We've all been there. You have a listing that's perfect—solid SDE, clean books, and an owner who actually listens to reason. You have a buyer with plenty of "dry powder" who seemed ready to sign. But then, silence.

Two weeks later, you find out they bought a competitor's listing. Why? Because while you were buried in spreadsheets managing five other "tire kickers," you forgot to send that one critical add-back schedule they asked for.

The reality of our industry is harsh: Time kills all deals.

Effective broker deal software isn't just about administrative data entry; it's about visibility. It's the difference between wondering where your commission went and knowing exactly when it's landing. With studies showing that sales professionals spend only about 28% of their week actually selling, the rest of your time is likely being eaten by administrative chaos.

The right deal tracking system keeps your pipeline visible, your forecasting accurate, and ensures that no matter how chaotic the due diligence gets, nothing falls through the cracks.

Broker Deal Software Categories: From Napkins to Automation

Not every brokerage needs a Ferrari when a pickup truck will do. The "best" broker deal software is entirely dependent on your deal volume, your budget, and how tech-savvy your team is.

Spreadsheet-Based Tracking

Best for: Solo brokers, low volume, budget constraints.

For many of us, this is where we started. The trusty Excel sheet or Google Sheet. It's the digital equivalent of the back of a napkin—familiar, flexible, and free.

Pros | Cons |

|---|---|

Free/Low Cost: No monthly subscriptions eating into your overhead. | Manual Updating: If you forget to update it, the data is useless. |

Fully Customizable: You can add a column for "Personality Type" if you want. | No Automation: It won't remind you to follow up on that NDA. |

Familiar Interface: No learning curve. | Limited Collaboration: Version control nightmares happen fast. |

Easy to Start: You can build one in 10 minutes. | Error-Prone: One broken formula can mess up your entire forecast. |

General CRM Platforms (HubSpot, Salesforce, Zoho)

Best for: Brokers wanting flexibility and deep integration.

These are the heavy hitters. They aren't built for us, but they can be made to work for us as broker deal software. According to Nucleus Research, the average ROI for CRM is $8.71 for every dollar spent, which makes the investment hard to ignore if you have the volume to justify it.

Pros | Cons |

|---|---|

Robust Features: Extensive reporting and marketing tools. | Configuration Required: You have to teach it what an "LOI" is. |

Wide Integration: Connects to your email, calendar, and website seamlessly. | Not Broker-Specific: It won't naturally understand "SDE" or "Multiples." |

Scalable: Grows from 1 user to 1,000. | Learning Curve: Can be overwhelming for non-tech users. |

Good Support: Massive help libraries and customer service teams. | Monthly Costs: Can get expensive as you add features/users. |

Industry-Specific Broker Deal Software (DealRelation, BizBuySell Tools, etc.)

Best for: Higher volume, broker-specific needs.

This is software built by people who know what a CIM is without you having to explain it. These platforms serve as dedicated broker deal software designed specifically for our industry's unique workflows.

Pros | Cons |

|---|---|

Built-in Workflows: Pre-set stages like "NDA Signed," "CIM Sent," "LOI." | Higher Cost: Niche software often commands a premium price. |

Broker Terminology: Speaks your language out of the box. | Less Flexibility: You often have to work their way. |

Matching Features: Can auto-match listings to buyer profiles. | Smaller Vendor: Risk of slower support or fewer updates. |

Industry Reports: Benchmarking data is often included. | May Have Excess Features: You might pay for valuation tools you don't use. |

Essential Features in Broker Deal Software

When you're demoing software, don't get distracted by the shiny bells and whistles. Focus on the engine. Every effective broker deal software platform should include these core capabilities.

Core Tracking Features

Pipeline Visualization

If you can't see a visual board (Kanban style) of where every deal sits, walk away. You need to see at a glance who is stuck in "Due Diligence." This visual pipeline is the heart of any quality broker deal software.

Contact Management

It needs to handle the intricate web of Buyers, Sellers, Attorneys, and CPAs. Every deal involves multiple stakeholders, and your system should track them all seamlessly.

Activity Logging

"Did I call him, or did I email him?" Your broker deal software should answer that for you automatically. Every call, email, and meeting should be captured without manual data entry.

Task Management

Automated reminders to follow up on NDAs are a lifesaver. Set it once, and the system keeps you on track through every deal stage.

Document Storage

A centralized vault for tax returns, P&Ls, and CIMs. Security and organization in one place—no more hunting through email attachments.

Powerful Search

You need to be able to find "manufacturing buyers" in seconds, not hours. Advanced search and filtering capabilities separate amateur systems from professional-grade broker deal software.

Advanced Features

Buyer Matching

Imagine listing a plumbing business and the system immediately spitting out 5 buyers from your database who are looking for exactly that. That is the power of automated matching in sophisticated broker deal software.

Reporting & Dashboards

For the broker-owner, seeing conversion rates by agent is crucial. Real-time dashboards show you exactly where your revenue is coming from and where deals are stalling.

Mobile Access

Deals happen in coffee shops and on golf courses. If you can't access your broker deal software on your phone, you're tethered to your desk and missing opportunities.

Email Integration

If it doesn't log emails automatically, you won't do it manually. Period. Two-way sync with Gmail or Outlook is non-negotiable.

Broker Deal Software Selection Criteria

Before you swipe your credit card, run the software through this framework.

Evaluation Framework

Fit

Does it match how you work, or do you have to change your entire process to fit the software? The best broker deal software adapts to your workflow, not the other way around.

Usability

As Benjamin Franklin famously said, "By failing to prepare, you are preparing to fail." If the system is too hard to use, your team won't prepare their data, and the implementation will fail.

Security

You are holding highly sensitive financial data. Bank-level security is non-negotiable for any broker deal software platform.

Integration

Does it talk to your email marketing tool? Your valuation software? Your accounting system? Isolated software creates data silos.

Scalability

Will this still work if you hire three more agents next year? Choose broker deal software that grows with your business.

Support

When the server goes down at 4 PM on a Friday before a closing, will anyone answer the phone? Test their support before you commit.

Total Cost

Look at the total cost of ownership, including setup fees, training, per-user costs, and any hidden integration fees.

Deal-Breakers

- Cannot track deals by stage (e.g., Inquiry vs. LOI)

- No mobile access

- Poor search functionality

- Inadequate security protocols

- No data export capability (Never let software hold your data hostage)

- Limited user permissions and access controls

Implementation Approach for Broker Deal Software

Buying the software is the easy part. Getting your team to use it consistently is the real challenge.

Phase 1: Setup (Week 1-2)

Define Pipeline Stages

Agree on what "Qualified" actually means. Document your deal stages:

Configure Fields

Add your custom fields for things like "Adjusted EBITDA," "Lease Terms," "Industry Category," and "Deal Source."

Set Up Integrations

Connect your email and calendar immediately. This is where broker deal software proves its worth—automation starts here.

Create Templates

Load in your standard NDA, email follow-up scripts, and CIM templates. Reduce repetitive typing from day one.

Phase 2: Migration (Week 2-3)

Export & Clean

This is the most painful part. Take your mess of spreadsheets and clean up the duplicates, standardize naming conventions, and verify contact information.

Import Data

Get the clean data into your new broker deal software. Most platforms have import wizards, but verify field mapping carefully.

Verify Accuracy

Spot check 10 random contacts to ensure notes transferred over. Check a few active deals to confirm document attachments migrated properly.

Phase 3: Adoption (Week 3-4)

The "Burn the Ships" Strategy

Stop accepting updates via email or spreadsheet. If it's not in the broker deal software, it doesn't exist. This sounds harsh, but it's the only way to force adoption.

Log Interactions Consistently

Make it a habit. Every call, every email, every showing goes into the system. No exceptions.

Review Weekly

Run your Monday morning sales meeting directly from the pipeline dashboard. Make the broker deal software the single source of truth.

Tracking Metrics in Your Broker Deal Software

You can't manage what you don't measure. Industry data suggests that only about 20% to 30% of businesses listed for sale ever actually cross the finish line. Tracking the right metrics in your broker deal software helps you beat those odds.

Pipeline Metrics

Deals by Stage

Where is the bottleneck? If you have 20 deals stuck in "NDA Pending," your follow-up process needs work.

Stage Conversion Rates

Are you losing everyone at the NDA stage? Maybe your CIM isn't compelling enough. Track conversion from each stage to the next.

Days in Stage

If a deal sits in "Negotiation" for 90 days, it's probably dead. Average time-in-stage helps identify stalled deals before they waste more of your time.

Pipeline Value

The total potential commission on the table. This is your forecasting number—what's realistically closable in the next 30, 60, 90 days?

Activity Metrics

New Inquiries

Are your marketing efforts working? Track inquiry sources to double down on what's effective.

NDAs Executed

The true measure of buyer interest. This is where tire-kickers separate from serious prospects.

Showings Conducted

The physical step toward a sale. Low showing rates indicate poor listing marketing or unqualified buyers.

Offers Received

The ultimate goal of the marketing phase. Track offer-to-list price ratios to gauge pricing accuracy.

Outcome Metrics

Close Rate

Your batting average. Track it overall and by listing type, price range, and industry.

Days to Close

Efficiency is money. The faster you close, the more deals you can handle simultaneously.

Win/Loss Reasons

Why did the deal die? "Financing fell through" requires a different fix than "Seller got cold feet." Your broker deal software should capture this data for every lost deal.

Common Mistakes with Broker Deal Software

Over-engineering

Don't create 50 required fields. Your agents will revolt. Keep it simple—you can always add complexity later.

Under-utilizing

Using powerful broker deal software just as an address book is like using a smartphone only for calculator functions. Explore the features you're paying for.

Inconsistent Use

If one agent tracks everything and another tracks nothing, your reporting is garbage. Mandate consistent usage across your entire team.

No Regular Review

The broker deal software must be the "source of truth" for weekly meetings. If you're still pulling data from spreadsheets, you haven't truly transitioned.

Ignoring Mobile

If you can't check a deal status while walking a manufacturing plant floor, you're at a disadvantage. Mobile access isn't optional anymore.

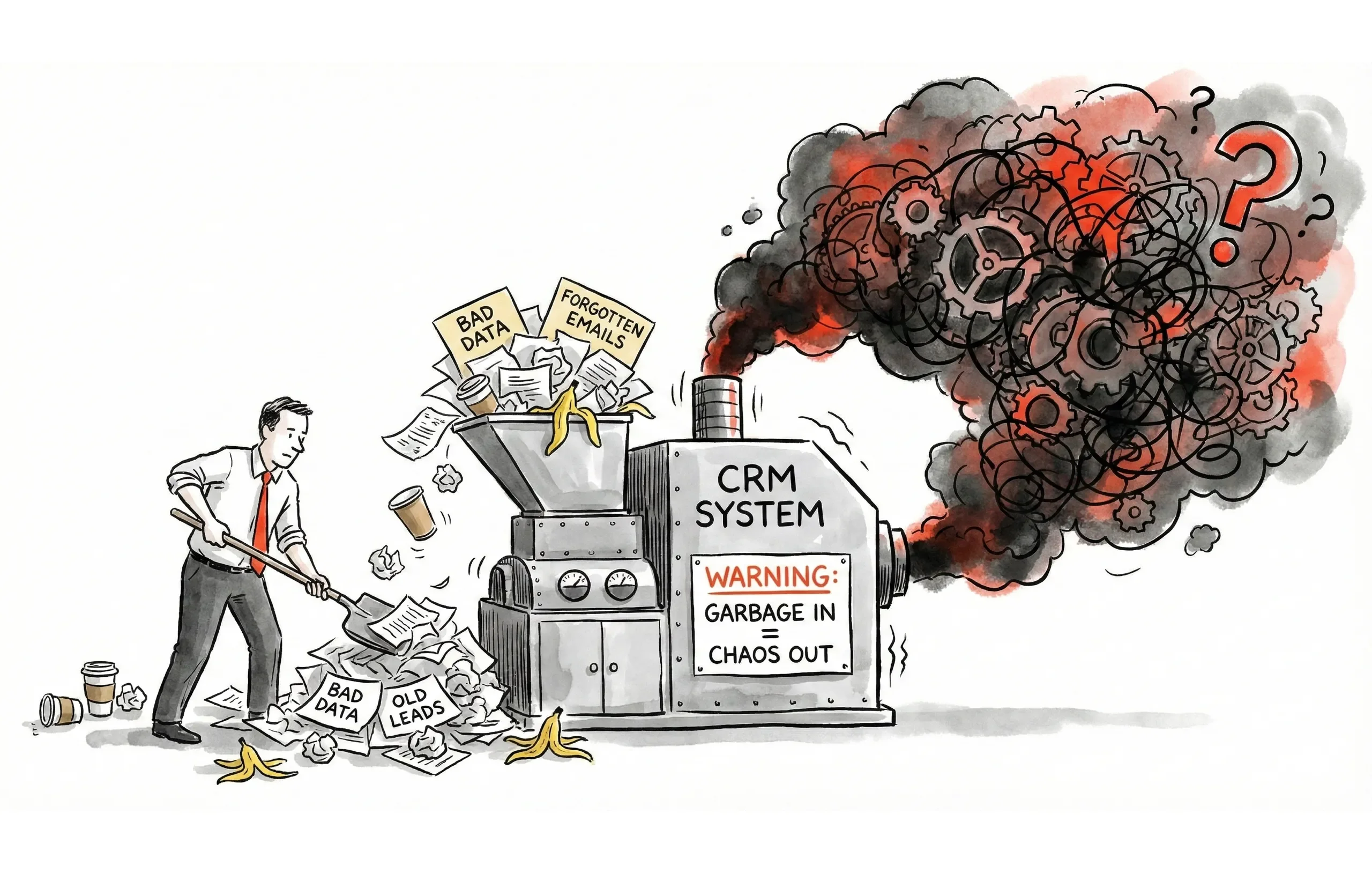

Poor Data Hygiene

Duplicate contacts, outdated information, and incomplete records render even the best broker deal software useless. Schedule quarterly data cleanup sessions.

Choosing the Right Broker Deal Software for Your Brokerage

The landscape of broker deal software continues to evolve. Whether you start with a simple spreadsheet or invest in enterprise-level CRM, the key is having some system that provides visibility into your pipeline.

Remember: the best broker deal software is the one you'll actually use consistently. Start with your must-have features, test 2-3 platforms thoroughly, and involve your team in the decision. A system that your agents hate won't get adopted, no matter how powerful it is.

The investment in proper broker deal software pays for itself by preventing just one lost commission due to poor follow-up or disorganization. In an industry where only 20-30% of listed businesses actually sell, having systematic visibility into every opportunity is what separates top performers from those struggling to hit their numbers.

![CIM Template for Business Brokers: Professional Format & Structure [2026]](https://d1pdxhu5fo8gl6.cloudfront.net/media/cim-template-business-broker_2025_Dec_1.webp)