You know the nightmare scenario. We’ve all seen it happen.

A deal is cruising toward the finish line. The LOI is signed, due diligence is 80% done, and the seller is already mentally spending their exit payout on a boat in the Keys. Then, a key manager walks into the owner's office, face pale, holding a printout of a "blind" listing they found online. They recognized the revenue figures. They recognized the "generic" location.

Two days later, that manager quits, taking three top salespeople and 20% of the client base with them. The buyer gets spooked by the sudden instability and pulls the offer. The deal dies on the table.

Confidentiality isn't just a box to check; it is the structural integrity of the entire transaction. Effective confidential marketing is the art of shouting from the rooftops that you have a great business for sale, while simultaneously whispering so quietly that the neighbors don't hear a thing.

The "Silent Killer" of Deal Value

We often talk about "deal fatigue" or "financing contingencies" as deal killers, but a breach of confidentiality is the silent assassin. When word leaks, the damage to the business's value is immediate and often irreversible.

According to industry data, offers can drop by 10–30% when leaks create perceived risk in the business[1] Buyers price in the uncertainty of fleeing customers and rattled employees.

Furthermore, statistics suggest that only 25% to 30% of businesses listed for sale actually cross the finish line to new ownership[2] While valuation gaps are often to blame, confidentiality breaches are a leading cause of the "deal wobble" that scares off qualified buyers in the eleventh hour.

The Ripple Effect of a Leak

As the California Association of Business Brokers (CABB) notes, "One of the quickest ways to damage any business that is for sale is for confidentiality to be breached."[3]

Stakeholder | The Risk | The "Deal Killer" Consequence |

|---|---|---|

Employees | Fear of layoffs or culture change. | Brain Drain: Key staff leave, forcing the buyer to recalculate SDE and transition risk. |

Customers | Uncertainty about service continuity. | Churn: Competitors use the rumor to poach accounts ("They're selling? Better switch to us for stability."). |

Competitors | Opportunity to exploit uncertainty. | Market Share Loss: Aggressive marketing campaigns targeting the seller's client base. |

Landlords | Lease transfer leverage. | Holdup: Landlord demands renegotiated (higher) rates to approve the assignment. |

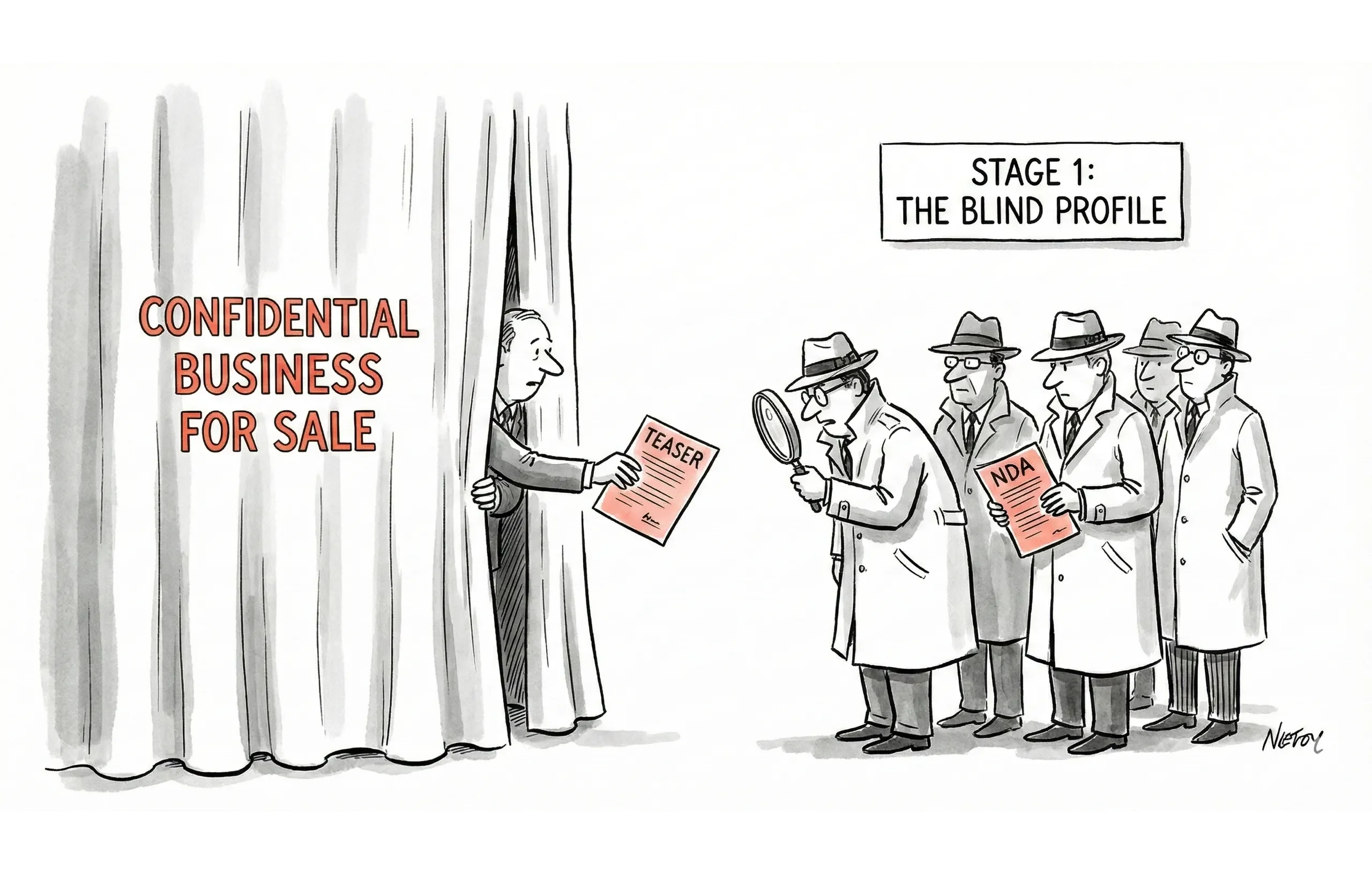

The Blind Profile: Your First Line of Defense

The goal of the blind profile (or "teaser") is to hook a buyer's interest without giving them the map to the front door. You are selling the financials and the story, not the address.

What to Include (The Hook)

- Region: Broaden the scope. Instead of "Downtown Scottsdale," use "Maricopa County" or "Southwest Metro Area."

- Financials: Use ranges for Revenue and SDE (Seller’s Discretionary Earnings). "Revenue: $2M - $3M" is safer than "$2,451,000."

- Industry: Be specific enough to attract the right PE firm or strategic buyer, but vague enough to hide the identity.

- The Sizzle: "High recurring revenue," "Absentee owner potential," or "Proprietary technology."

What to Exclude (The Breadcrumbs)

- Exact Location: Never list the city if the town is small.

- Unique Attributes: If they are the only distributor of "Brand X" widgets in the state, don't mention "Brand X."

- Photos: Never use exterior shots or recognizable interior photos. Use high-quality stock images that represent the vibe of the business.

Sample Blind Profile: The "Goldilocks" Teaser

This profile is specific enough to get an LOI, but vague enough to keep the secret.

CONFIDENTIAL BUSINESS OPPORTUNITY

Reference: #SW-2024-007

Title: Established Commercial Services Co. – High Margins & Recurring Rev.

Location: Greater Southwest Region (Sun Belt)

OPPORTUNITY HIGHLIGHTS:

• Strong Cash Flow: Consistent SDE between $450k - $550k

• History: 20+ years of operation with brand recognition

• Team: 18 FT employees; General Manager in place (Owner works 15hrs/wk)

• Growth: 12% YoY growth; Recession-resistant service model

• Asking Price: $1.4M - $1.6M

Reason for Sale: Retirement planning. Owner willing to stay for 6-month transition.

Strict NDA required for full Confidential Information Memorandum (CIM).

Information Staging: The "Striptease" Protocol

Smart brokers don't dump the data room on the first date. You need a staged release of information that rewards serious buyers while keeping the "tire kickers" in the dark.

Stage 1: The Teaser (Public)

Goal: Generate leads.Info: Blind profile only. No names, no addresses.Access: Open to the public on listing sites.

Stage 2: The Gatekeeper (NDA)

Goal: Filter out the curious neighbors and nosey competitors.Info: Still limited.Action: Buyer must sign a Non-Disclosure Agreement (NDA) and provide a basic financial qualification (proof they have the "dry powder" to close).

Stage 3: The Reveal (CIM)

Goal: Deep dive for qualified buyers.Info: The Confidential Information Memorandum (CIM). This reveals the business name, exact location, and granular financials (with add-backs detailed).Pre-requisite: Signed NDA + Broker vetting call.

Stage 4: The Visit (Site Tour)

Goal: Smell test and culture check.Info: Physical walkthrough.Protocol: After hours or under a cover story.

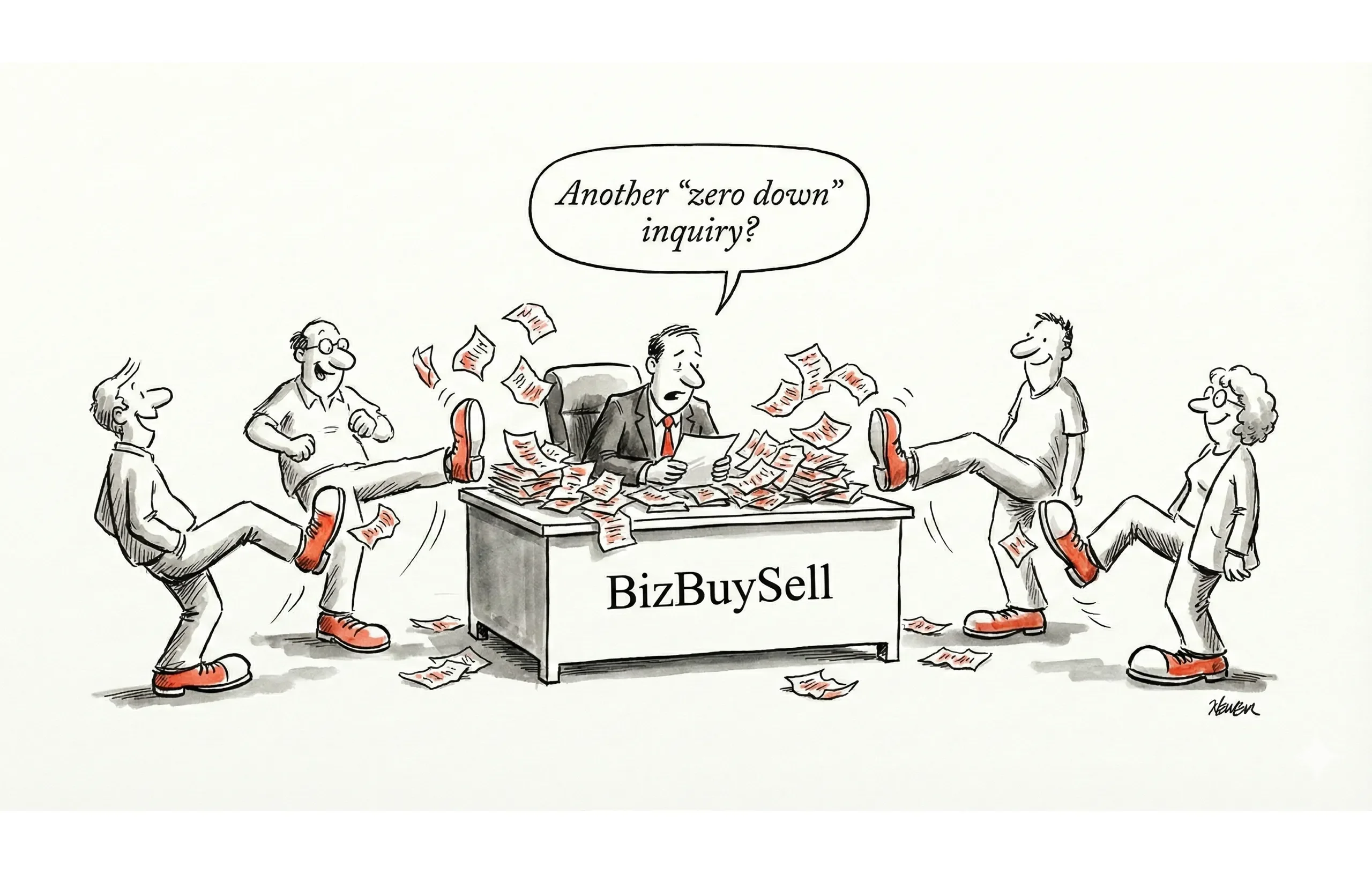

The "Tire Kicker" Filter

You will get inquiries from people who just want to know "which place is it?" so they can go look. Do not yield.

Buyer: "I don't want to sign an NDA just to know the name. Can you just tell me if it's [Business Name]?"

Broker Response:

"I appreciate the question, but I'm sure you understand that protecting the seller's goodwill is my primary duty—just as I would protect yours if you were the owner. The NDA takes 30 seconds to sign digitally. Once that's done and we've briefly discussed your acquisition criteria, I can release the full file to you immediately."

If they refuse to sign an NDA, they aren't a buyer. They are a liability.

The Art of the Site Visit (And the Cover Story)

Eventually, a buyer needs to walk the floor. This is the highest risk moment for a leak. If a guy in a suit walks around pointing at machinery with a clipboard, employees will talk.

The "Insurance Inspector" Gambit: The classic move. The buyer is introduced as an insurance agent updating the policy or a "risk management consultant."

The "Banking Partner" Play: "This is a representative from our bank doing a routine walkthrough for our line of credit renewal."

The "Operational Consultant": "We've hired a consultant to look at workflow efficiency."

Rules for the Visit:

- No Direct Questions: The buyer is strictly forbidden from asking employees questions about tenure, pay, or morale.

- After Hours: Ideally, visit before opening or after closing.

- The Seller Leads: The owner should control the tour flow to steer clear of chatty employees.

Crisis Management: When the Dam Breaks

Despite your best efforts, rumors happen. Maybe a buyer left a CIM on a printer, or a bank teller talked.

If the leak happens, speed is your only ally.

- Control the Narrative: The owner must address the staff immediately. "We are exploring strategic partnerships to help us grow" sounds better than "I'm selling out."

- Lock In Key Staff: If a key manager finds out, bring them into the circle of trust. Consider a "stay bonus" that pays out only if they remain through the transition.

- Accelerate the Deal: If the market knows, time is ticking. You may need to push the buyer to close faster, perhaps by offering a slight concession on the closing timeline.

Works Cited 3 sources cited

- THE SILENT KILLER OF BUSINESS SALES: WHY YOUR CONFIDENTIALITY IS ALREADY COMPROMISED - Infinity Business Brokers, accessed December 12, 2025, https://www.bizlistsell.com/post/the-silent-killer-of-business-sales-your-confidentiality

- IBBA Market Pulse - International Business Brokers Association, accessed December 12, 2025, https://www.ibba.org/wp-content/uploads/2023/02/ibba-q4-2022-market-pulse-execsum.pdf

- The Tremendous Importance of Maintaining Confidentiality When Selling Any Business, CA Association of Business Brokers, accessed December 12, 2025, https://cabb.org/news/tremendous-importance-maintaining-confidentiality-when-selling-any-business