We've all been there. It's Friday afternoon, and your inbox pings with an inquiry from a "Cash Buyer" with a Gmail address. They want the financials, the employee list, and the tax returns—now.

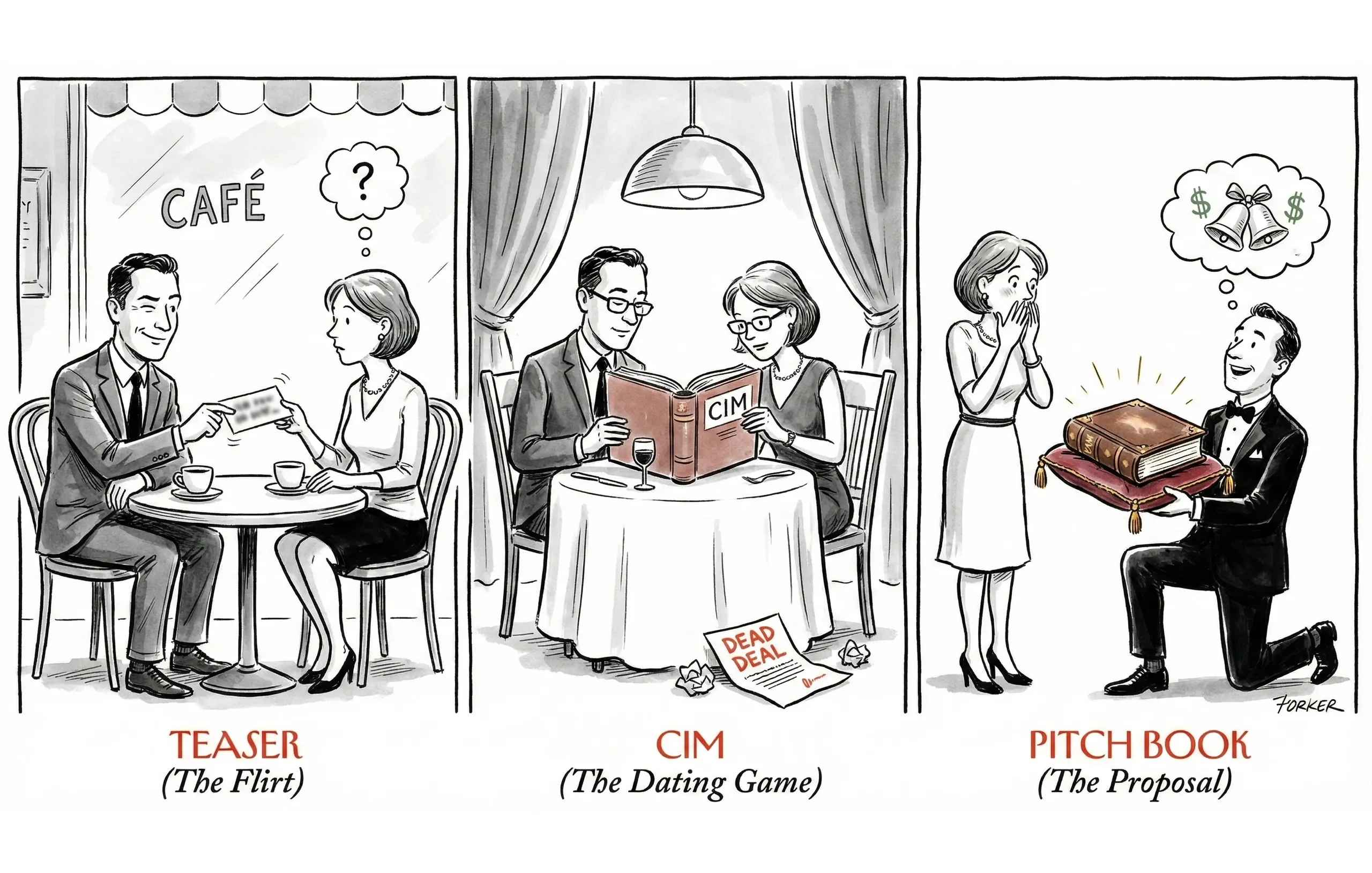

If you send them a full CIM (Confidential Information Memorandum), you risk leaking sensitive data to a tire kicker. If you send them nothing, they ghost you. But if you send a Teaser, you might just hook a qualified lead without giving away the farm.

In the world of business brokerage, deal fatigue is real. According to the IBBA's Q3 2024 Market Pulse Report, "unrealistic seller expectations" remains a top deal killer for businesses valued between $2M and $5M. But equally dangerous is the "Diligence Bomb"—when a deal crumbles because the buyer finds a surprise that wasn't disclosed early enough.

Understanding the M&A documents comparison between Teaser, CIM, and Pitch Book is your first line of defense against wasted time and broken deals. Each document serves a distinct purpose in the deal funnel, and knowing when to deploy each one separates rookie brokers from seasoned deal-makers.

M&A Documents Comparison: The Complete Breakdown

When conducting an M&A documents comparison, think of these materials as a strategic funnel. You start wide and anonymous, then get narrow and specific as trust is established. This hierarchy protects your client's confidentiality while maximizing qualified buyer engagement.

Quick Reference: M&A Documents Comparison Chart

Document Feature | Teaser (Blind Ad) | CIM (Information Memorandum) | Pitch Book (Investment Presentation) |

|---|---|---|---|

Deal Stage | Pre-NDA | Post-NDA | Strategic / Middle Market |

Target Audience | General Public / Aggregators | Qualified Individual Buyers | PE Groups & Strategic Buyers |

Business Identity | Anonymous | Revealed | Revealed |

Financial Detail | Revenue/SDE Ranges | Adjusted P&L + Add-backs | Projections + Synergies |

Typical Length | 1-2 Pages | 20-35 Pages | 30-50+ Pages |

Primary Goal | Get the NDA Signed | Get the LOI Signed | Drive Premium Valuation |

Confidentiality Level | Public | High | High |

Best For | Main Street Deals | Most Transactions | Lower Middle Market+ |

This M&A documents comparison framework helps you select the right tool for each buyer type and deal stage.

The Teaser: Your First Line in the M&A Documents Comparison

What Is a Teaser in M&A Deal Documentation?

The teaser (or blind profile) is exactly what it sounds like: a marketing hook. In any M&A documents comparison, the teaser sits at the top of the funnel. It's designed to create enough curiosity to get a buyer to sign an NDA, without revealing who the seller is.

The Broker's Strategic Approach

Your goal here is volume and screening. You want to cast a wide net on sites like BizBuySell, but you also want to filter out the noise before they reach your client's doorstep.

Industry Tip: Never list the specific city if it gives the business away. For a "niche aerospace manufacturer in Seattle," you're better off saying "Precision Manufacturer in the Pacific Northwest." This is basic operational security in the M&A documents comparison hierarchy.

What's Included in a Teaser

- High-Level Financials: Revenue and SDE (Seller Discretionary Earnings) ranges

- The "Sizzle": "30% YoY Growth," "Absentee Owner," "10-Year Government Contracts"

- General Location: Region or State only

- Industry Position: Market leadership claims, competitive advantages

What's Left Out of a Teaser

- Business Name & Address

- Specific Customer Names

- Exact Add-Back Schedule

- Proprietary processes or IP details

Why This Matters in the M&A Documents Comparison: The teaser's job is to qualify interest, not close deals. Think of it as a movie trailer—just enough to get people into the theater.

The CIM: The Cornerstone of M&A Documents Comparison

What Is a CIM in M&A Transactions?

The Confidential Information Memorandum is the "Bible" of the deal. In any comprehensive M&A documents comparison, the CIM is the workhorse document. Once the NDA is signed and you've vetted the buyer (checked their LinkedIn, verified "dry powder"), this is what you send.

Why the CIM Matters in M&A Deal Flow

A professionally crafted CIM does more than just inform—it defends the price. Research from Roadmap Advisors suggests that a high-quality CIM can contribute to a 6% to 25% pricing premium by framing the opportunity professionally and reducing perceived risk.

Conversely, a weak CIM leads to "death by a thousand questions." If a buyer has to email you 15 times to understand the COGS (Cost of Goods Sold), they will assume the seller's books are messy—and your valuation defensibility evaporates.

What's Included in a CIM

- The Narrative: History, operations, and the "story" of why they are selling (retirement, burnout, strategic pivot)

- Financial Deep Dive: 3-5 years of P&Ls, balance sheets, and a clear Add-Back Schedule

- SWOT Analysis: Be honest about the weaknesses. Buyers will find them anyway; it's better to frame them as "growth opportunities"

- Employee Census: Titles, tenure, and wages (but no names for privacy and retention protection)

- Customer Concentration Analysis: Top customer revenue percentages

- Operations Overview: Systems, processes, vendor relationships

The "Goldilocks" Rule for CIM Content

Don't include everything. In the M&A documents comparison framework, the CIM is detailed but not exhaustive. Customer lists, vendor contracts, and the "secret sauce" (IP formulas) should remain in the Data Room until after the LOI (Letter of Intent) or during advanced due diligence.

Strategic Positioning: The CIM should answer 80% of buyer questions and create urgency for the remaining 20% to be explored in person at the management meeting.

The Pitch Book: The Premium Tier in M&A Documents Comparison

What Is a Pitch Book in M&A?

The Pitch Book—often called a Confidential Information Presentation (CIP)—is the CIM's sophisticated older sibling. In the M&A documents comparison hierarchy, it represents the most advanced and strategic document type. It is primarily used in Lower Middle Market (LMM) deals ($5M - $50M+) targeted at Private Equity (PE) firms, Family Offices, or strategic corporate buyers.

Why the Pitch Book Differs in M&A Documents Comparison

Individual buyers look at the past (SDE, tax returns). Strategic buyers look at the future (EBITDA, synergies, scale). A Pitch Book sells the Investment Thesis, not just the business.

This is the critical distinction in any M&A documents comparison: CIMs are retrospective, pitch books are prospective.

What's Included in a Pitch Book (Beyond the CIM)

- Forward-Looking Projections: 3-5 year Pro Forma financial models

- Synergy Analysis: "If you acquire us, you save $500k in logistics immediately"

- Market Analysis: Third-party data on industry TAM (Total Addressable Market), growth rates, and competitive positioning

- Management Team Profiles: PE firms buy management teams as much as they buy revenue

- Strategic Alternatives: Build vs. Buy analysis for acquirers

- Exit Strategy Scenarios: What the next buyer might value in 3-5 years

Visual Sophistication: Pitch books typically include more graphics, charts, and visual data storytelling than CIMs. They're often designed by investment banking teams with graphic design support.

The M&A Documents Comparison Workflow: Orchestrating the Deal

Failure to stage these documents correctly is a rookie mistake. You don't hand the keys to the Ferrari before checking the driver's license. Here's how the M&A documents comparison framework plays out in real deal flow:

Stage 1: The Teaser (Lead Generation)

- Posted on listing sites and distributed to broker networks

- Generates inbound leads and expressions of interest

- Success Metric: Number of NDA requests from qualified parties

Stage 2: The Gate (Qualification)

- Buyer signs NDA and submits Proof of Funds or financing letter

- Broker conducts preliminary vetting (LinkedIn, past acquisitions, references)

- Success Metric: Quality of buyer pipeline entering CIM review

Stage 3: The CIM (Deal Presentation)

- Sent only to qualified buyers who've cleared The Gate

- This document's job is to get you to the Management Meeting or LOI

- Success Metric: LOI submission rate from CIM recipients

Stage 4: The Data Room (Due Diligence)

- After the LOI is signed, the "gritty" details (bank statements, contracts, customer lists) go here

- Not technically part of the M&A documents comparison trio, but the critical next step

- Success Metric: Deal closure rate post-LOI

Stat Check: According to the IBBA Q4 2022 Market Pulse Report, for Main Street deals (<$500k), "Poor Financials" was the #1 reason deals failed (43%). A good CIM cleans up that narrative before the buyer sees the raw tax returns.

Common Pitfalls in M&A Documents Comparison and Deployment

Understanding the M&A documents comparison is one thing. Executing it flawlessly is another. Here are the most common mistakes brokers make:

The "Data Dump" Error

Sending a Dropbox link with 50 unorganized PDF files instead of a structured CIM. This screams "risk" to a buyer and suggests the seller's operations are equally chaotic. In the M&A documents comparison framework, organization equals professionalism equals reduced risk premium.

The "Identity Reveal" Mistake

Saying "The only Italian Restaurant in [Small Town Name]" in your teaser is basically doxxing your client. Word travels fast in small business communities. Protect anonymity at all costs in the teaser phase.

The "Missing Why" Problem

If your CIM doesn't clearly explain why the owner is selling, buyers will assume the ship is sinking. Frame the exit story positively and authentically. "Retiring after 25 years" is far better than silence or vagueness.

The "Premature Disclosure" Risk

Sending detailed customer contracts or proprietary formulas in the CIM before the LOI is signed. Remember the M&A documents comparison hierarchy: each document reveals progressively more, but only after trust milestones are achieved.

The "Wrong Document for Wrong Buyer" Mismatch

Sending a pitch book to a Main Street individual buyer confuses them. Sending a basic teaser to a PE firm insults them. Know your audience and match the document sophistication to buyer expectations.

M&A Documents Comparison Best Practices for Business Brokers

After facilitating hundreds of deals, here's what separates the top 10% of brokers in M&A documents comparison execution:

Best Practice 1: Customize, Don't Template

While templates are helpful starting points, the best M&A documents are customized to the specific business story. Generic language is immediately recognizable and reduces perceived value.

Best Practice 2: Lead with Visuals in Higher-Value Deals

For deals above $5M, invest in professional design for your CIM or pitch book. Charts showing revenue growth, customer retention curves, and market position maps communicate faster than text.

Best Practice 3: Build a Document Library

Maintain a swipe file of excellent teasers, CIMs, and pitch books (with identifying info removed). Study what works in the M&A documents comparison across industries.

Best Practice 4: Test Your Teaser Language

A/B test different teaser versions on listing sites. Track which language generates higher NDA request rates. This is free market research.

Best Practice 5: Include Add-Back Justifications

In the M&A documents comparison framework, the CIM is where add-backs are defended. Don't just list them—explain them. "Owner's spouse salary: $75k for bookkeeping duties now performed by $35k staff accountant" is defensible. "Owner discretionary spending: $150k" is not.

Advanced M&A Documents Comparison Considerations

Industry-Specific Variations

SaaS companies need different CIM sections than manufacturing businesses. Include metrics that matter to buyers in your industry:

- SaaS: MRR, churn rate, CAC, LTV, gross margin

- Manufacturing: Capacity utilization, equipment age, CAPEX requirements

- Service Businesses: Customer concentration, employee retention, contract renewal rates

The Virtual Data Room Strategy

Modern M&A documents comparison discussions must include VDRs (Virtual Data Rooms). Platforms like DealRoom, Intralinks, or even DocSend allow you to:

- Track which buyers are reviewing which documents

- Revoke access if a buyer drops out

- Stage document releases progressively

- Maintain an audit trail for compliance

Cross-Border Deal Considerations

International buyers may expect different M&A documents comparison standards. European buyers, for example, often expect more detailed employee information earlier in the process due to different labor law structures.

Measuring Success in Your M&A Documents Comparison Strategy

Track these KPIs to evaluate your deal document effectiveness:

Teaser Metrics

- View-to-NDA Rate: What percentage of teaser viewers request the NDA?

- Target: 5-10% for well-qualified listings

CIM Metrics

- CIM-to-LOI Rate: What percentage of CIM recipients submit an LOI?

- Target: 20-30% for properly qualified buyers

Time Metrics

- Days from Teaser to NDA: Shorter is better

- Days from CIM to LOI: 14-30 days is typical for Main Street deals

Quality Metrics

- Number of Clarification Questions: Fewer questions = better CIM quality

- LOI Price vs. Asking Price: Closer spread = better value communication

The Future of M&A Documents Comparison

The deal documentation landscape is evolving. Here's what savvy brokers are watching:

AI-Assisted Document Creation

Tools are emerging that can draft baseline CIMs from uploaded financial documents. While they can't replace broker expertise, they can accelerate first-draft creation.

Video CIMs

Some brokers are experimenting with video presentations as supplements to traditional CIMs, particularly for lifestyle businesses where "feel" matters as much as financials.

Interactive Digital Presentations

HTML-based CIMs with clickable navigation, embedded videos, and interactive financial models are gaining traction in middle-market deals.

Summary: Mastering the M&A Documents Comparison

In the M&A documents comparison framework, each document type serves a specific strategic purpose:

- Teaser: Hook qualified buyers anonymously (1-2 pages, pre-NDA)

- CIM: Inform and persuade with detailed analysis (20-35 pages, post-NDA)

- Pitch Book: Sell the strategic future to sophisticated buyers (30-50+ pages, middle market+)

The brokers who master this M&A documents comparison hierarchy close more deals at higher valuations with fewer blown-up transactions. The brokers who don't end up in endless email chains with tire kickers, wondering why their deals never get to the finish line.

Your document strategy is your deal strategy. Get it right, and everything else gets easier.

Take Action: Elevate Your M&A Documents Comparison Game

Don't let poorly structured deal documents cost you commissions and credibility. The difference between a $2M deal and a $2.3M deal often comes down to how professionally you frame the opportunity in your CIM.

Remember: In the M&A documents comparison framework, the right document at the right time is the difference between a closed deal and a blown opportunity. Master the hierarchy, protect your client's confidentiality, and watch your close rates climb.

![CIM Template for Business Brokers: Professional Format & Structure [2026]](https://d1pdxhu5fo8gl6.cloudfront.net/media/cim-template-business-broker_2025_Dec_1.webp)