Deal management, reimagined with AI.

Intelligent financial spreading. Automated buyer qualification. Smart data rooms that answer questions 24/7. Plus complete deal tracking, staged disclosure, and audit documentation—all purpose-built for M&A.

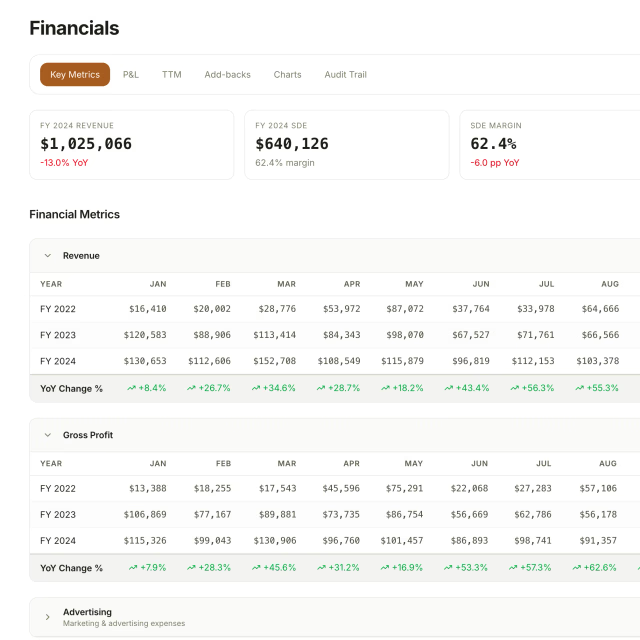

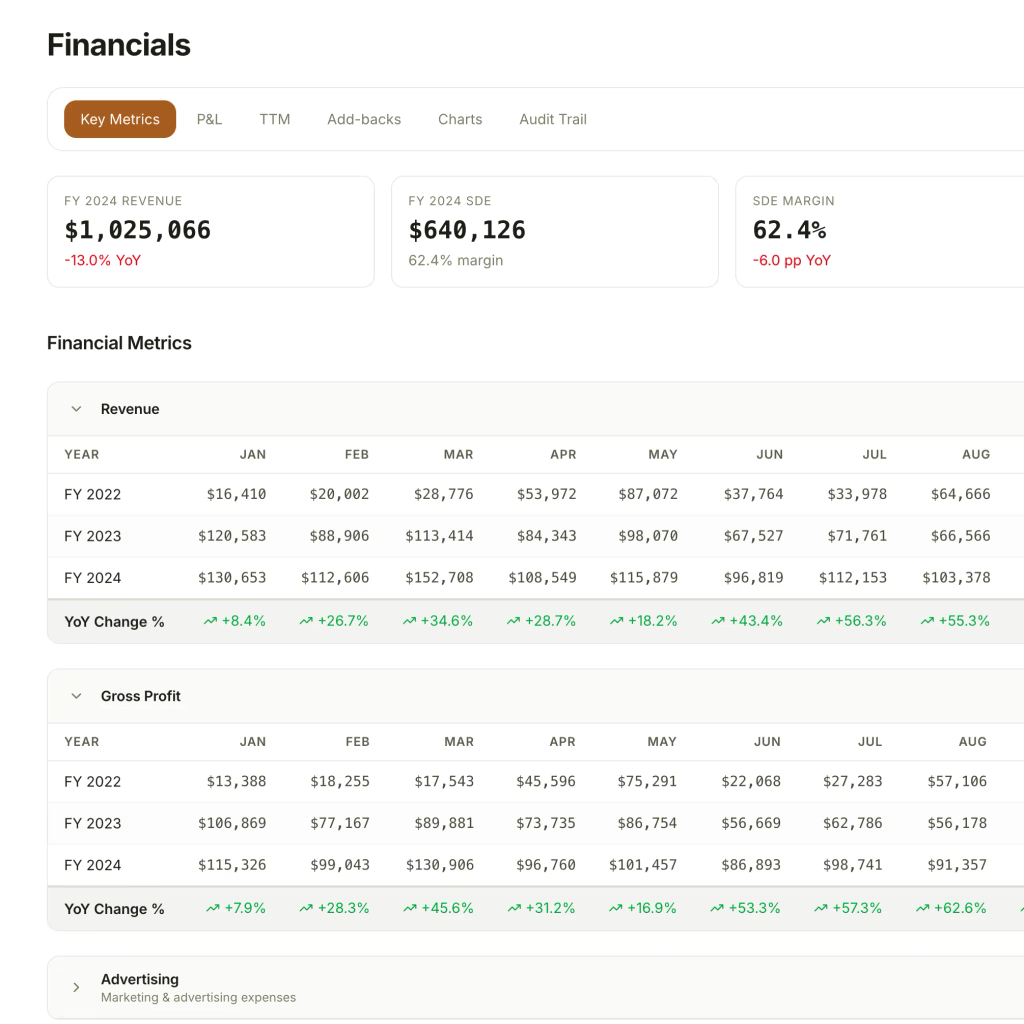

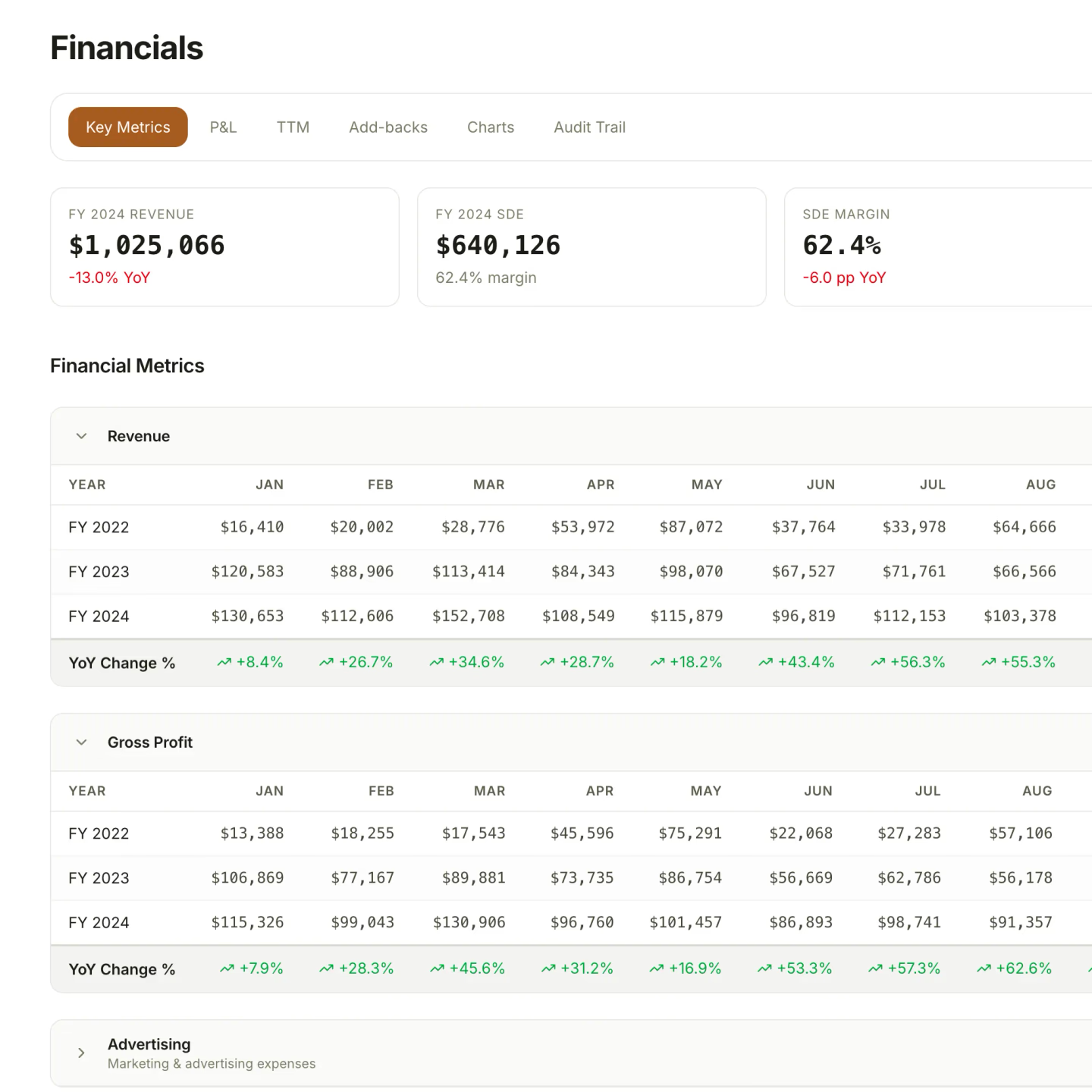

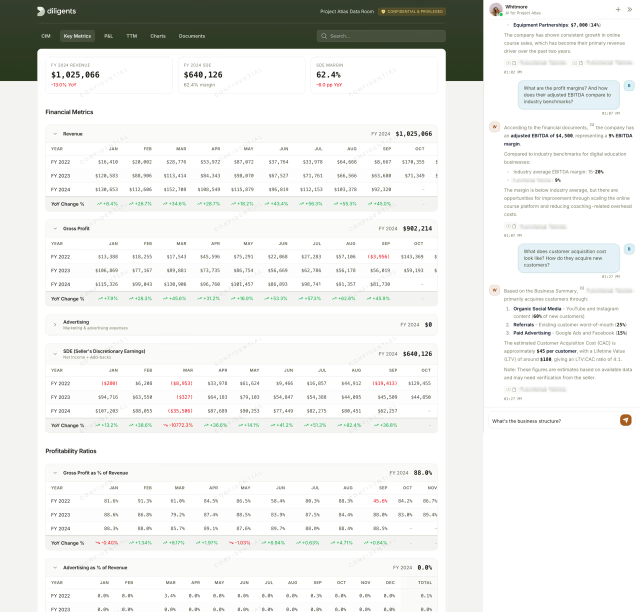

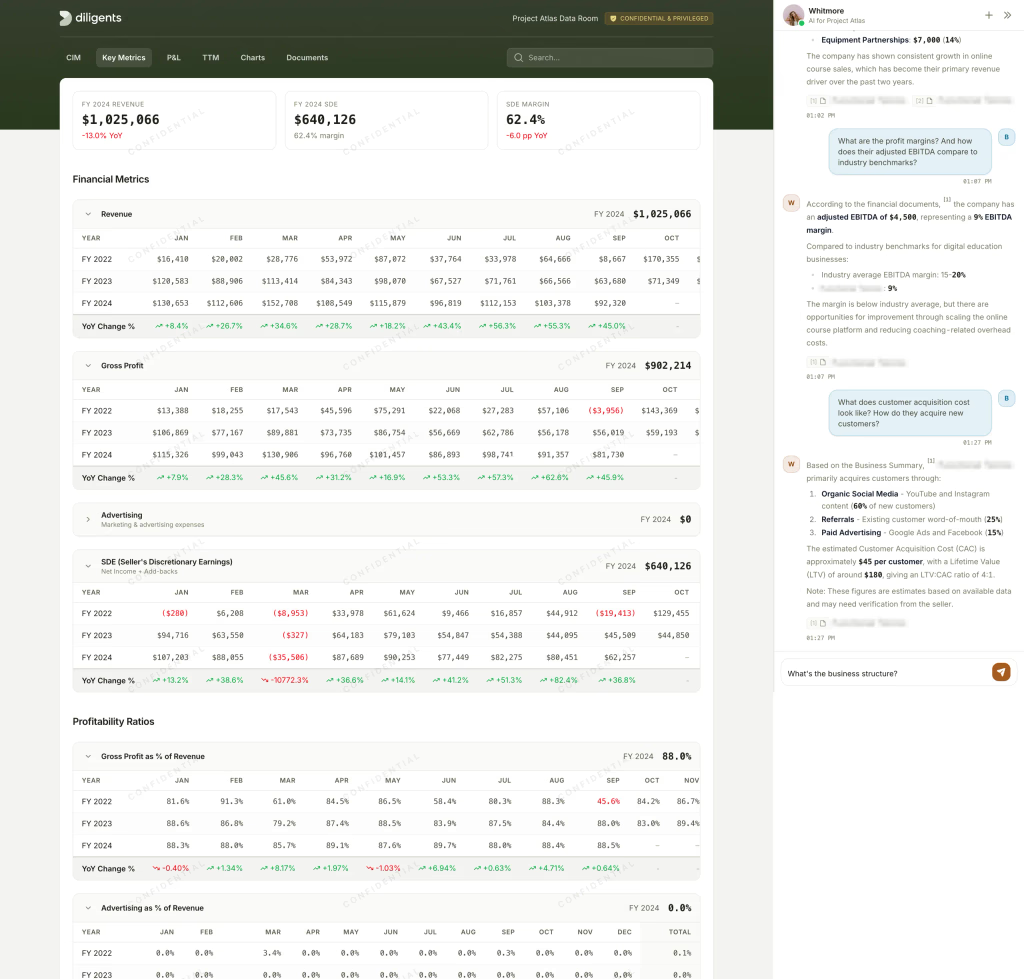

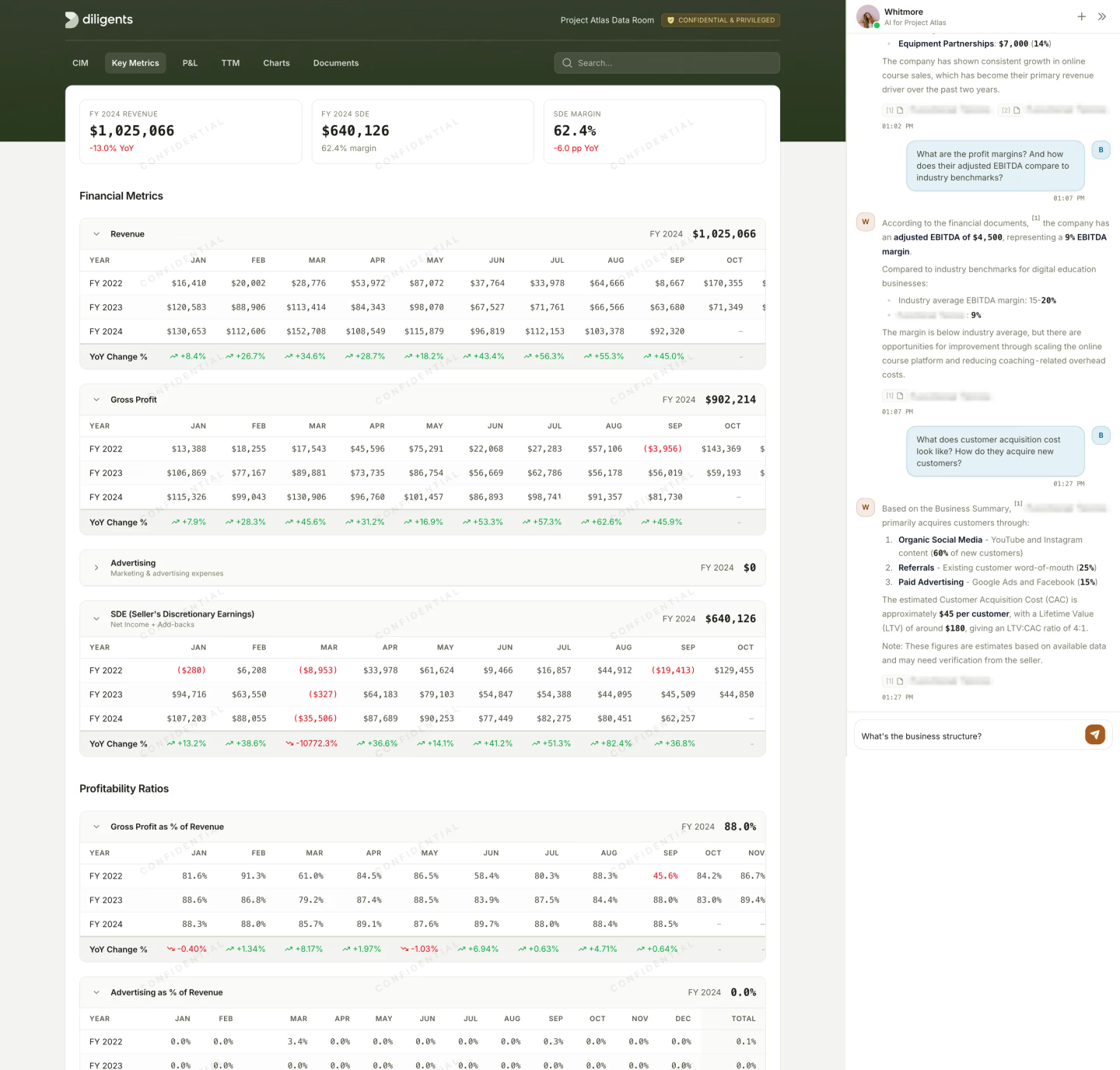

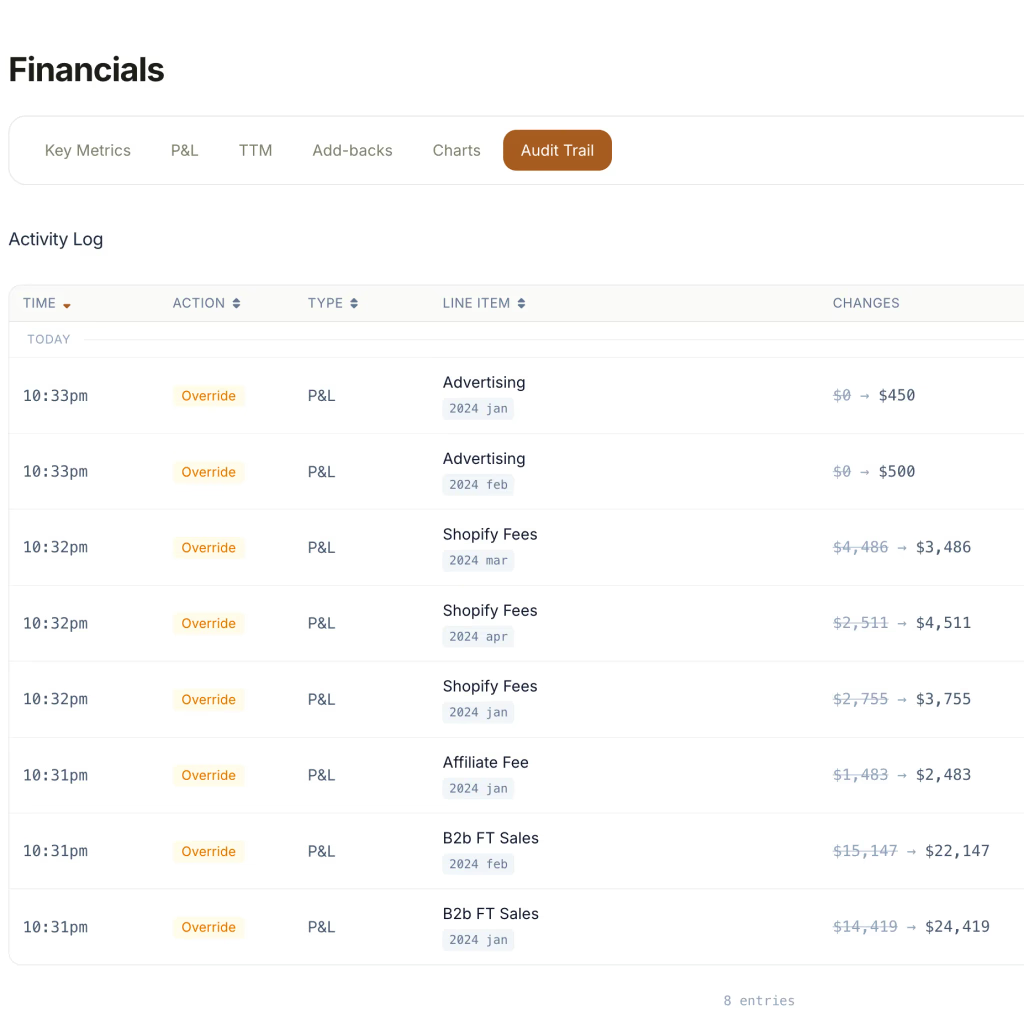

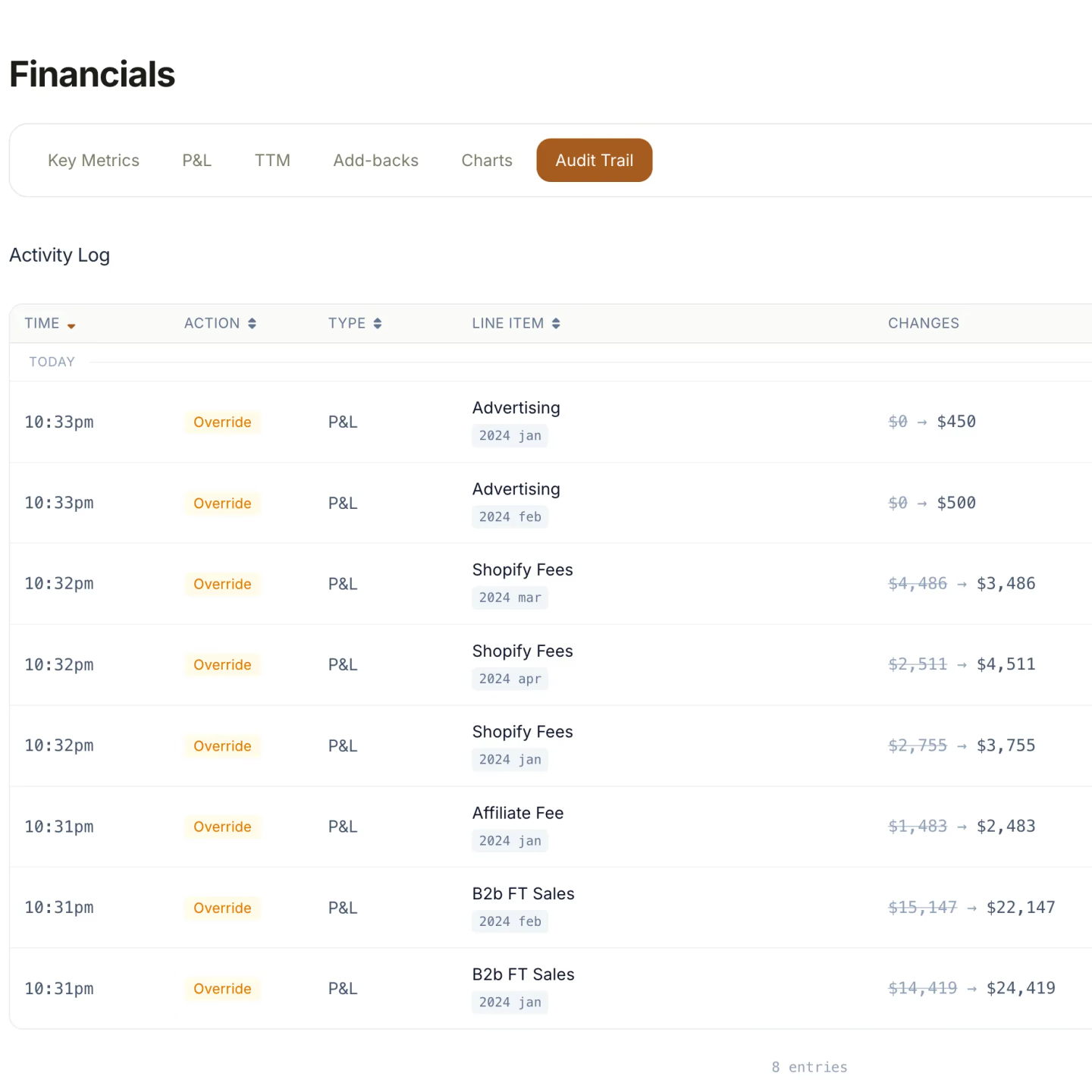

Financial intelligence that transforms chaos into clarity

Upload tax returns, P&Ls, balance sheets—messy PDFs, faded scans, that shoebox of statements. Spencer normalizes every number, identifies add-backs you'd miss, and flags anomalies with confidence scores. No more manual Excel spreads. Clean, well-documented financials in a fraction of the time.

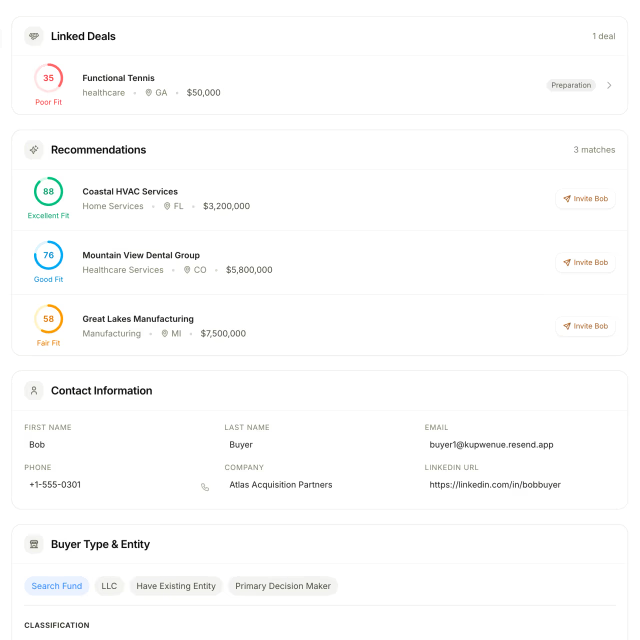

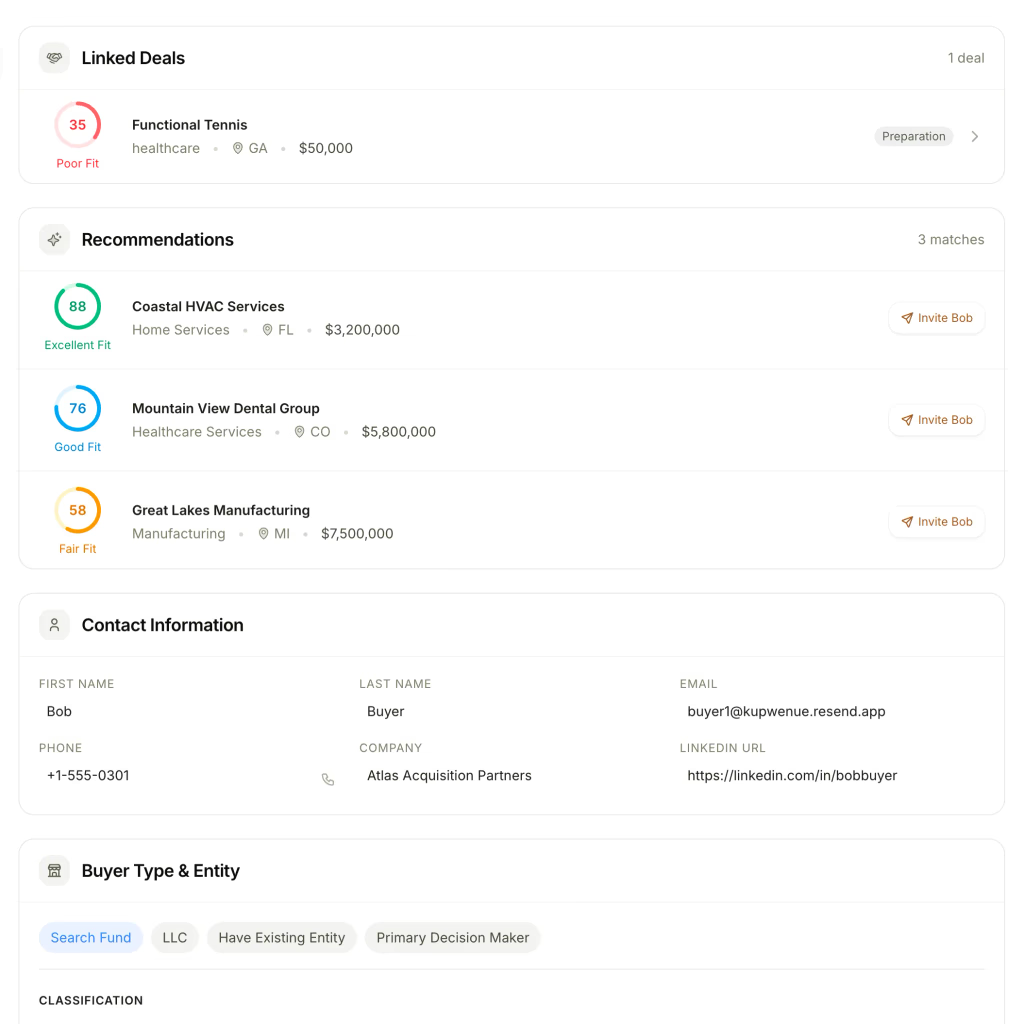

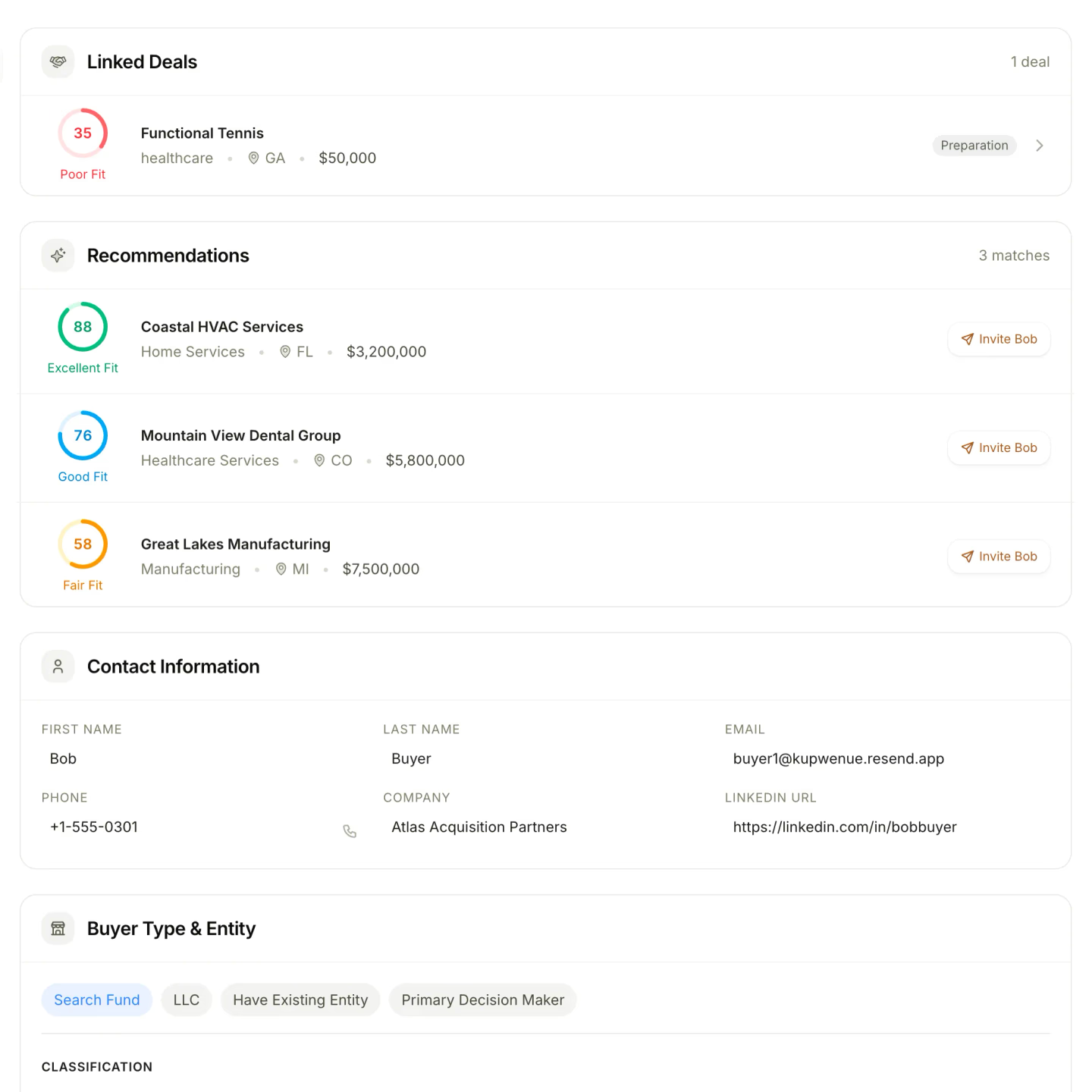

Qualify buyers before they reach your inbox

Every buyer inquiry gets the same courteous, immovable treatment: signed NDA, verified identity, proof of funds confirmed—automatically. Aldrich handles the 20+ hours per week that used to vanish into email chains. Serious buyers reach your desk pre-qualified. Everyone else receives a polite but permanent goodbye.

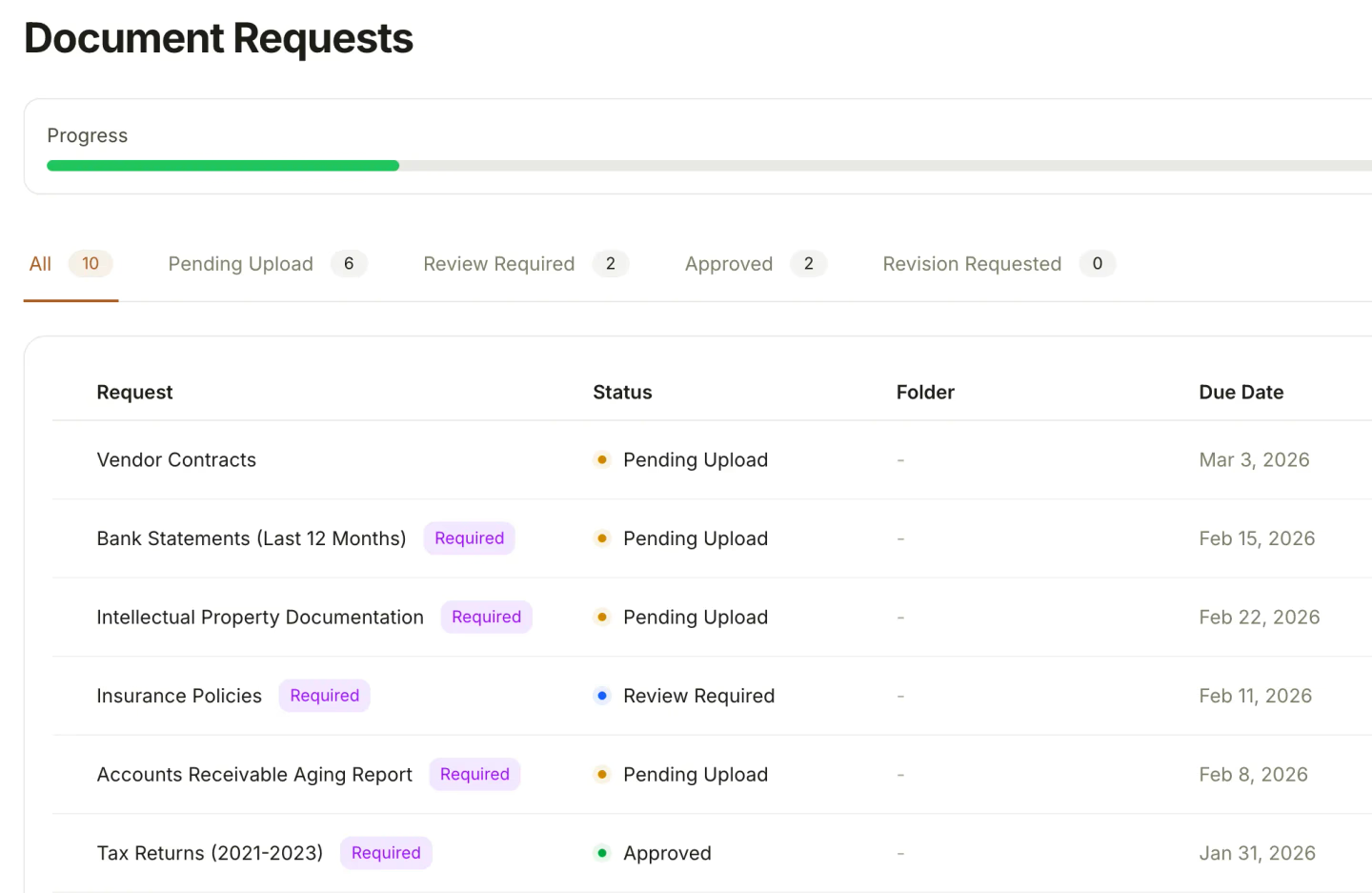

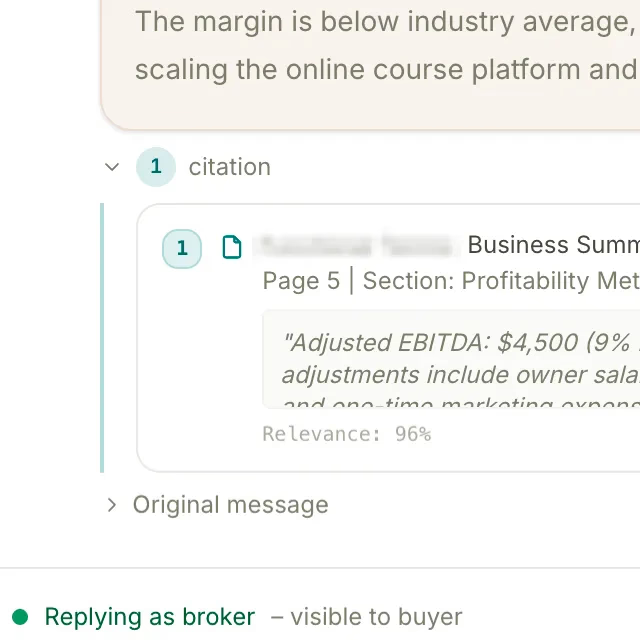

Your 24/7 answer desk. Your documentation advantage.

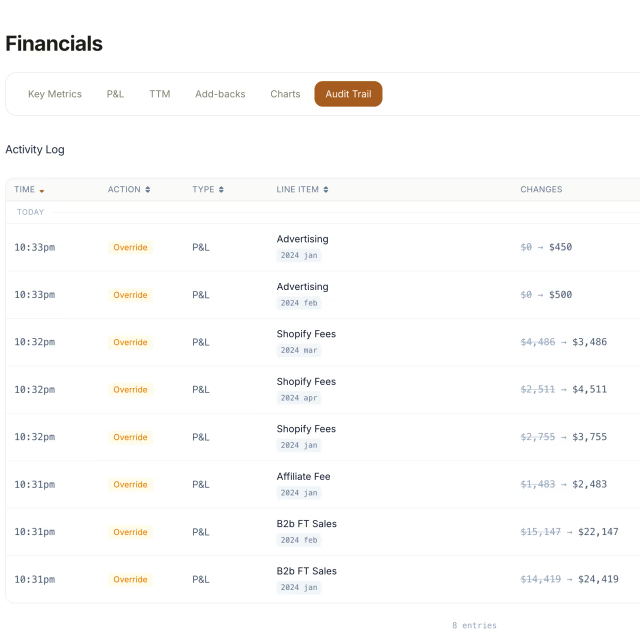

Whitmore hosts your documents and never stops working. Buyers ask questions anytime—and get instant answers with exact citations. You see every conversation. When a buyer later claims they didn't see a disclosure, Whitmore shows you exactly what they viewed and when. Detailed audit trail. Greater peace of mind.

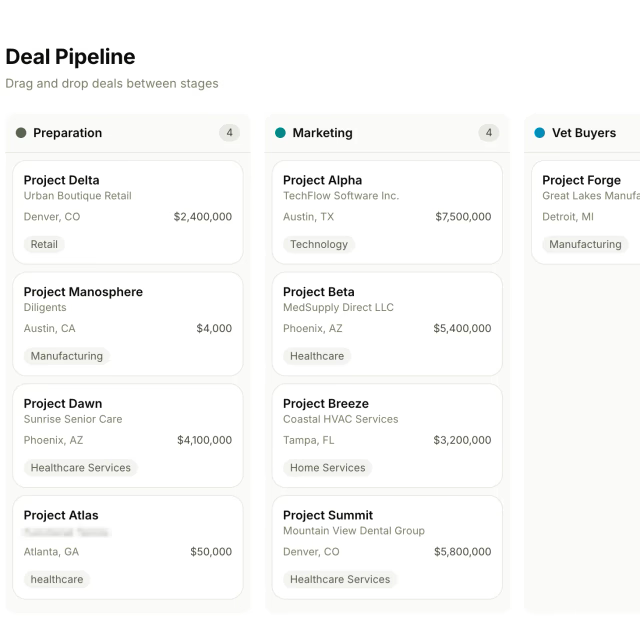

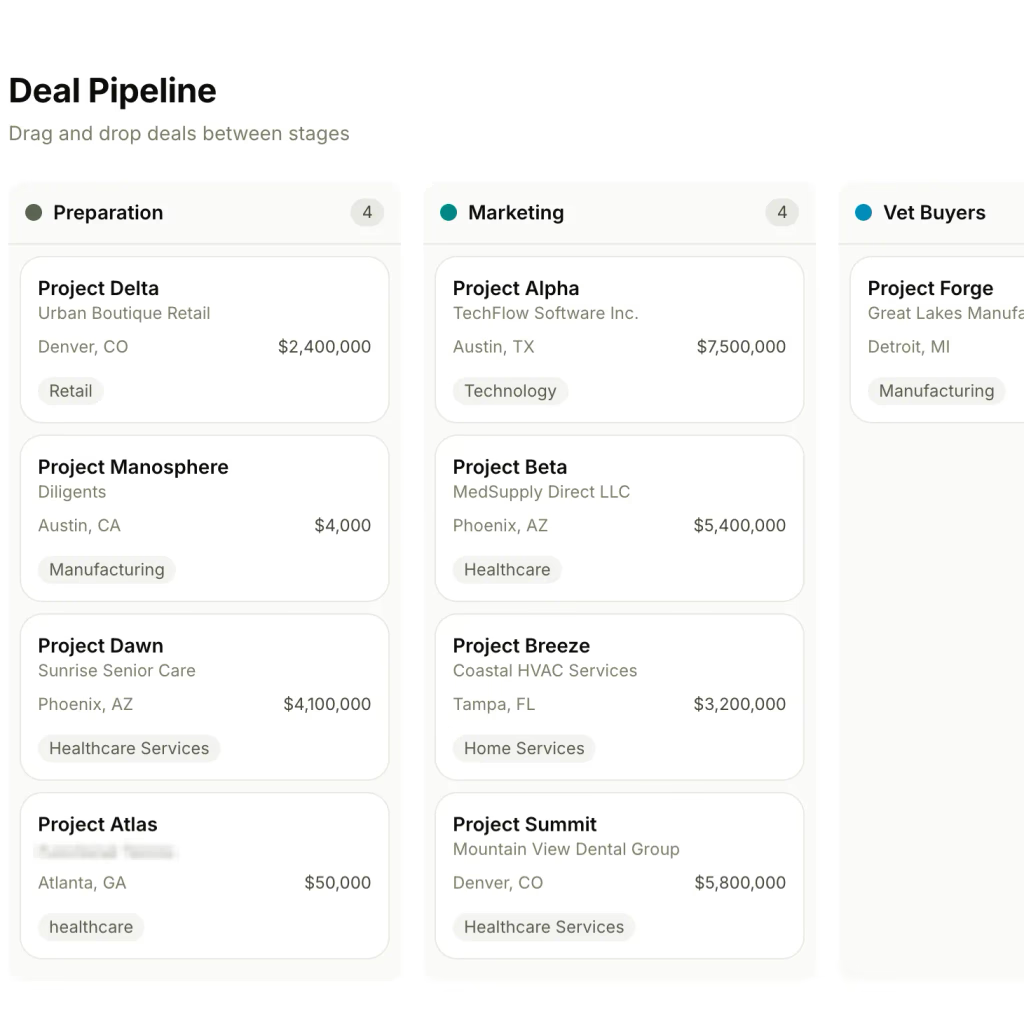

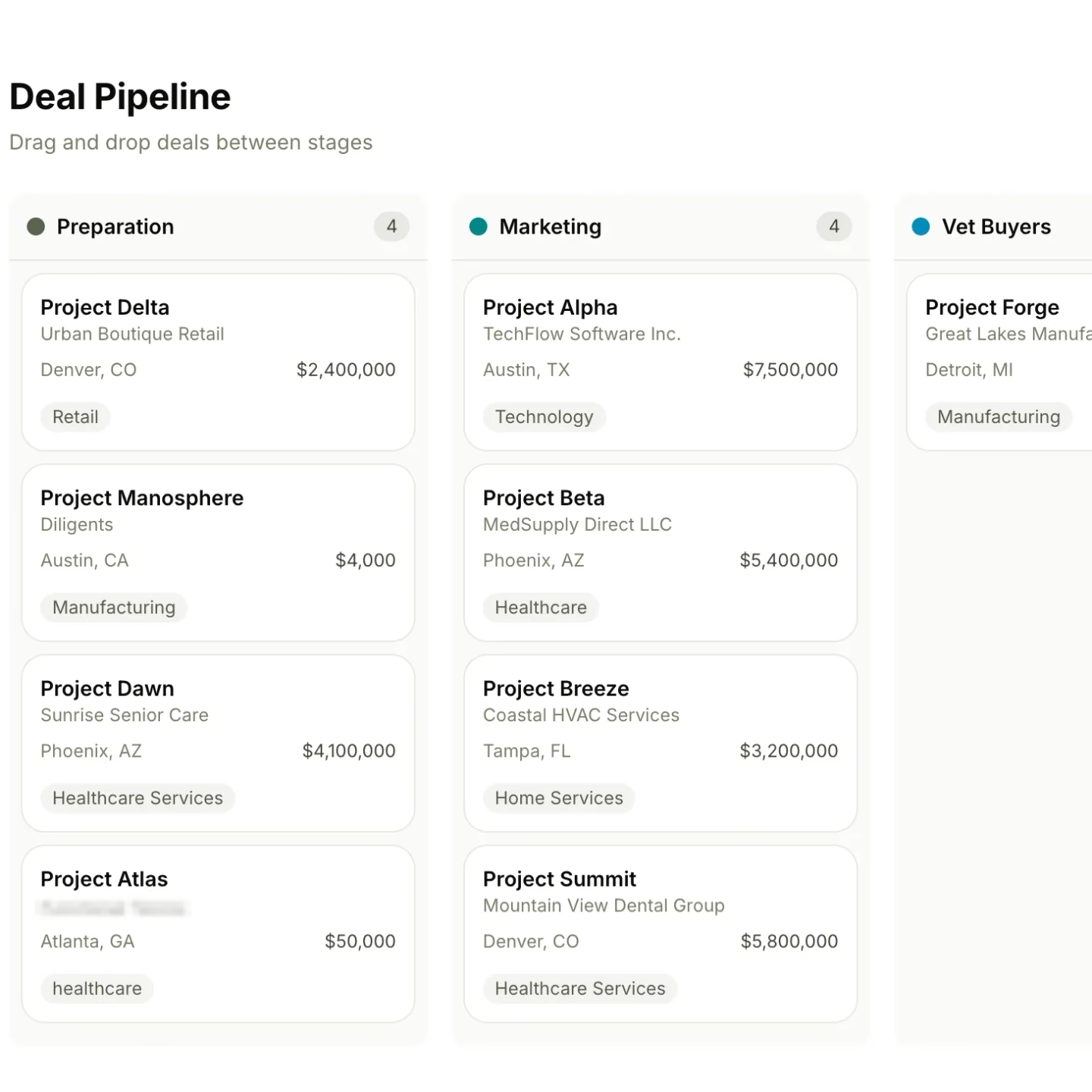

One platform replaces your five-tool stack.

HubSpot doesn't understand what an NDA or CIM is. Diligents does. Manage deals from listing to close with M&A-native workflows: LOI tracking, buyer profiling, commission calculations. Replace HubSpot + DocuSign + Dropbox + Mailchimp with one platform built for deals.

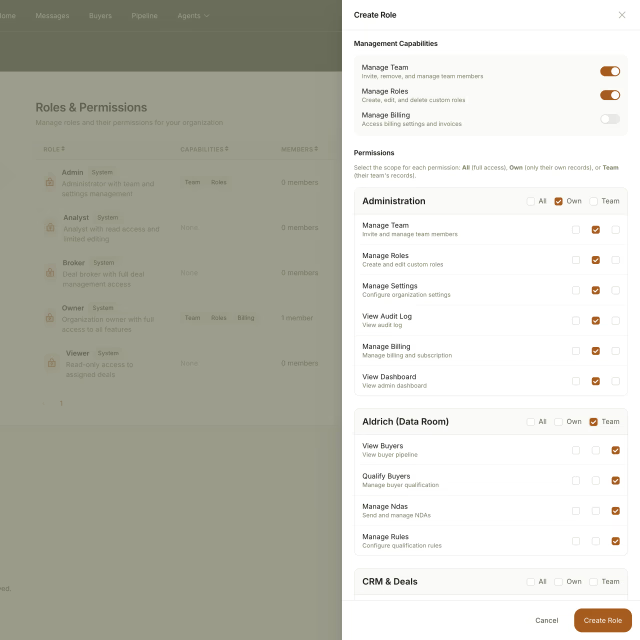

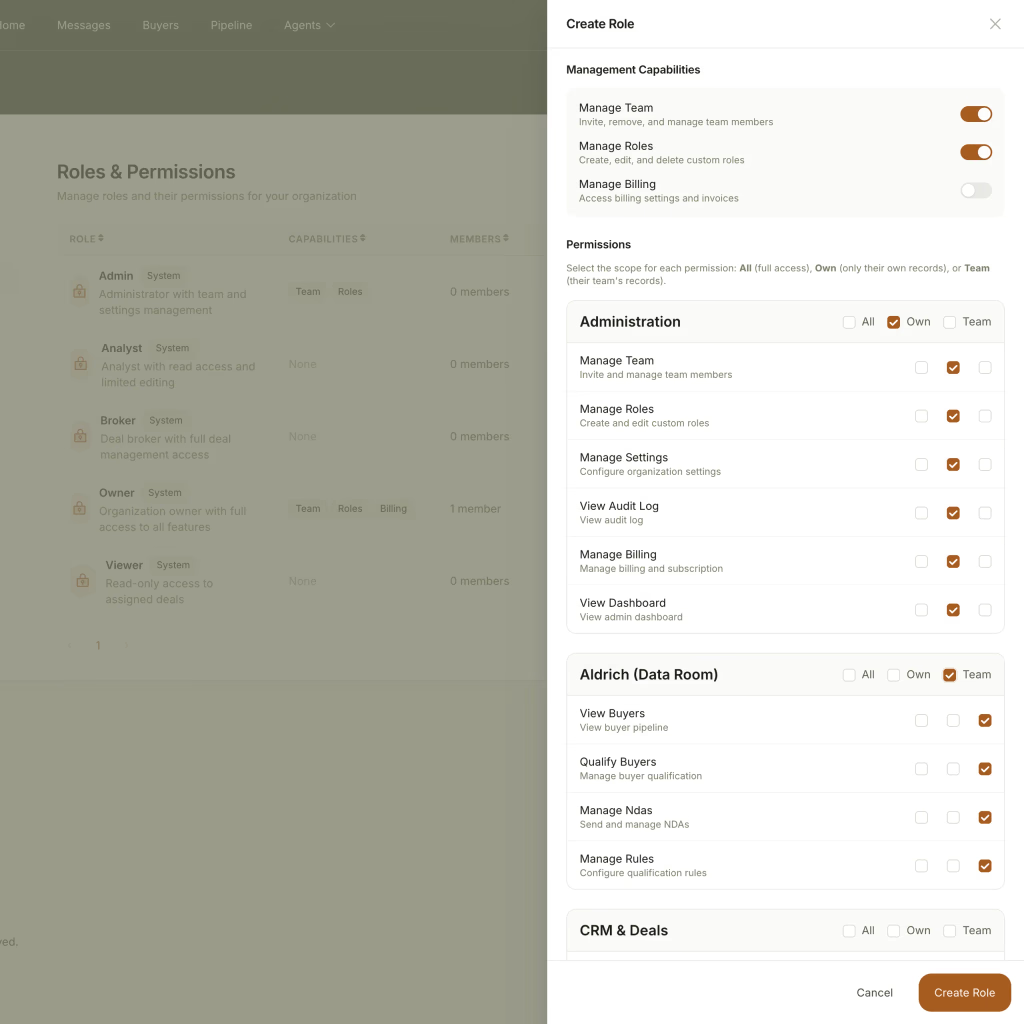

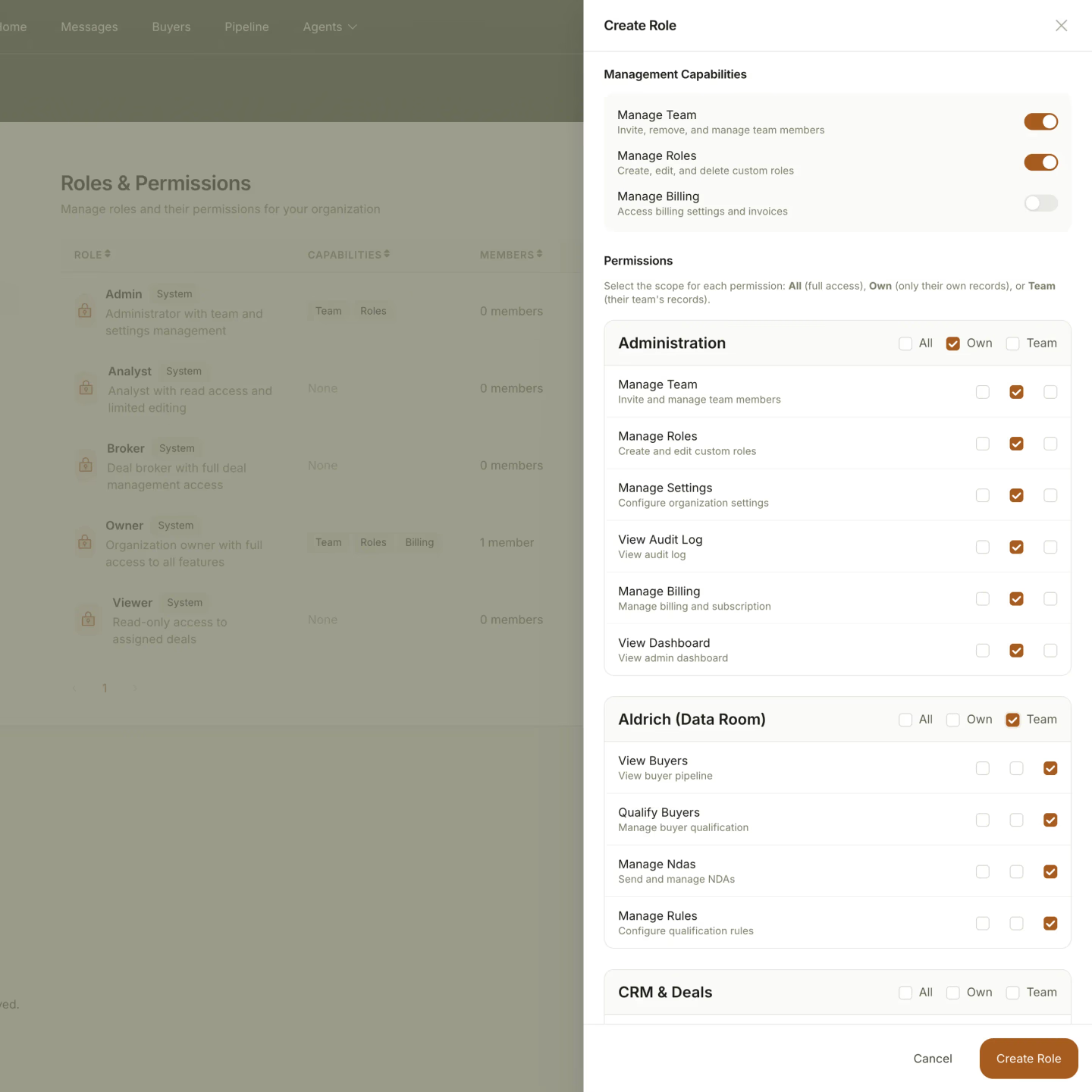

Control who sees what. Control when they see it.

Stage 1 teaser materials. Stage 2 detailed financials post-LOI. You set the timeline and permissions per buyer. Time-limited access windows prevent surprises. Watermarked documents provide accountability. You're not just protecting information—you're managing the narrative.

Every action documented. Every disclosure tracked.

Every document viewed. Every question asked. Every answer given. Timestamp-locked records that document exactly what was disclosed and when. When a post-close dispute arises, export a detailed compliance report. Documentation to counter “I never saw that” claims.

Diligents has completely transformed how we handle due diligence. What used to take weeks of back-and-forth now happens in days. Our buyers get answers instantly, and I finally have time to focus on what matters—closing deals.

Sarah Mitchell

Managing Partner, Apex Business Advisors

Every feature designed for one purpose: close deals faster.

From automated NDA management to buyer engagement tracking, everything in Diligents is built around the way M&A actually works—not how generic software companies imagine it might work.

Keep sellers informed without the back-and-forth

Sellers upload documents, view buyer engagement metrics, and provide input on add-backs—all without direct buyer contact. Less email, more progress.

You approve everything

AI drafts responses. You decide what goes out. Every answer, disclosure, and buyer communication requires your sign-off before it's sent.

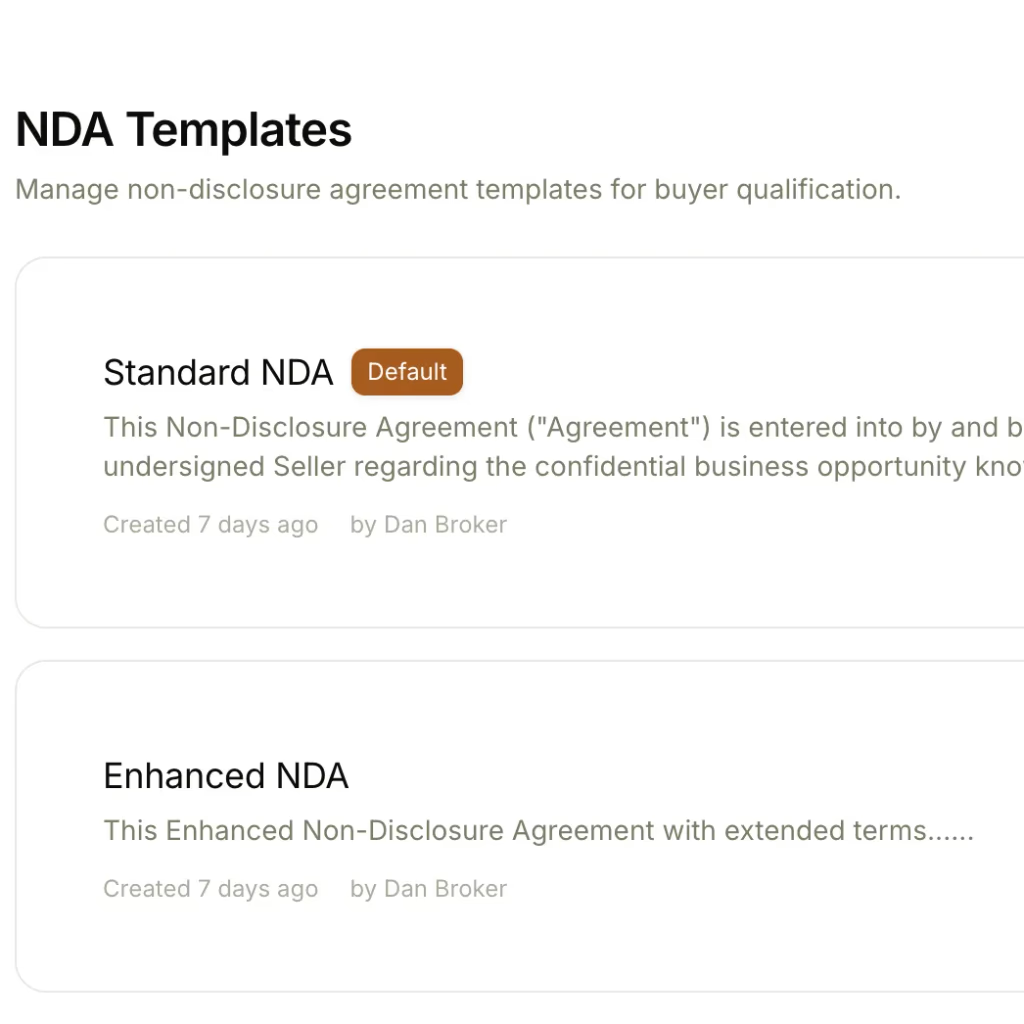

NDAs signed in minutes, not days

Template library, embedded e-signature, and automatic reminders. Buyers sign before they forget, and you never chase paper again.

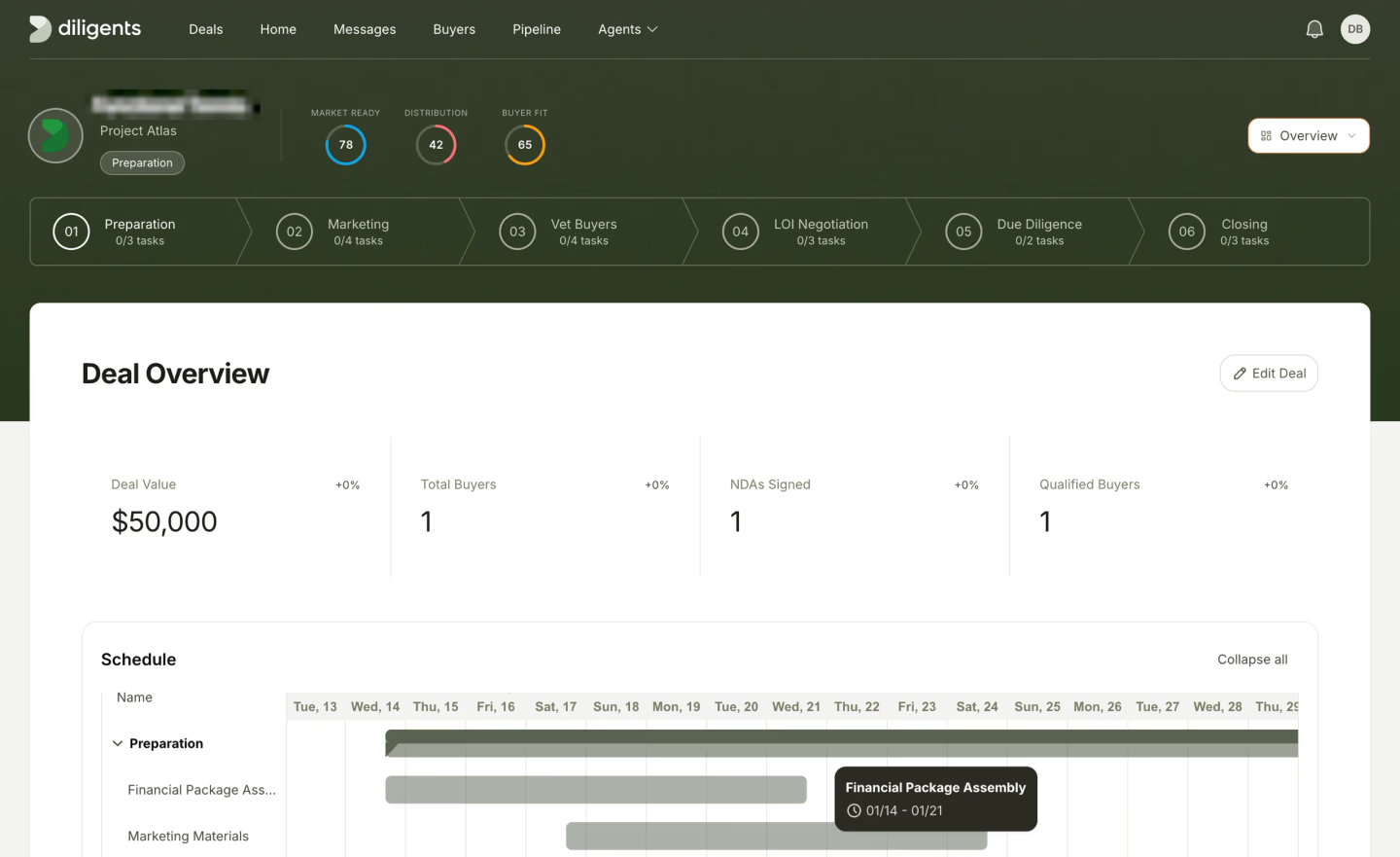

Know where every deal stands at a glance

Market Ready, Distribution, and Buyer Fit scores quantify deal health. Gantt-style scheduling keeps milestones on track from listing to close.

Stop trading hours for deals.

Join forward-thinking brokers who are already saving 20+ hours per week and closing more deals. Get early access to Diligents today.