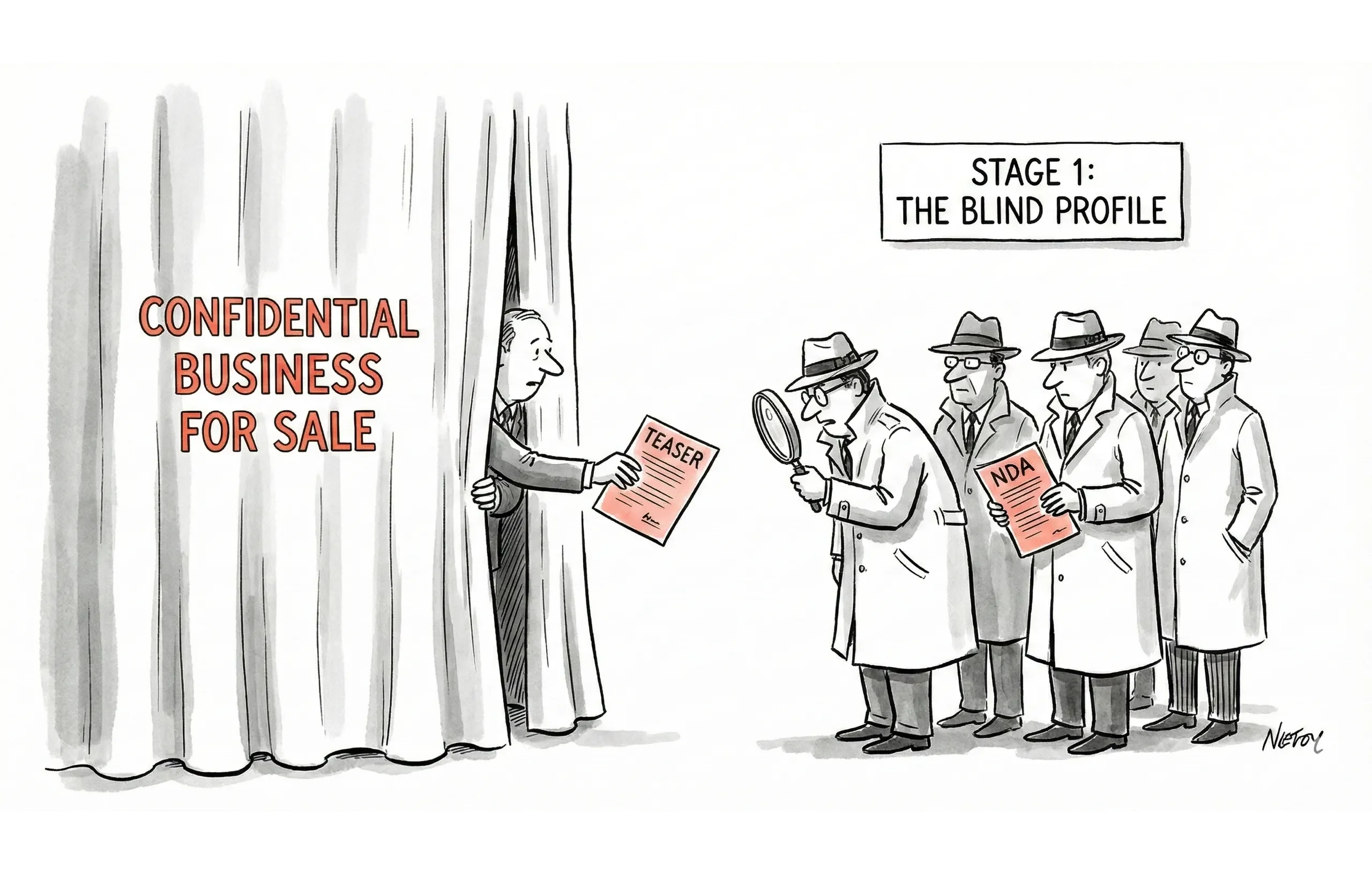

$5M+ | Direct Outreach, Investment Banker Networks. Public listings can sometimes hurt perception at this level ("Why is this on a public board? Is it broken?"). Use caution and blind listings. |

By Industry

Industry | Best Platforms |

|---|---|

Restaurants | BizBuySell, Restaurant-specific sites (e.g., WeSellRestaurants) |

Professional Services | BizBuySell, Industry networks (CPA/Legal associations) |

Manufacturing | BizBuySell (for smaller shops), Industry trade pubs, BusinessesForSale.com (international reach) |

Real Estate-Heavy | LoopNet, BizBuySell (Cross-list to capture both business and property investors) |

Technology | Direct outreach, Tech-specific sites (e.g., Flippa for smaller assets), MicroAcquire |

By Buyer Type Sought

Target Buyer | Best Approach |

|---|---|

Individual / Corporate Refugee | BizBuySell, BizQuest. They are searching evenings and weekends. |

Strategic Buyers | Direct Outreach. They aren't browsing listing sites; they are running their own businesses. You have to call them. |

Financial Buyers (PE) | Direct Outreach, PE Databases. They have "dry powder" to deploy but need vetted deal flow. |

International | BusinessesForSale.com. Essential for E-2 Visa compliant deals. |

Multi-Platform Strategy for Listing a Business for Sale

Recommended Approach

"Post and pray" is dead. The modern broker uses a "Core + Satellite" strategy.

Core Platforms (The "Must-Haves"):

- BizBuySell & BizQuest: This covers 80%+ of the active buyer market. Most CRM systems for brokers (like DealBuilder or others) allow one-click syndication to both.

Supplemental (The "Snipers"):

- BusinessBroker.net: Turn this on when you are open to co-brokering or have a franchise resale.

- LoopNet: Only expend budget here if the real estate value is >50% of the deal value.

- Industry Specifics: If you are selling a dental practice, PracticeTransitions is better than Craigslist.

Managing Multiple Listings

- Consistency is Key: Ensure your EBITDA and SDE numbers match across all platforms. Nothing kills confidence faster than a buyer seeing two different cash flow numbers for the same blind listing.

- Source Tracking: Ask every lead: "Where did you see this listing?" If LoopNet isn't generating leads for your laundromat deal, cut the spend.

- The "Stale" Factor: Refresh your headlines every 30 days. Change "Profitable HVAC" to "HVAC with $400k SDE - Owner Retiring." Algorithms love fresh content.

Beyond Listing Platforms

If you are relying solely on inbound leads from websites, you are leaving money on the table.

Direct Marketing Channels

Channel | When to Use |

|---|---|

Buyer Database | First. Before you go public, blast your internal list. Your best buyer is often someone who missed out on your last deal. |

Strategic Outreach | Simultaneously. While the listing is live, identify 5-10 competitors or complementary businesses and make the confidential call. |

Professional Networks | Always. Let your CPA and Attorney referral partners know you have a new deal. They often know which of their clients are in "acquisition mode." |

Social Media | LinkedIn. Post a blind teaser. "New Listing: $5M Rev Logistics Co in the Midwest." It builds your authority even if it doesn't sell that specific deal. |

Co-Brokering

Don't be the broker who hoards a listing until it expires.

- Share with peers: If you're a generalist with a complex medical manufacturing deal, find a specialist and offer a generous co-broke.

- Broker-to-Broker Platforms: Use private groups or listservs (like IBBA) to circulate deals before they hit the public market.