We’ve all seen it: The "Zombie Deal."

You have a motivated seller with a solid P&L and a qualified buyer with plenty of dry powder. The LOI is signed, the excitement is palpable, and then… silence.

The buyer asks for the 2022 tax returns. The seller sends three different files named Scan_001.pdf, Untitled_Spreadsheet.xls, and a blurry iPhone photo of a K-1. The buyer asks for the lease agreement; the seller says, "I think it’s in the filing cabinet at the shop."

Days turn into weeks. The buyer’s enthusiasm cools. They start wondering, "If their files are this messy, what does the rest of the business look like?" This is where deals go to die. According to recent data from the CFA Institute, roughly 70% to 90% of M&A deals fail, and a significant chunk of that failure is attributed to a flawed or stalled due diligence process.

A pristine data room isn't just a file repository; it's your seller’s digital storefront. It signals competence, justifies the multiple, and keeps the deal momentum moving forward.

Data Room Options: Dropbox vs. The Pros

For smaller main street deals, you might get away with a basic cloud drive. But as you move upmarket into lower middle-market transactions, security and tracking become non-negotiable. You need to know if that "interested" buyer actually opened the CIM or if they're just kicking tires.

Virtual Data Room (VDR) Comparison

Type | Examples | Best For | The Broker's Take |

|---|---|---|---|

Basic File Sharing | Dropbox, Google Drive, Box | Main Street deals (<$1M), simple DD | Cheap and familiar, but risky. One wrong "Share" link and the wrong person sees the payroll. |

Purpose-Built VDR | Firmex, Intralinks, Datasite | Lower Middle Market ($5M+), Complex deals | The gold standard. Expensive, but allows you to revoke access after the fact. |

Broker Platforms | DealRoom, Batman, BizBuySell | Integrated workflows | Often "good enough" for mid-sized deals and keeps everything in one ecosystem. |

Key Features to Consider

- Access Controls: Who sees what? You don't want a potential buyer seeing unredacted employee names until the very end.

- Activity Tracking: Are they reading it? If a buyer claims they are "reviewing the financials" but your logs show zero logins, you know they are stalling.

- Q&A Functionality: Keeps the endless "email tennis" to a minimum by centralizing questions within the room.

Folder Structure: The "Deal Architecture"

Structure matters. A chaotic data room forces the buyer to hunt for information, which breeds frustration. A logical structure guides them through the narrative of the business.

We recommend a Tiered Release approach. Don't dump everything at once. Build the folder structure, but only populate sensitive folders (like 04_Operations) as trust is established.

Recommended Organization

- 01_Executive_Summary

- CIMConfidential Information Memorandum

- Company OverviewThe "Story"

- Investment Highlights

- 02_FinancialThe "Engine Room"

- Tax_ReturnsLast 3 Years

- Financial_StatementsP&L, Balance Sheet

- Bank_StatementsProof of Cash

- AR_AP_AgingWho owes us, who we owe

- SDE_CalculationThe Add-Backs Schedule

- 03_Legal

- Formation_DocumentsArticles of Inc, Operating Agreement

- ContractsMajor vendor/client agreements

- LeaseThe make-or-break doc for brick & mortar

- Licenses_Permits

- LitigationPast or present

- 04_Operations

- Organization_ChartAnonymized initially

- Employee_InformationHandbooks, Benefits

- ProcessesSOPs

- EquipmentAsset lists with valuation

- 05_Sales_Marketing

- Customer_InformationConcentration reports

- Marketing_Materials

- Sales_DataChurn rates, CAC

- 06_Real_EstateIf applicable

- Lease_Agreement

- Property_Information

- EnvironmentalPhase I reports

- 07_Other

- InsurancePolicies

- Miscellaneous

Document Preparation: "Scan001.pdf" is a Deal Killer

Nothing screams "unprofessional" louder than a sideways scan of a coffee-stained tax return.

Naming Conventions

Adopt a strict naming convention that includes the Year, Document Type, and Context.

- Good: 2023_Federal_Tax_Return_Final.pdf

- Bad: Scan_001.pdf

- Bad: Tax Return.pdf (Which year? Is it the draft or filed?)

Document Format & Quality

- PDF is King: For final documents (Tax returns, Contracts).

- Excel is for Math: Always provide working financials in Excel. Buyers need to verify your add-backs and test your SDE (Seller Discretionary Earnings) calculations. Sending a PDF of a spreadsheet suggests you are hiding formulas.

- Redaction: Before uploading, redact sensitive info (SSNs, home addresses of employees).

Pro Tip: "Time kills deals." A study by Bayes Business School found that the average due diligence period has stretched to 203 days. Organized documents are your best weapon to compress this timeline.

Security Considerations

As brokers, we are the gatekeepers. With 43% of cyber attacks targeting small businesses, a data breach during a sale isn't just embarrassing—it's a liability nightmare.

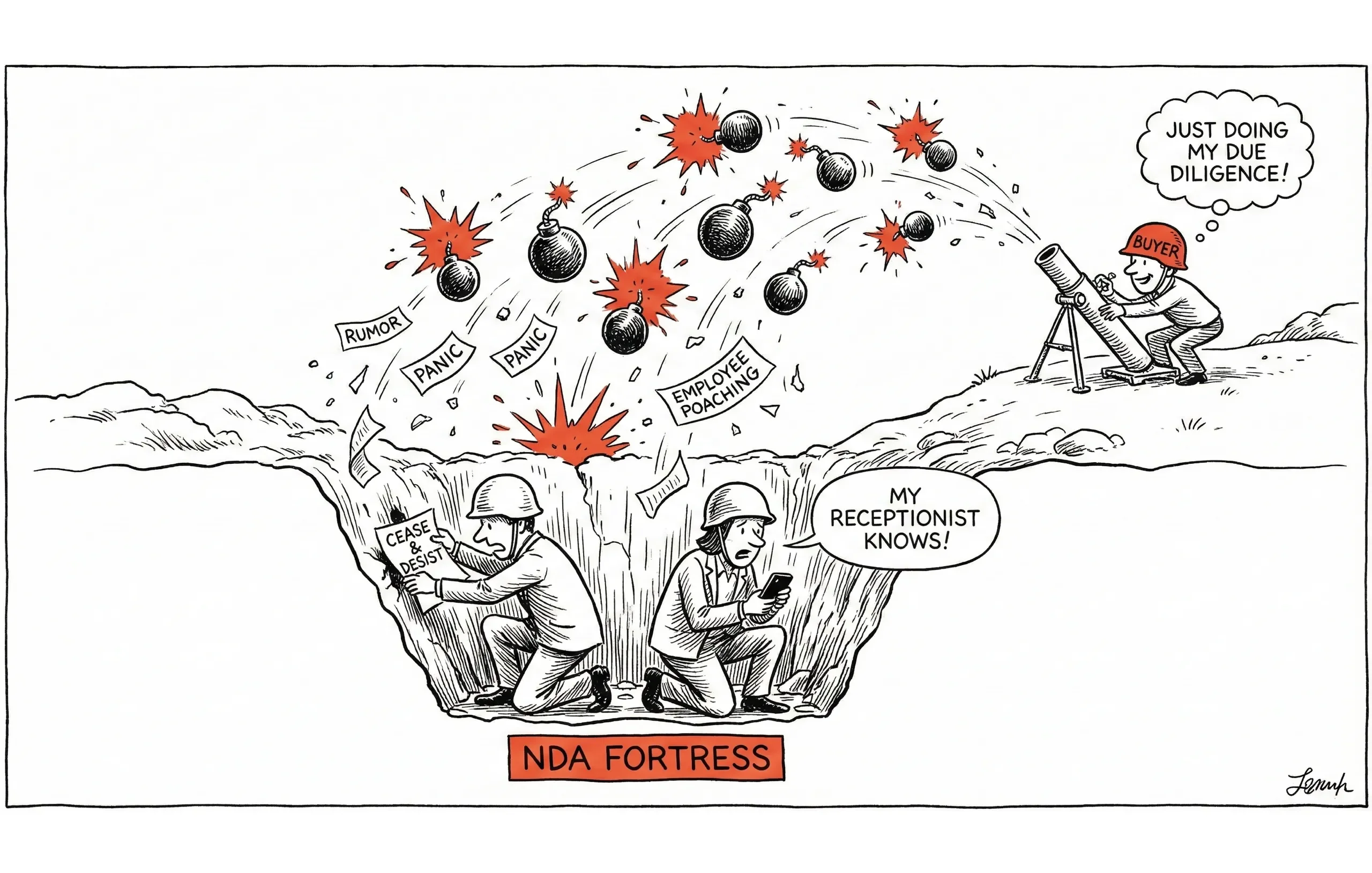

Access Management Tiers

- Administrator: (You and the Seller). Full control.

- Tier 1 (The "Looker"): The qualified buyer who just signed the NDA. They get 01_Executive_Summary and redacted 02_Financials.

- Tier 2 (The "Serious Buyer"): LOI is signed. They get 03_Legal and unredacted 02_Financials.

- Tier 3 (The "Closing Table"): Final diligence. 04_Operations, Employee names, and sensitive IP.

Essential Security Features

- Watermarking: Stamp the user’s email address across the PDF. If a document leaks, you know exactly who did it.

- Expiration Dates: Set access to expire automatically after 30 days. This creates urgency and protects data if the deal goes cold.

- "Fence" the Data: Disable the "Download" button for highly sensitive files (like customer lists) until the very last stage.

Managing Data Room Access: The Workflow

You don't just hand over the keys; you act as the chaperone.

- Buyer Signs NDA: No NDA, no access. Period.

- Broker Qualifies Buyer: Verify they have the funds. Don't open the data room for "hobbyist" investors.

- The Invitation: Send a professional invite link.

- Monitor Usage: Check the logs weekly.

- Scenario: The buyer says they are worried about "Customer Concentration." You check the logs and see they haven't even opened the Customer_Information folder. Now you know it's a negotiation tactic, not a genuine concern.

- The Revoke: If the deal dies, revoke access immediately. Do not leave "zombie users" in your data room.

![CIM Template for Business Brokers: Professional Format & Structure [2026]](https://d1pdxhu5fo8gl6.cloudfront.net/media/cim-template-business-broker_2025_Dec_1.webp)