Financial analysis, automated.

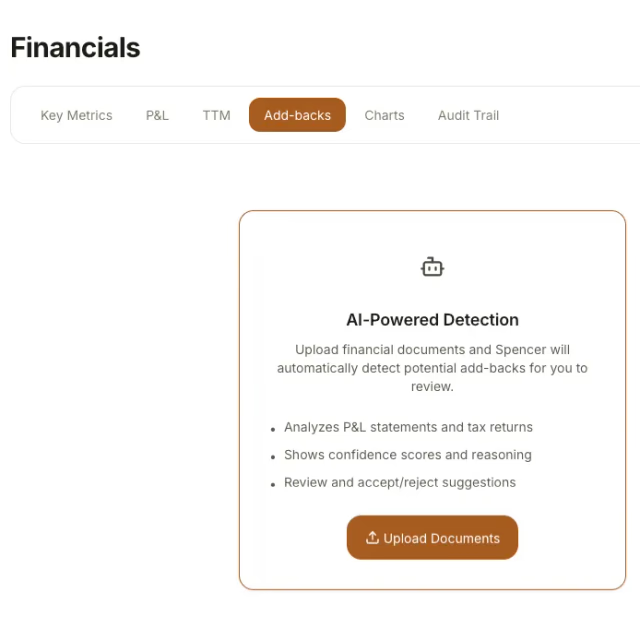

Spencer detects notes others miss. Drop a shoebox of PDFs on his desk—tax returns, P&Ls, leases, bank statements—and he returns a clean spread with add-backs highlighted and anomalies flagged.

What takes you 4-6 hours, Spencer handles in 8 minutes.

Financial intelligence that transforms chaos into clarity.

Spencer turns stacks of unorganized financial documents into standardized spreads, complete with add-back analysis and anomaly detection.

Drop the shoebox. He'll sort it out.

Tax returns, profit & loss statements, balance sheets, bank statements, lease agreements—Spencer ingests them all. PDFs, Excel files, even scanned documents with OCR.

He automatically classifies each document, extracts the relevant data, and organizes everything into a coherent financial picture. What used to take hours of copying figures into spreadsheets now happens in seconds.

Raw numbers in. Standardized spreads out.

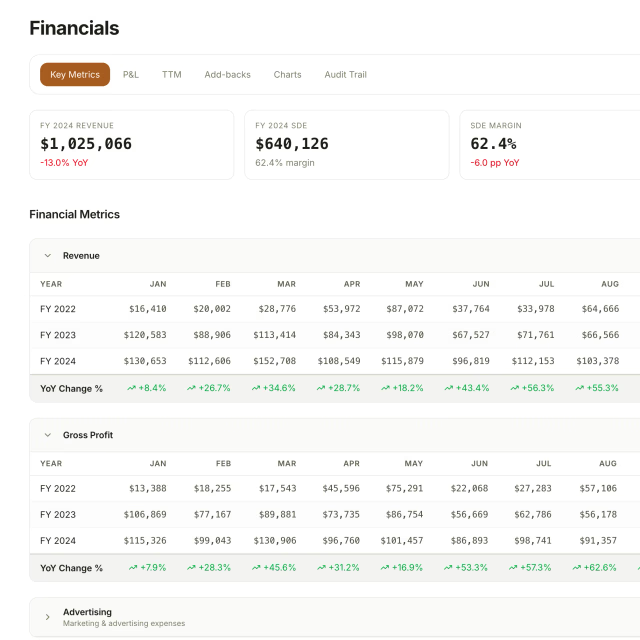

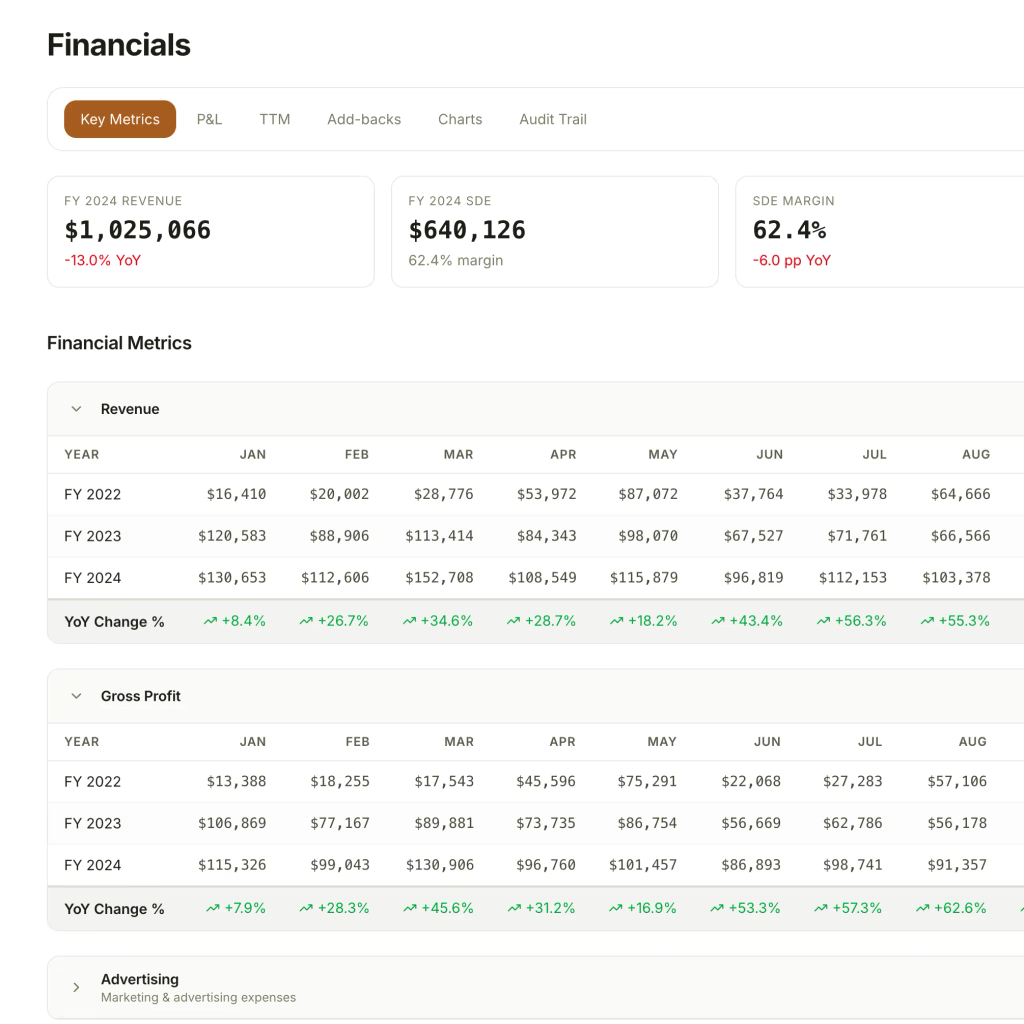

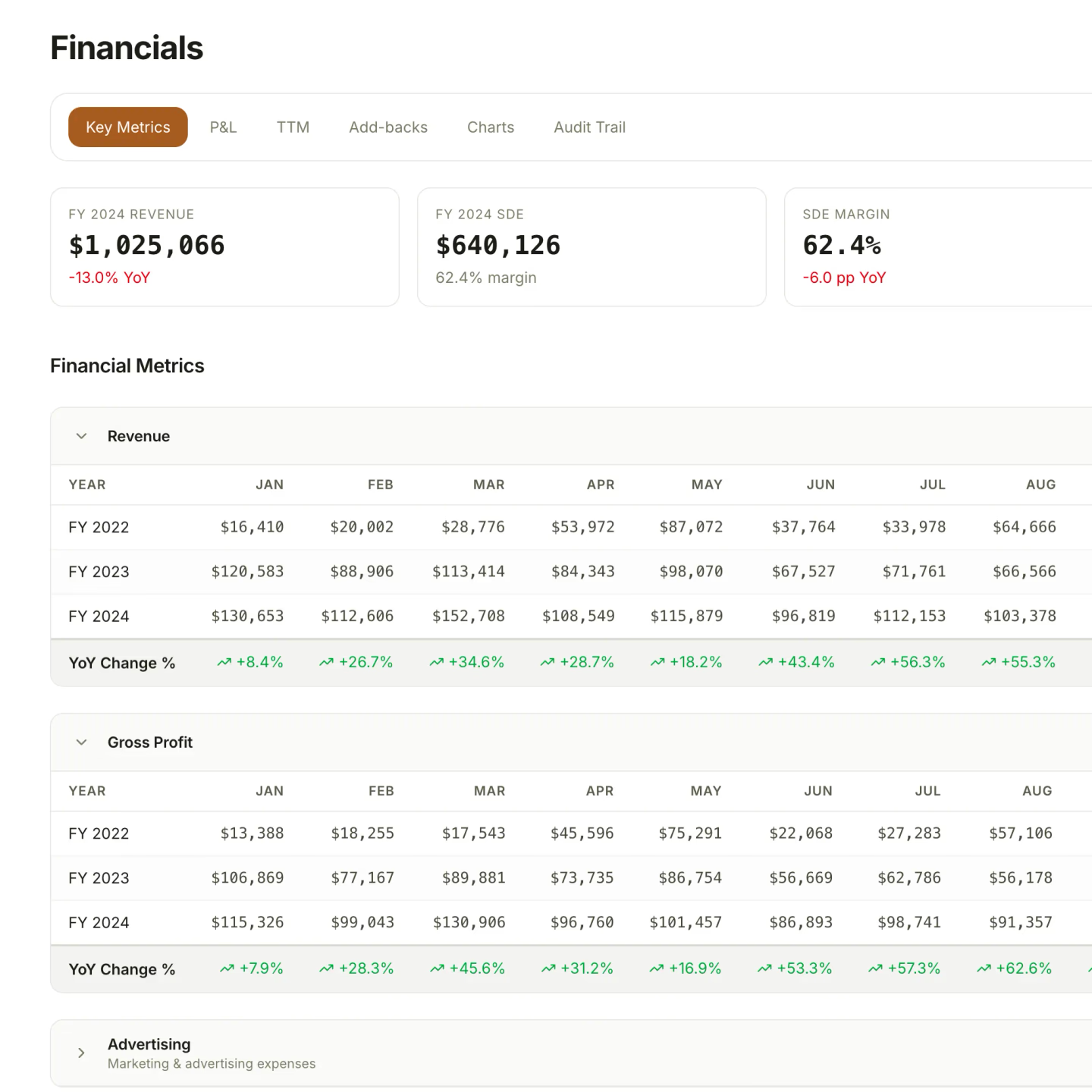

Spencer extracts line items from disparate sources and normalizes them into consistent financial spreads. Revenue, COGS, operating expenses, owner compensation—all mapped to standard categories.

The result: clean, formatted financial charts that are defensible, consistent, and buyer-ready. Every number aligns. Every calculation checks out.

That boat slip? He noticed.

Spencer identifies add-backs that others miss—the country club membership buried in marketing, the owner's cell phone in utilities, the daughter's car payment coded as vehicle expense.

Each potential add-back comes with a confidence score and source citation, so you can review and approve with full context. On average, that's $47,000 in adjustments you would have missed.

Every number, verified and contextualized.

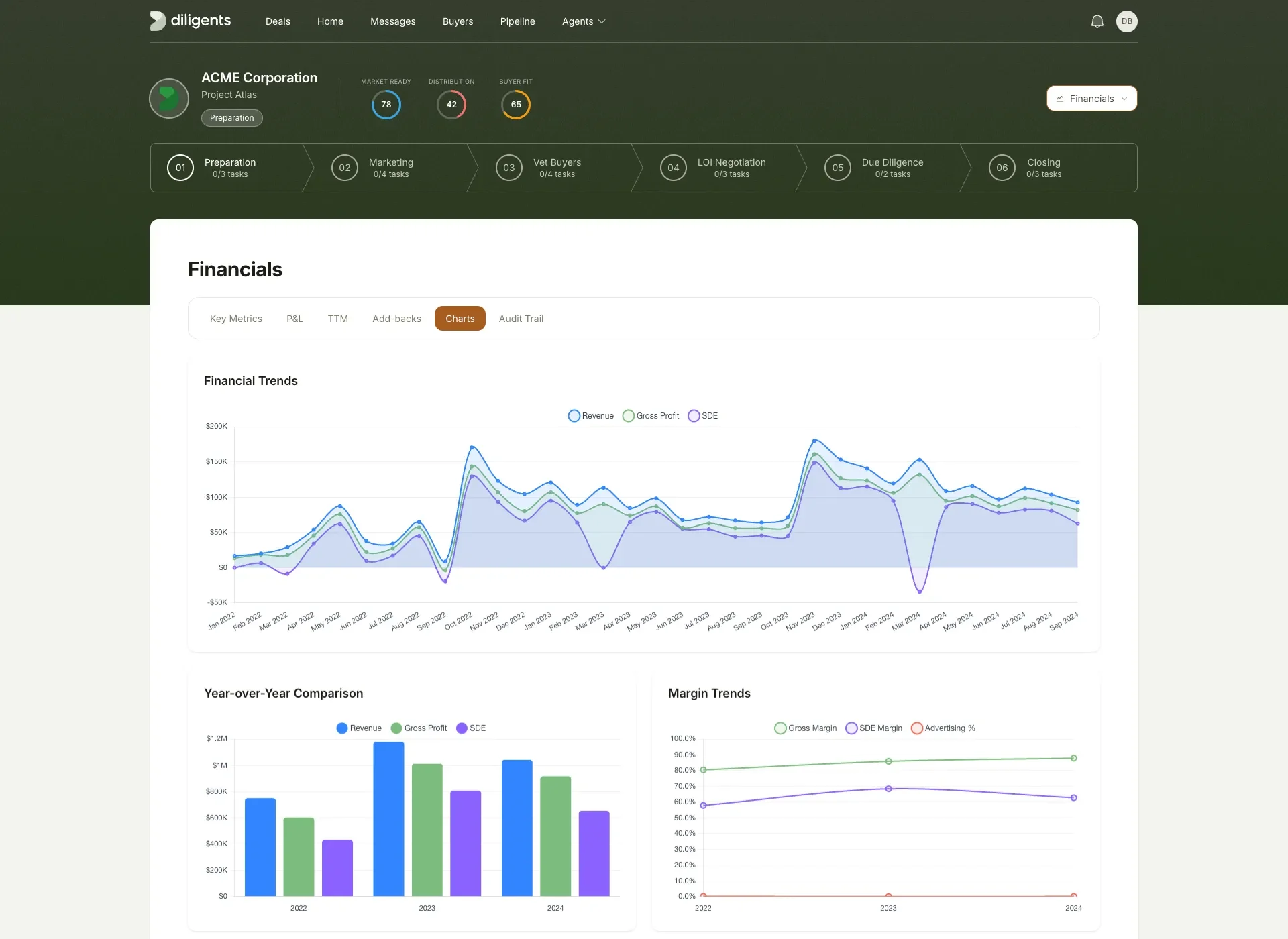

From trend analysis to CIM-ready exports, Spencer provides the comprehensive financial intelligence your deals demand.

Trend analysis

Revenue seasonality, expense spikes, margin compression—Spencer identifies patterns across time periods and flags significant variances for review.

Anomaly detection

Unusual patterns flagged automatically. One-time expenses, revenue irregularities, and accounting inconsistencies surfaced before they become surprises.

Source verification

Every number links back to its original document and page. Click any figure to see exactly where it came from—no black boxes.

Multi-year comparison

Side-by-side analysis across tax returns, P&Ls, and bank statements. Spencer reconciles discrepancies and highlights material differences.

SDE calculation

Seller's Discretionary Earnings calculated automatically with itemized add-backs. Adjustments categorized and documented for buyer review.

CIM-ready exports

Generate the financials section of your CIM with one click. Formatted charts, add-back schedules, and trend analysis ready for presentation.

Financial intelligence at scale.

Spencer has been quietly analyzing the financials behind thousands of transactions.

Documents processed through Spencer's analysis engine

In add-backs identified that sellers had overlooked

Accuracy rate on high-confidence add-back detection

Average time to spread a full year of financials (vs. 4-6 hours manual)

Spencer found $47,000 in add-backs I would have missed—boat slip, country club dues, daughter's cell phone. That's a $140,000 difference in valuation at a 3x multiple. Paid for itself on the first deal.

David Park

Managing Director, Horizon Business Brokers

Frequently asked questions

Everything you need to know about Spencer and financial intelligence.

Spencer accepts PDFs (including scanned documents with OCR), Excel files (.xlsx, .xls), CSV files, and most common image formats. Tax returns, profit & loss statements, balance sheets, bank statements, and lease agreements are all supported.

For best results, we recommend uploading documents in their original digital format when available. Scanned documents work well but may require additional verification.

Spencer achieves 94% accuracy on high-confidence add-back detection. Every potential add-back is assigned a confidence score based on the evidence available. High-confidence items (90%+) are typically accurate, while lower-confidence items are flagged for human review. You always have final approval over which add-backs to include.

Spencer identifies common add-back categories including: owner compensation and benefits, personal expenses coded to the business (vehicles, phones, travel), one-time or non-recurring expenses, above-market rent to related parties, and discretionary expenses (entertainment, donations, memberships).

Each identified add-back includes the source document, line item reference, and reasoning for why it was flagged.

Absolutely. Spencer is a tool to assist your analysis, not replace your judgment. You can accept, reject, or modify any add-back suggestion. You can also manually add items that Spencer didn't catch. All changes are tracked so you have a complete audit trail of your adjustments.

Spencer exports to Excel, PDF, and directly integrates with popular CRM and deal management platforms. Financial spreads can be embedded in CIMs, shared with buyers via Whitmore's data room, or exported for use in your existing valuation tools. API access is available for enterprise customers.

Let Spencer spread the numbers.

Request a demo to see how financial intelligence can transform 4-6 hours of manual spreading into 8 minutes of review.